GBP/USD Price Analysis: Bulls move in from critical hourly support

- GBP/USD bears take control ahead of the central bank meetings this week.

- Bulls and bears battle it out at key hourly support.

GBP/USD has been in the hands of the bears at the start of this week in the lead into the centerpiece events being the Bank of England and the Federal Reserve. Currently, the price is attempting to correct from the lows of 1.1357 at 1.1370 but is well off from the highs of the day's range at 1.1460. The following illustrates the market structure from both a near-term and longer-term perspective.

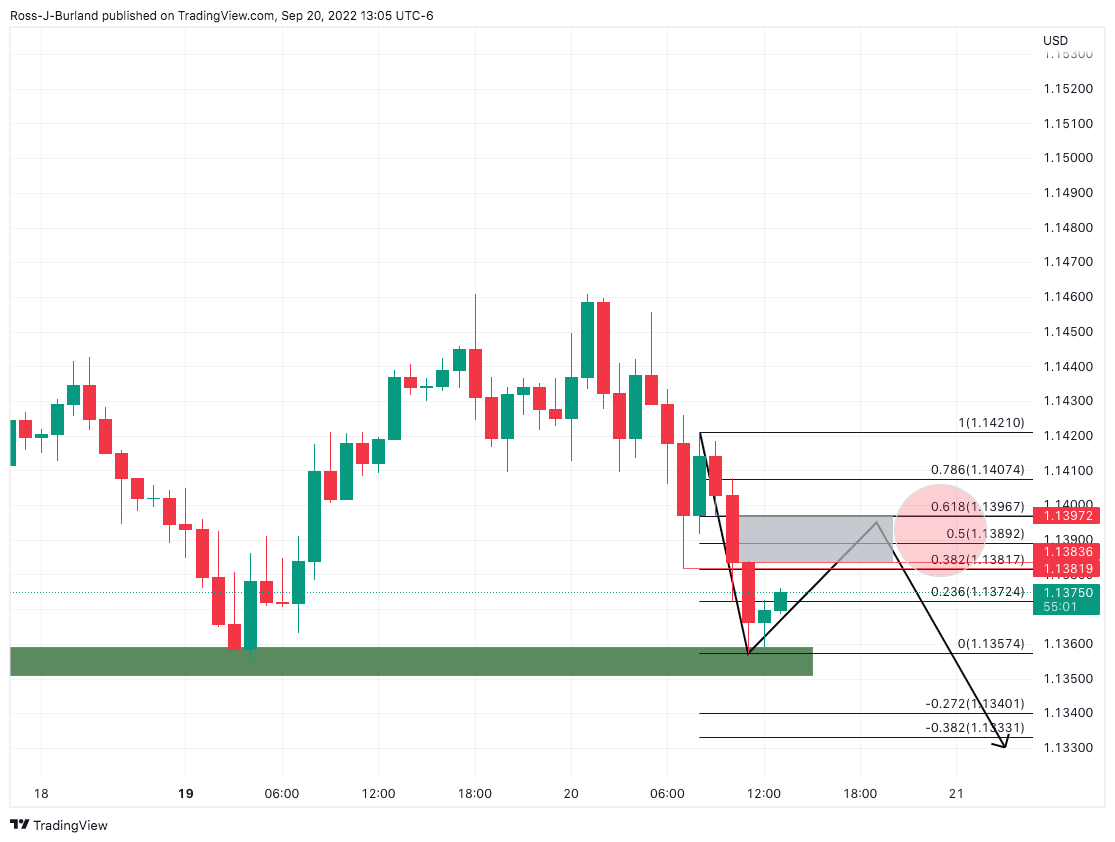

GBP/USD H1 chart

From an hourly perspective, the price has run into a familiar support area and would be expected to correct higher from here with the price imbalance between 1.1380and close to 1.40 the figure eyed.

