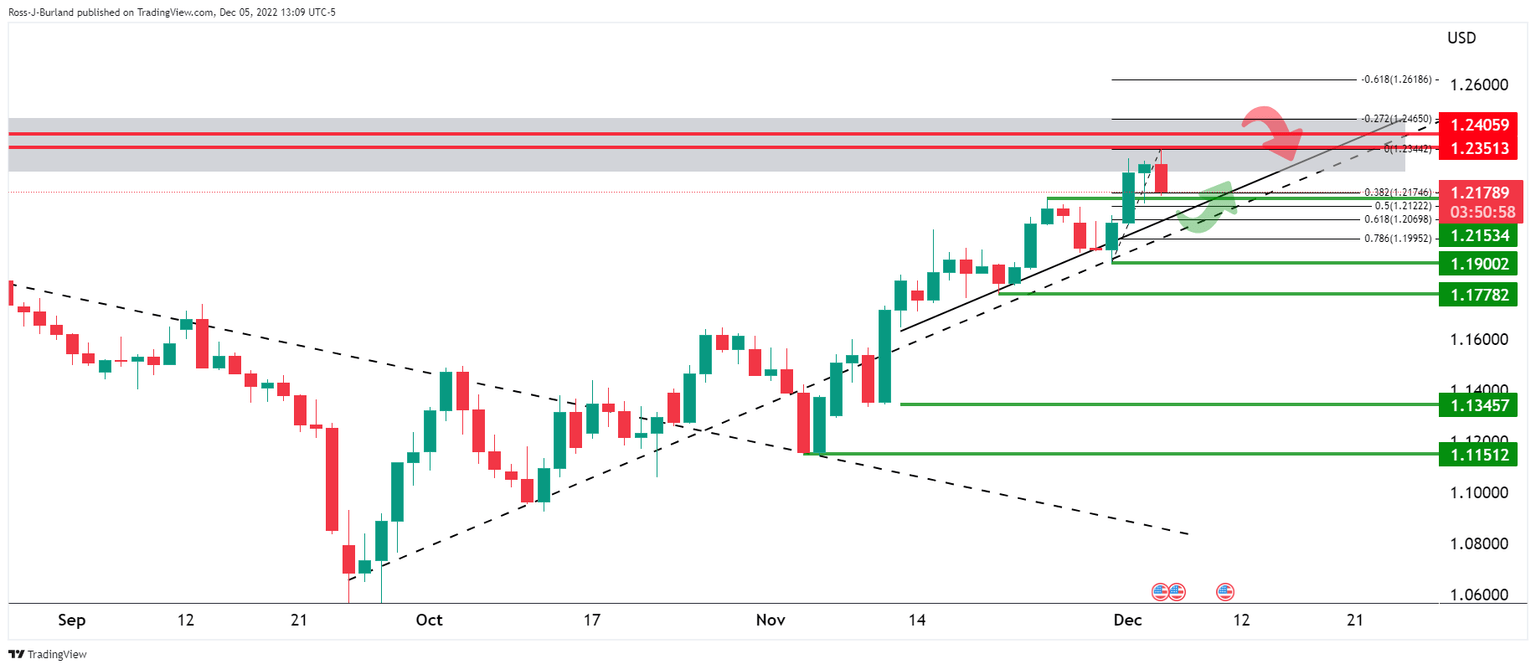

GBP/USD Price Analysis: Bears stay the course and eye trendline support

- GBP/USD H4 M-formation makes for a possibility of correction prior to further declines.

- Bears eye trendline support for their days ahead.

As per the prior analyses, GBP/USD bears step up the pace, eye break of 1.2150s, and GBP/USD Price Analysis: Bulls look to 1.2450 while bears eye test of 1.2100, the British Pound has continued to chip away into commitments below 1.2200 and at 1.2150. The low of the week so far has been 1.2121 and the following illustrates the prospects of a deeper correction should the bears stay the course.

