GBP/USD Price Analysis: Poised for further losses towards 1.4000

- GBP/USD defends 1.4100 threshold after the heaviest drop in 12 days.

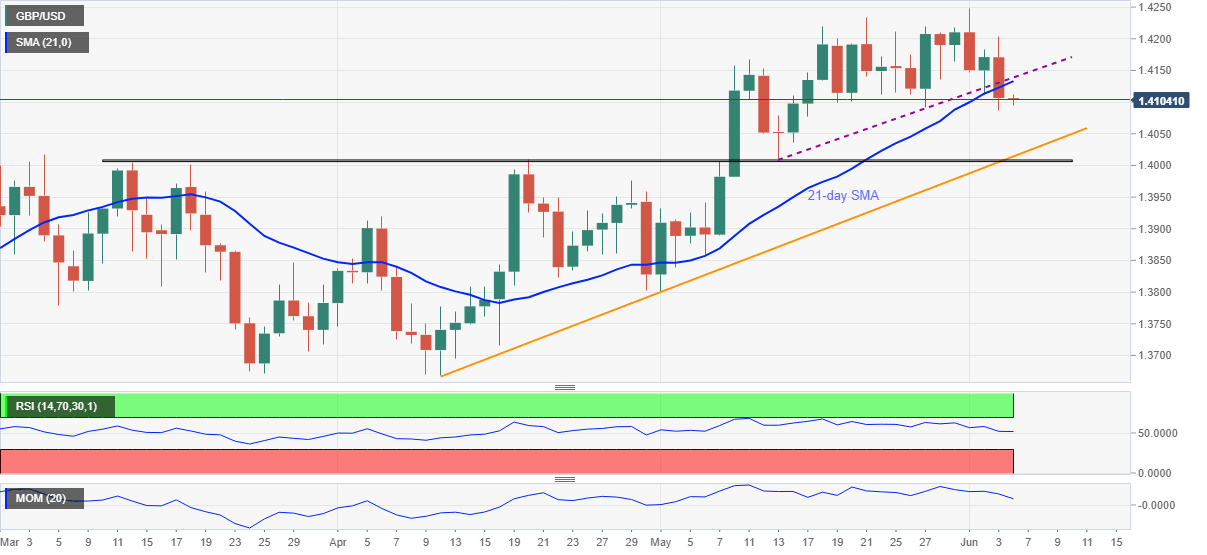

- Downside break of 21-day SMA, three-week-old trend line favor sellers.

- Descending Momentum line, normal RSI back the moves.

GBP/USD remains subdued around 1.4100 amid Friday’s quiet Asian session. The Cable dropped the most since May 19 the previous day while conquering 21-day and an ascending support line, now resistance, from May 13.

The breakdown joins a downward sloping Momentum line and a lack of oversold RSI conditions to back the GBP/USD bears.

Hence, the quote’s further downside below the 1.4100 threshold becomes imminent. In doing so, a confluence of a two-month-long horizontal area and an ascending trend line from April 12, around 1.4010-05, will be the key support to watch.

In a case where the post-NFP slump conquers the 1.4000 psychological magnet, the GBP/USD prices become vulnerable to revisit early April lows near 1.3920.

On the flip side, a corrective pullback needs to cross the 1.4130-40 area, comprising 21-day SMA and previous support line, to extend the recovery moves.

Following that, the 1.4200 round figure and a monthly high near 1.4250 should lure the GBP/USD bulls.

GBP/USD daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.