GBP/USD Price Analysis: Extends pullback from weekly resistance line towards 1.2100

- GBP/USD takes offers to refresh intraday low, looks set to refresh fortnight bottom.

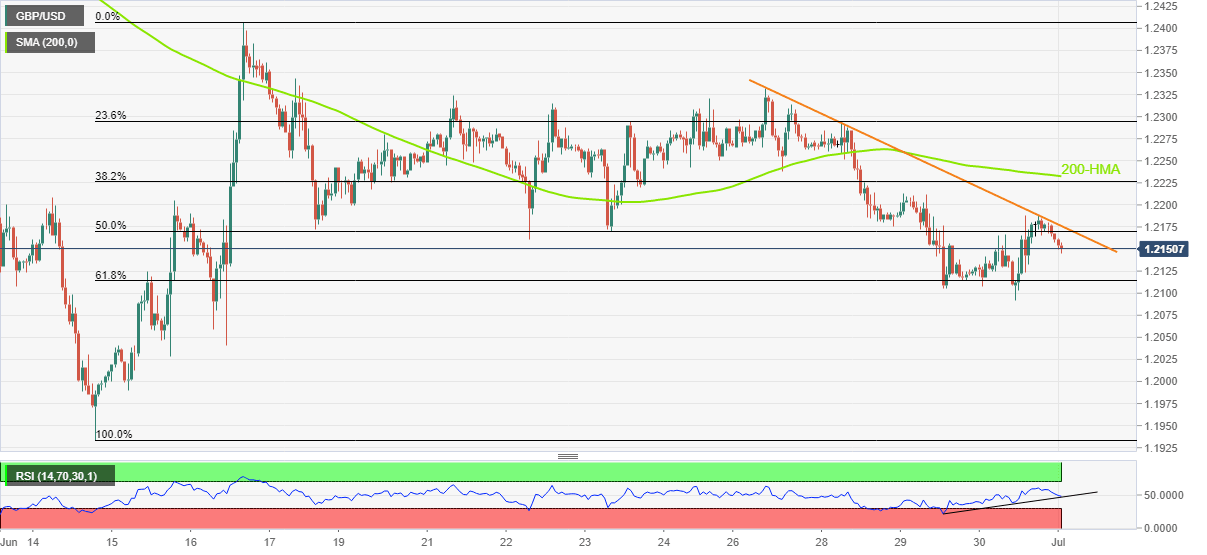

- One-week-old resistance line restricts short-term advances, immediate support line on RSI tests bears targeting 61.8% Fibonacci retracement support.

- 200-HMA acts as the tough nut to crack for the bulls.

GBP/USD reverses the previous day’s corrective pullback from a two-week low, refreshing intraday bottom around 1.2150 during Friday’s Asian session.

In doing so, the Cable pair extends the previous day’s pullback from a one-week-long resistance line, at 1.2180 by the press time.

The bearish bias also gains momentum due to the RSI (14) pullback from the oversold territory.

However, a two-day-long support line on the RSI (14) may challenge the GBP/USD pair’s further downside targeting the 61.8% Fibonacci retracement of June 14-16 upside, near 1.2110. Also acting as the downside filter is the 1.2100 threshold.

Meanwhile, recovery remains elusive until the quote stays below the aforementioned resistance line of around 1.2180.

Even if the GBP/USD pair rises past 1.2180, it needs to cross the 200-HMA hurdle surrounding 1.2235 to recall the buyers.

Following that, a run-up towards the 1.2330 resistance level and the mid-June swing high near 1.2410 appears more likely.

Overall, GBP/USD is likely to remain pressured unless crossing the 1.2235.

GBP/USD: Hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.