GBP/USD prior analysis

While it was stated that the British Pound's bullish trend would still be intact while structures 1.2150 and 1.1900 are yet to be broken:

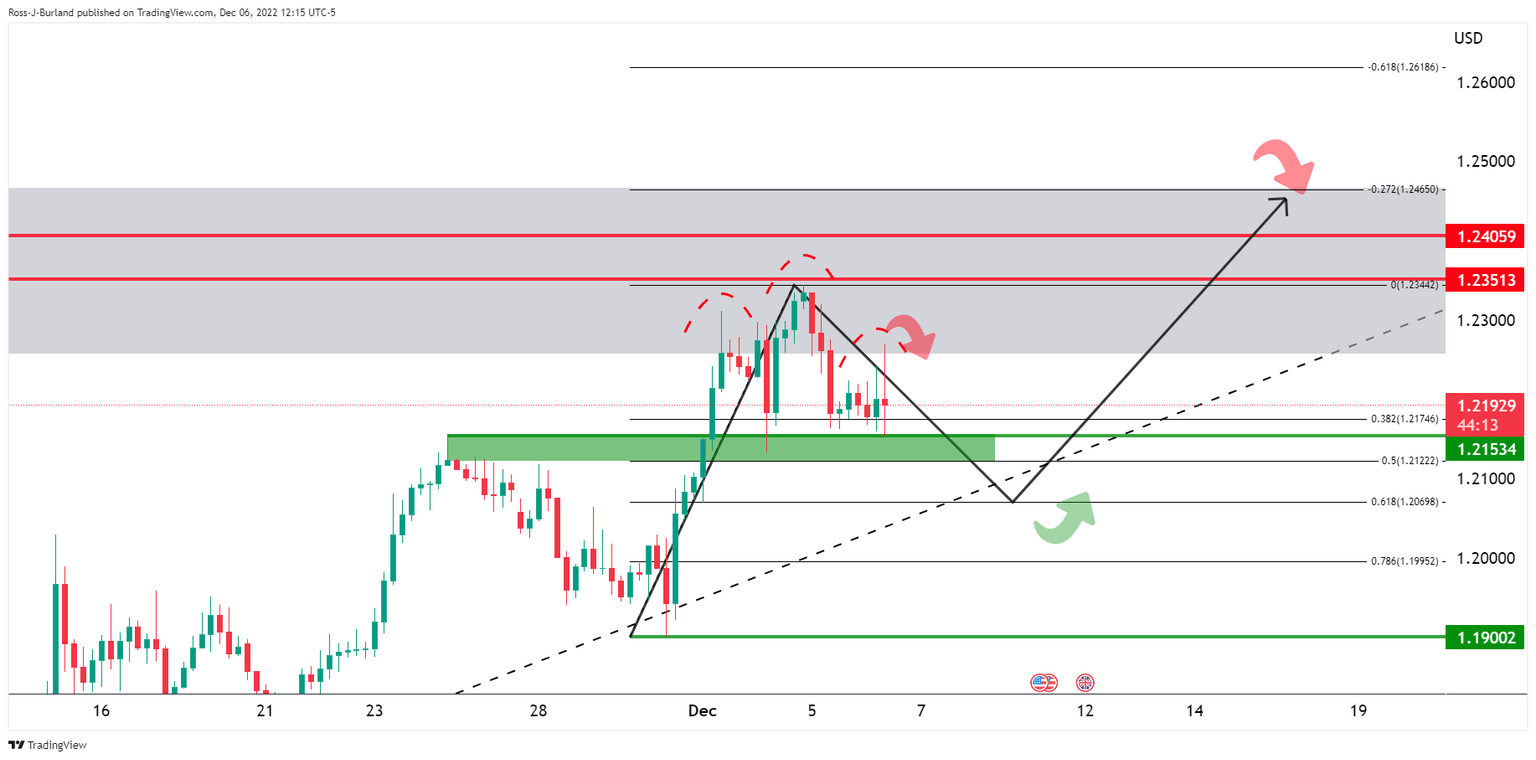

In the 4-hour chart, we could see that the price was forming a head & shoulders pattern with lower highs in the right-hand shoulder. This gave rise to the prospects of a break of structure in the 1.2150s for a move into testing the trendline support and commitments at 1.21 the figure.

GBP/USD update

As illustrated, the price continues to decline on the daily chart as anticipated.

On the 4-hour chart, the H&S pattern is playing out as follows:

Zoomed in...

The M-formation is a reversion pattern so a return to the neckline is a strong possibility prior to further declines towards the trendline support.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.