GBP/USD Price Analysis: Refreshes day high around 1.2330 as USD Index dives further, BoE policy eyed

- GBP/USD has printed a fresh day's high at 1.2330 as the USD index has continued its downside journey.

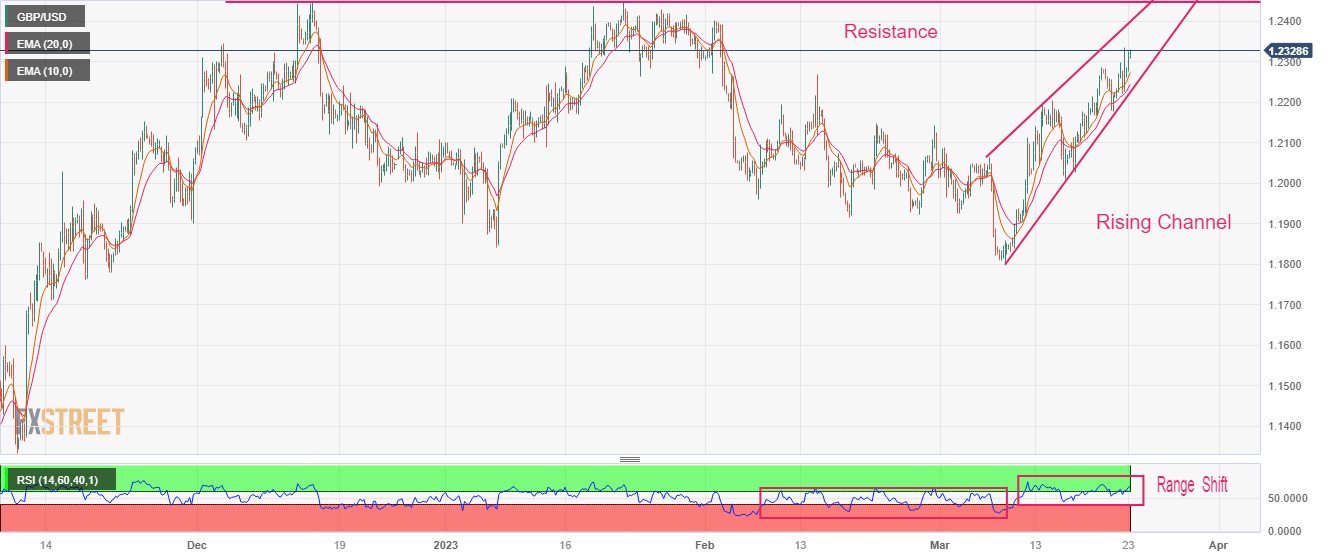

- The cable is auctioning in a Rising Channel chart pattern in which every pullback is considered as a buying opportunity.

- A range shift move by the RSI (14) into the bullish territory of 40.00-80.00 cement more upside ahead.

The GBP/USD pair has printed a fresh day high at 1.2330 in the early European session. The upside bias for Cable is backed by further weakness in the US Dollar Index (DXY) as the Federal Reserve (Fed) is approaching the phase of policy-tightening. Also, rising hawkish bets for Bank of England (BoE) policy after a surprise jump in the United Kingdom inflation is supporting the Pound Sterling.

Economists at Bank of America Global Research (BoA) are expecting a 25bp BoE rate hike, with dovish guidance.

The USD Index is struggling to sustain above 102.00 and is expected to extend its downside journey as the spotlight has shifted to risk-perceived assets. S&P500 futures have recovered firmly, indicating some revival in the risk appetite of the market participants.

GBP/USD is auctioning in a Rising Channel chart pattern on a four-hour scale in which every pullback is considered as a buying opportunity by the market participants. The Cable is marching towards the horizontal resistance plotted from December 13 high at 1.2444.

The 20-period Exponential Moving Average (EMA) at 1.2245 is providing cushion to the Pound Sterling bulls.

A range shift move by the Relative Strength into the bullish arena of 40.00-80.00 from the bearish region of 20.00-60.00 indicates more upside ahead.

The Cable has already shown a stellar rally, therefore, a mean-reversion move to near 10-period EMA 1.2275 would be an optimal opportunity for making fresh long. This will drive the asset toward December 05 high at 1.2345 followed by the horizontal resistance plotted from December 13 high at 1.2444.

On the flip side, a breakdown below March 21 low at 1.2212 would drag the Cable toward the round-level support around 1.2100 and March 15 low around 1.2000.

GBP/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.