GBP/USD Price Analysis: Finds resistance around 1.2400 amid Fed-BoE policy-inspired volatility

- GBP/USD has dropped after facing barricades around 1.2400 despite the upbeat market mood.

- Volatility to remain squeezed ahead of the Fed-BoE interest rate policy.

- An oscillation by the RSI (14) in the 40.00-60.00 range indicates a consolidation head.

The GBP/USD pair has sensed selling interest near the round-level resistance of 1.2400 in early Asia after a gradual upside move. The cable is expected to remain on the tenterhooks as investors are shifting their focus toward the announcement of the interest rate decision by the Federal Reserve (Fed) and the Bank of England (BoE) this week.

Meanwhile, the risk appetite of the market participants has been improved after a decline in the United States core Personal Consumption Expenditure (PCE) price index (Dec), which signified that the overall demand is softening along with inflationary pressures. The US Dollar Index (DXY) is continuously declining from its capped upside around 101.80.

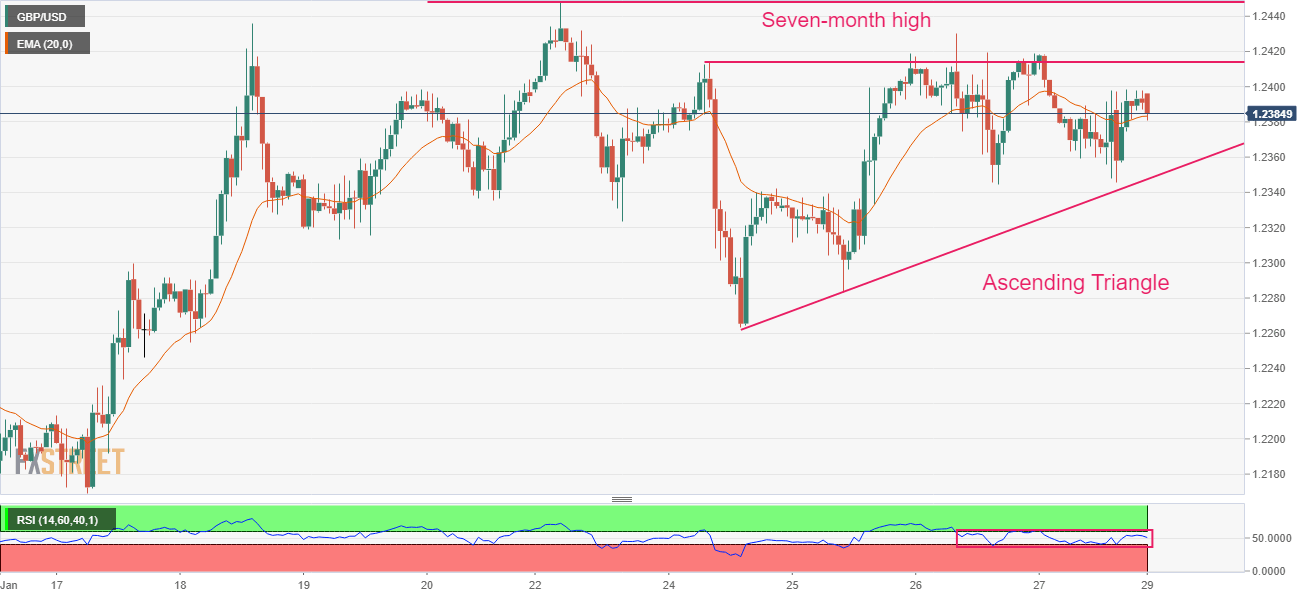

On an hourly scale, GBP/USD is auctioning in an Ascending Triangle chart pattern, which indicates a slippage in volatility. The rationale behind the volatility contraction should be the monetary policy announcements by the Fed and the BoE this week. The upward-sloping trendline of the above-mentioned chart pattern is plotted from January 24 low at 1.2263 while the horizontal resistance is placed from January 24 high around 1.2414.

The 20- period Exponential Moving Average (EMA) at 1.2382 is overlapping the cable, which indicates consolidation ahead.

Also, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which indicates an absence of a potential trigger for a decisive move.

Should the Cable break above the seven-month high of 1.2448 decisively, Pound Sterling bulls will drive the asset towards the psychological resistance of 1.2500 and the June 7 high around 1.2600.

The Cable will display a sheer downside if it drops below Monday’s low at 1.2171 as it will drag the major toward January 11 low at 1.2100 followed by the psychological support at 1.2000.

GBP/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.