GBP/USD Price Analysis: Holds firm around 1.2840 ahead of Fed’s decision

- GBP/USD consolidates between 1.2800 and 1.2890 amid uncertain Fed and BoE decisions.

- RSI remains flat, indicating a balanced market with no clear trend.

- Key support levels are at 1.2778 and 1.2750, with resistance at 1.2888 and 1.2900.

The Pound Sterling registers minuscule gains during the North American session as traders brace for the US Federal Reserve’s decision, which is expected to hold rates unchanged but to prepare the ground to ease policy. The GBP/USD trades at 1.2845, virtually unchanged.

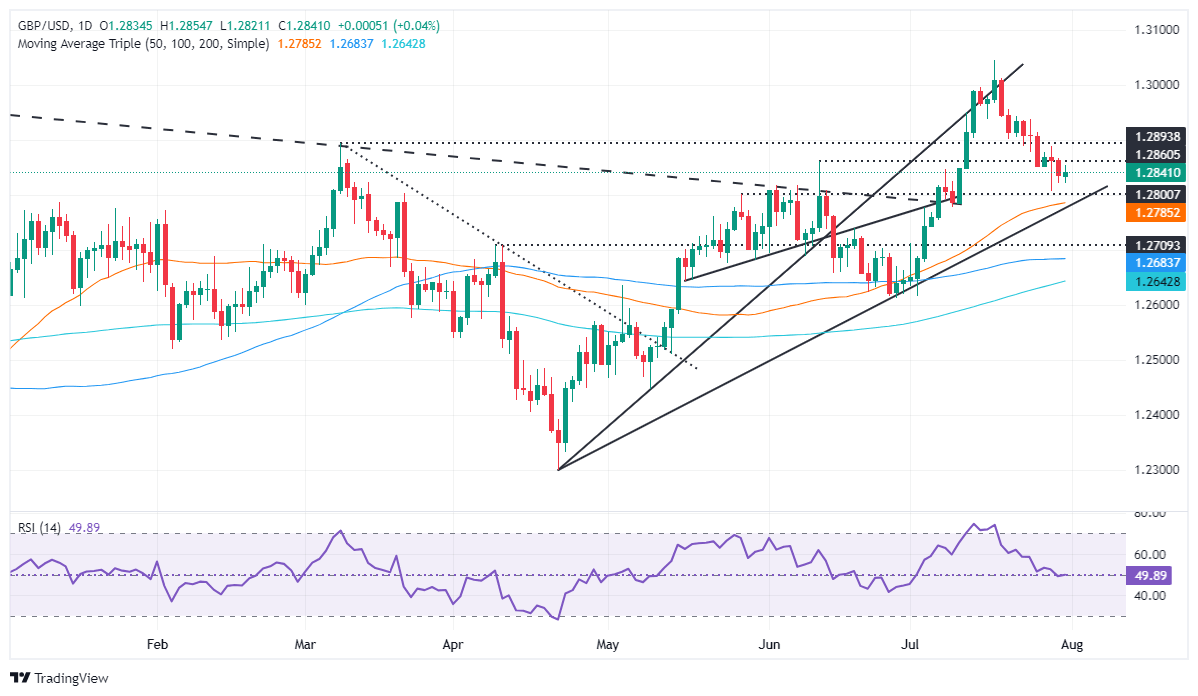

GBP/USD Price Analysis: Technical outlook

The GBP/USD has consolidated at around 1.2800-1.2890 during the last four days, with neither buyers nor sellers committing to a position amid risks on both sides of the Atlantic, with the Fed and the Bank of England’s decisions.

Consequently, the Relative Strength Index (RSI) is flat at its neutral line, underscoring the abovementioned, but the GBP/USD fall from yearly highs to current spot prices hints that bears are lurking.

If GBP/USD drops below 1.2800, it would expose key support levels like the July 9 low at 1.2778 and the psychological 1.2750. A further downside is seen at the 100-day moving average (DMA) at 1.2682.

On the other hand, key resistance lies at the July 29 peak at 1.2888, followed by 1.2900.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.16% | -0.05% | -1.70% | -0.34% | 0.06% | -0.64% | -0.33% | |

| EUR | 0.16% | 0.13% | -1.51% | -0.16% | 0.21% | -0.46% | -0.15% | |

| GBP | 0.05% | -0.13% | -1.66% | -0.28% | 0.07% | -0.58% | -0.28% | |

| JPY | 1.70% | 1.51% | 1.66% | 1.44% | 1.78% | 1.08% | 1.44% | |

| CAD | 0.34% | 0.16% | 0.28% | -1.44% | 0.37% | -0.30% | 0.01% | |

| AUD | -0.06% | -0.21% | -0.07% | -1.78% | -0.37% | -0.68% | -0.38% | |

| NZD | 0.64% | 0.46% | 0.58% | -1.08% | 0.30% | 0.68% | 0.32% | |

| CHF | 0.33% | 0.15% | 0.28% | -1.44% | -0.01% | 0.38% | -0.32% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.