GBP/USD Price Analysis: Bulls are moving in and eye a key imbalance of price

- GBP/USD bulls stay the course in the correction into the Fed.

- The bears could be lurking above a key hourly area for the day ahead.

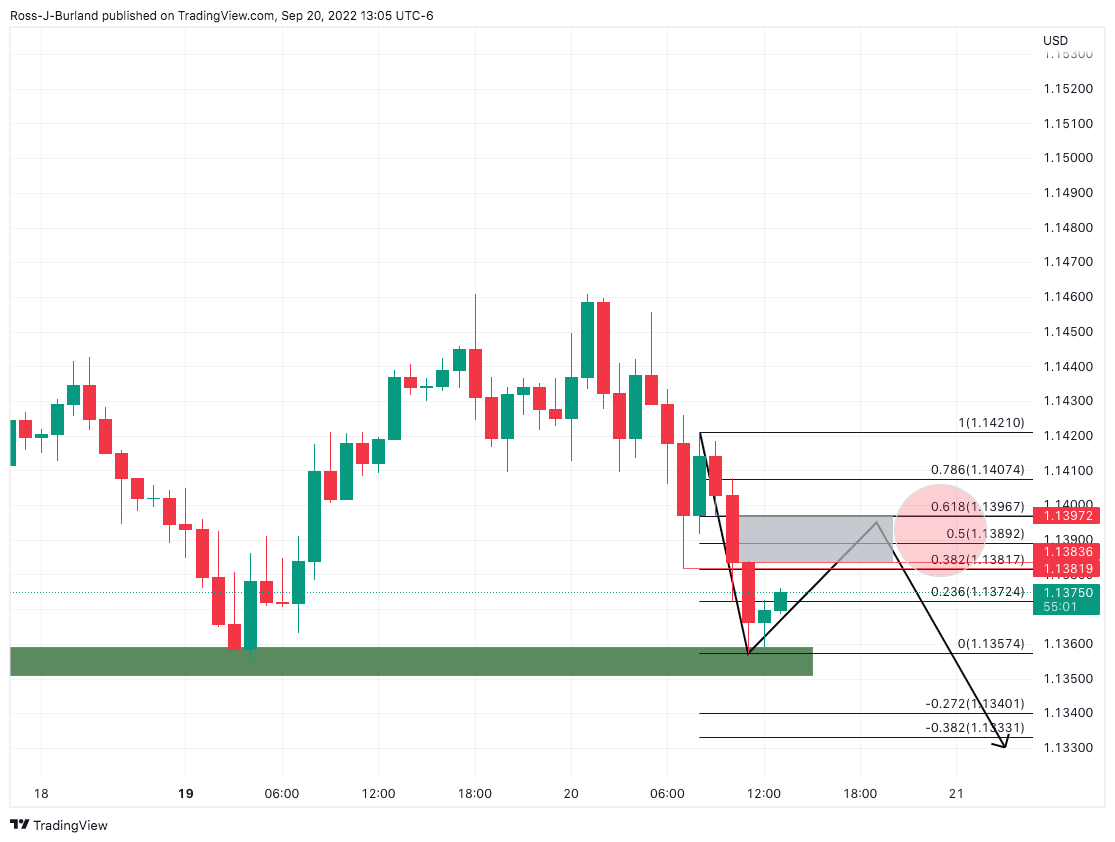

As per the prior analysis from the New York session on Tuesday, GBP/USD Price Analysis: Bulls move in from critical hourly support, the bears are potentially lurking higher up as the price corrects from the well-extablished lows as the following update will show.

GBP/USD prior analysis

From an hourly perspective, it was stated that the price had run into a familiar support area and was expected to correct higher with the price imbalance between 1.1380 and close to 1.40 the figure eyed.