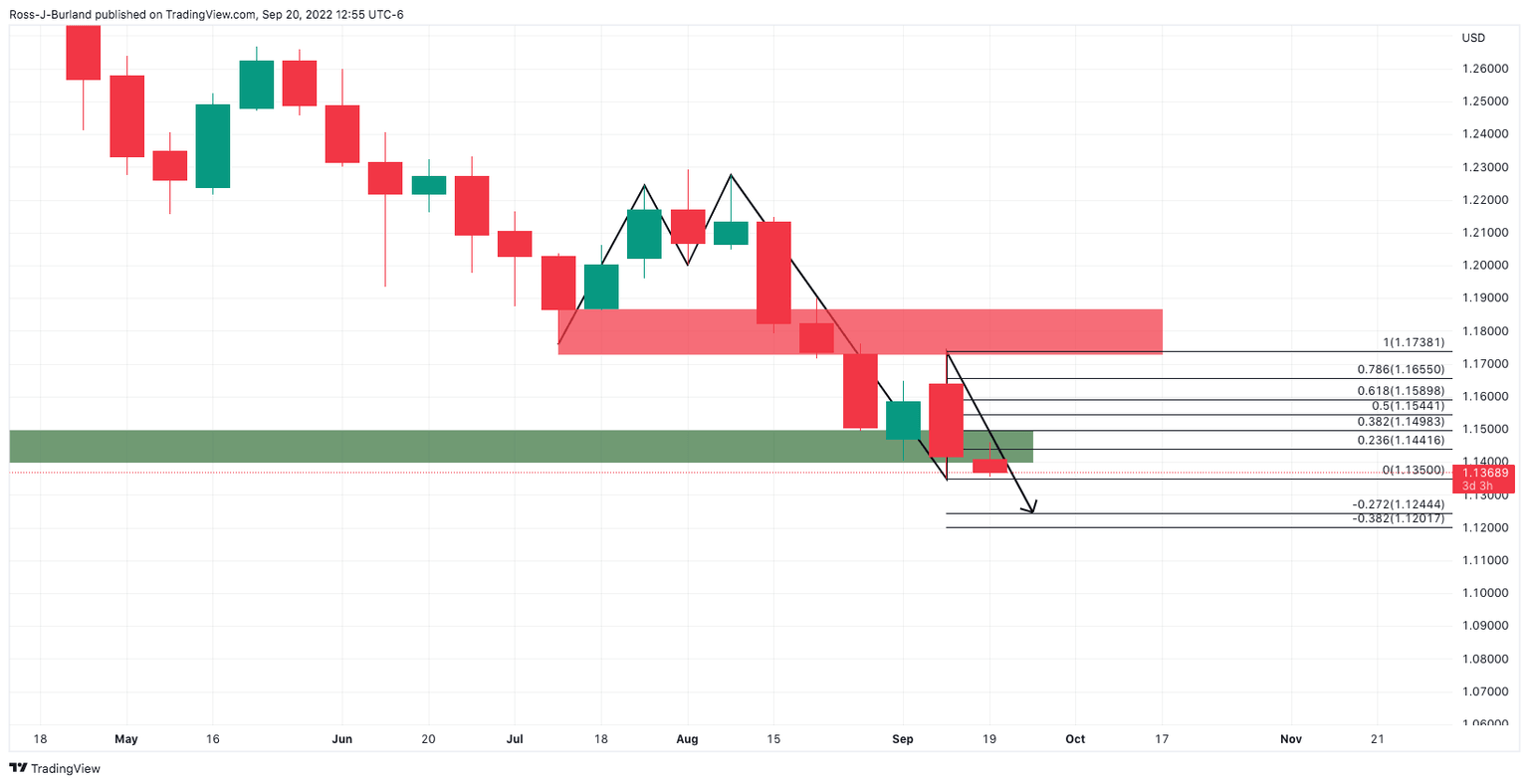

GBP/USD daily chart

Overall, as per the daily chart above and the weekly below, the price is in a strong bearish trend which leaves the focus on the downside, especially as the bears take out the 2020 low of 1.1410.

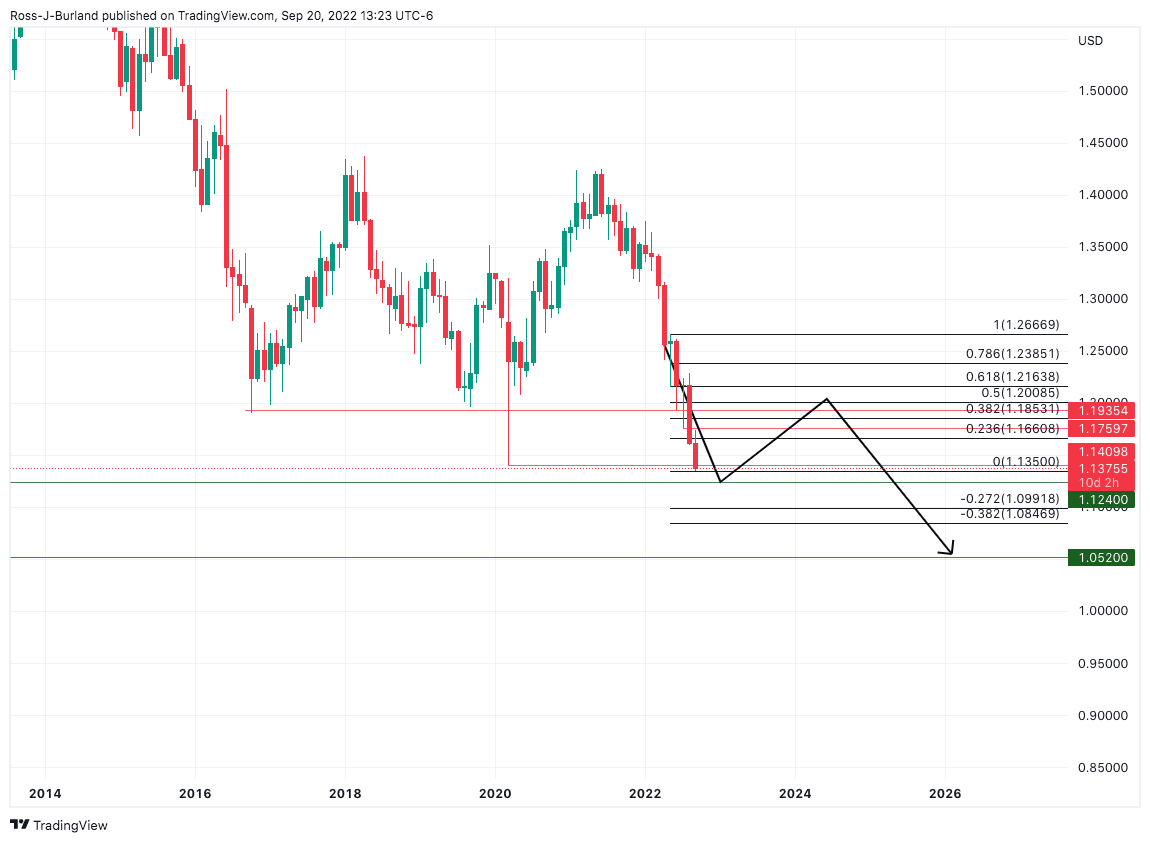

GBP/USD weekly and month charts

1.1240 and 1.0520 are a focus on the longer-term outlook. However, a revisit to 1.19 and 1.20 in a mean reversion of the recent monthly bearish impulse to meet and prior lows could be in order:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.