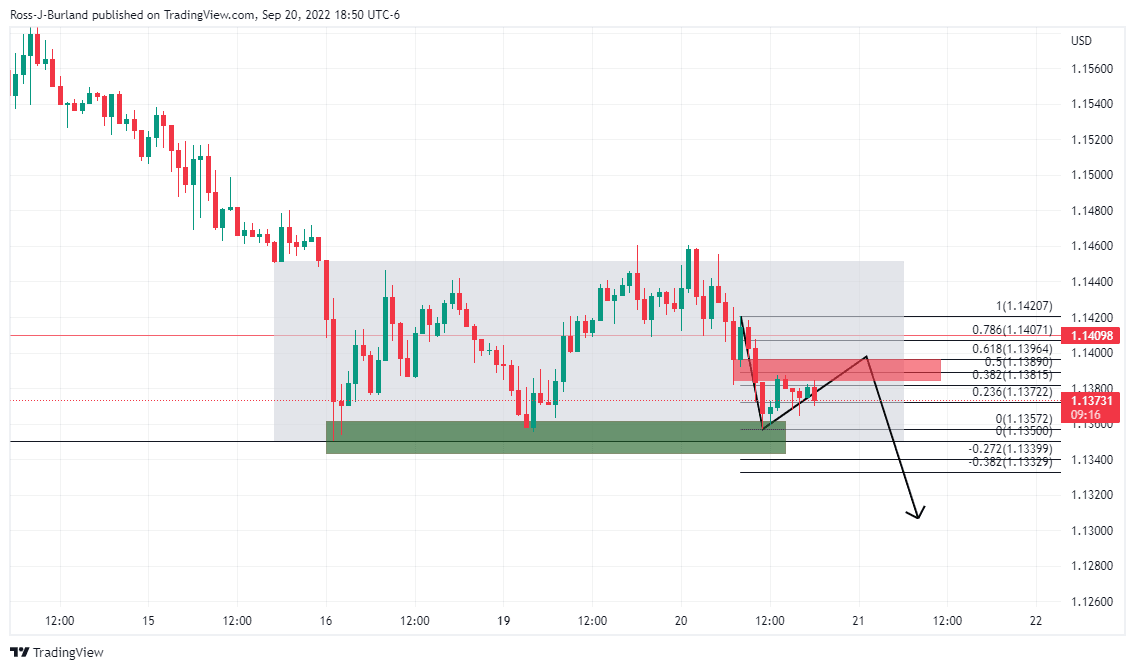

GBP/USD update

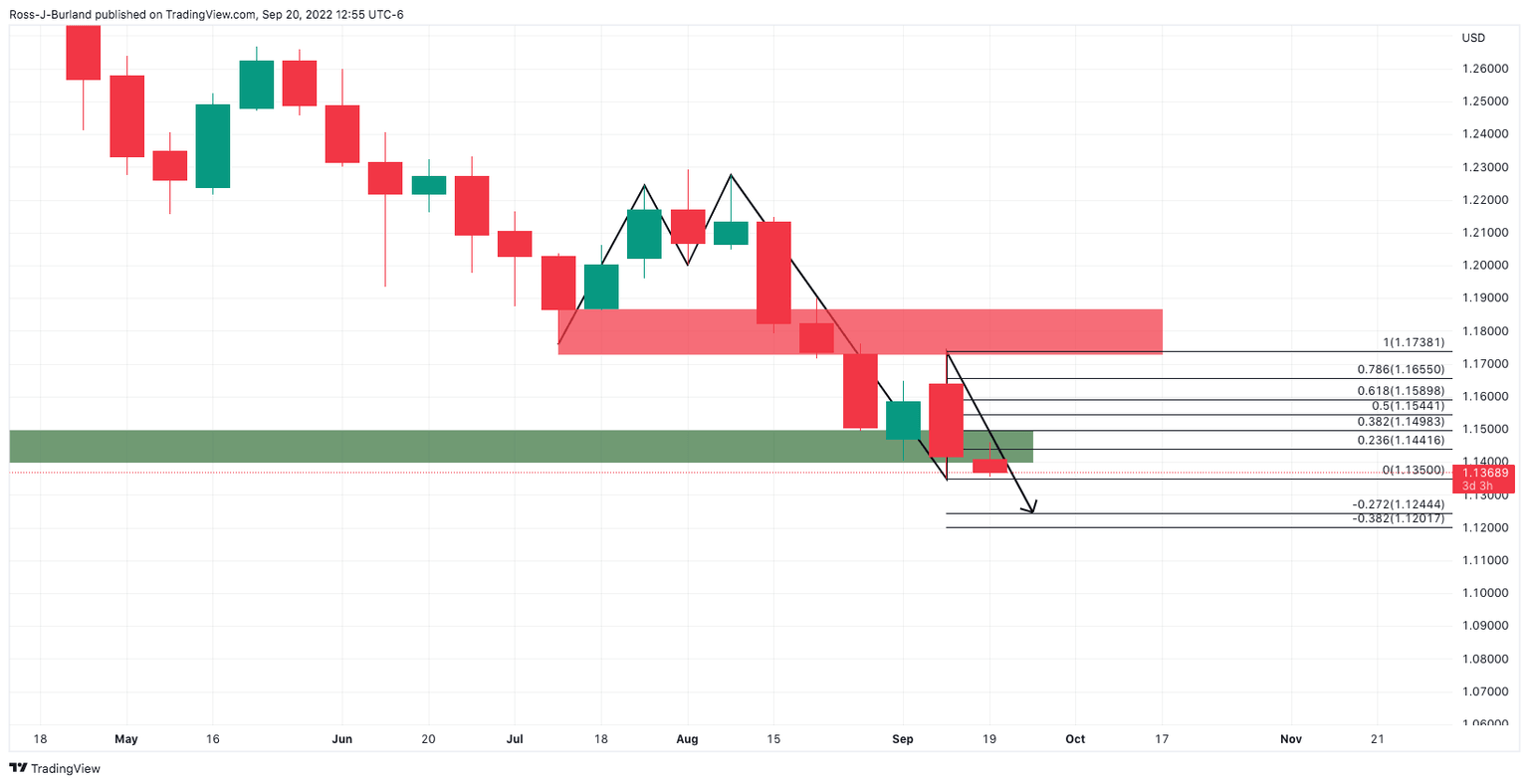

The area of mitigation could see the bears move in, making for a resistance zone for the day ahead. If this were to play out, then the daily chart's downside potential is for an extension of the broader bear cycle:

The bears will be focused especially on the 2020 low of 1.1410.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.