GBP/USD Price Analysis: Bears could be about to make their moves

- GBP/USD bears are making their moves and a correction could be on the cards.

- Weekly resistance is a compelling feature across the time frames.

GBP/USD bulls are tiring following the overnight rally that was sparked by a miss in US Consumer Price Index. There are complications for the bulls at this point as they run into weekly resistance and there is a reversion pattern left behind on the daily chart that followed Wednesday's rally. The following illustrate the prospects of a move to the downside for the day ahead.

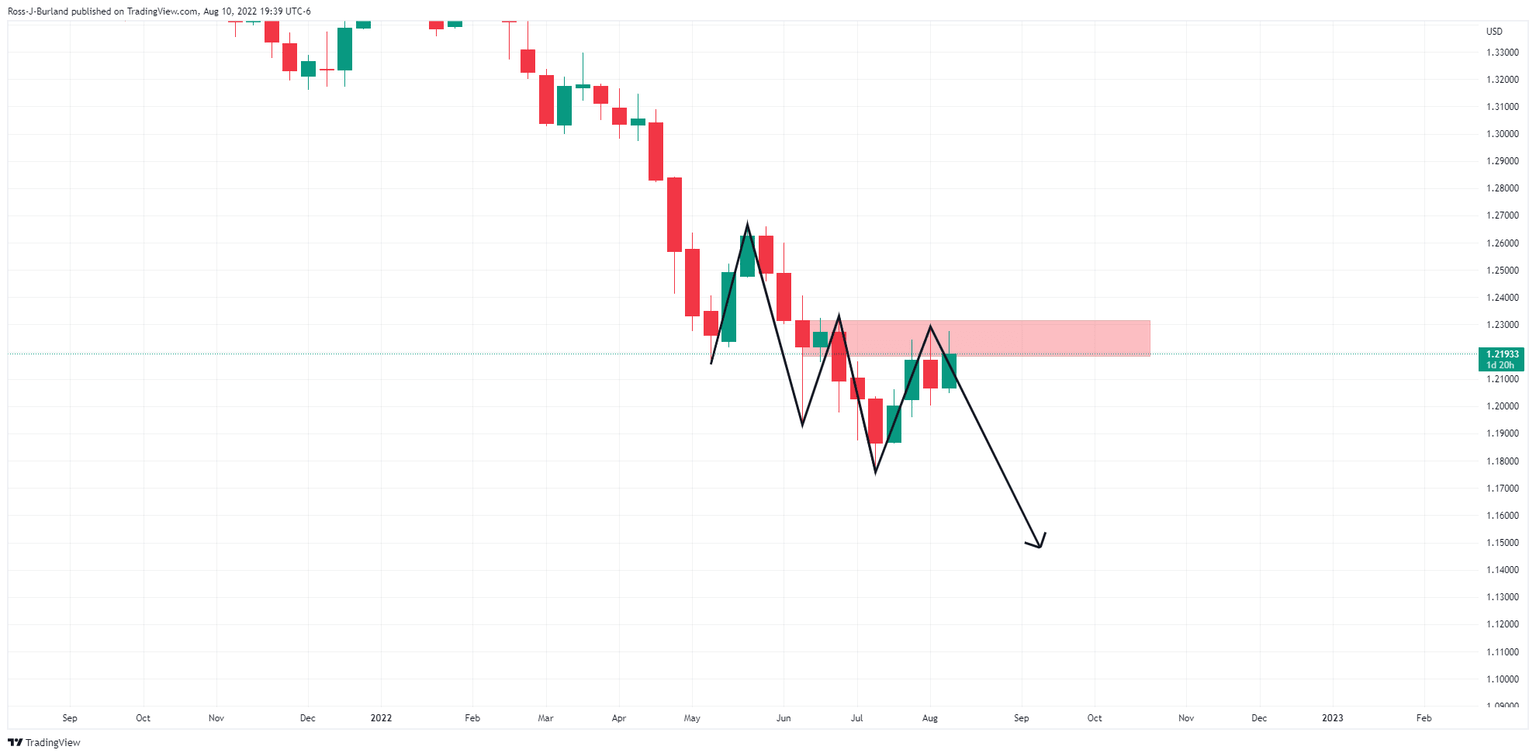

GBP/USD weekly chart

The weekly M-formation's neckline has been hit and the price could well start to feel a bout of strong supply at this juncture.

GBP/USD daily chart

The daily W-formation is compelling as the bears move in at resistance and eye the neckline of the pattern.

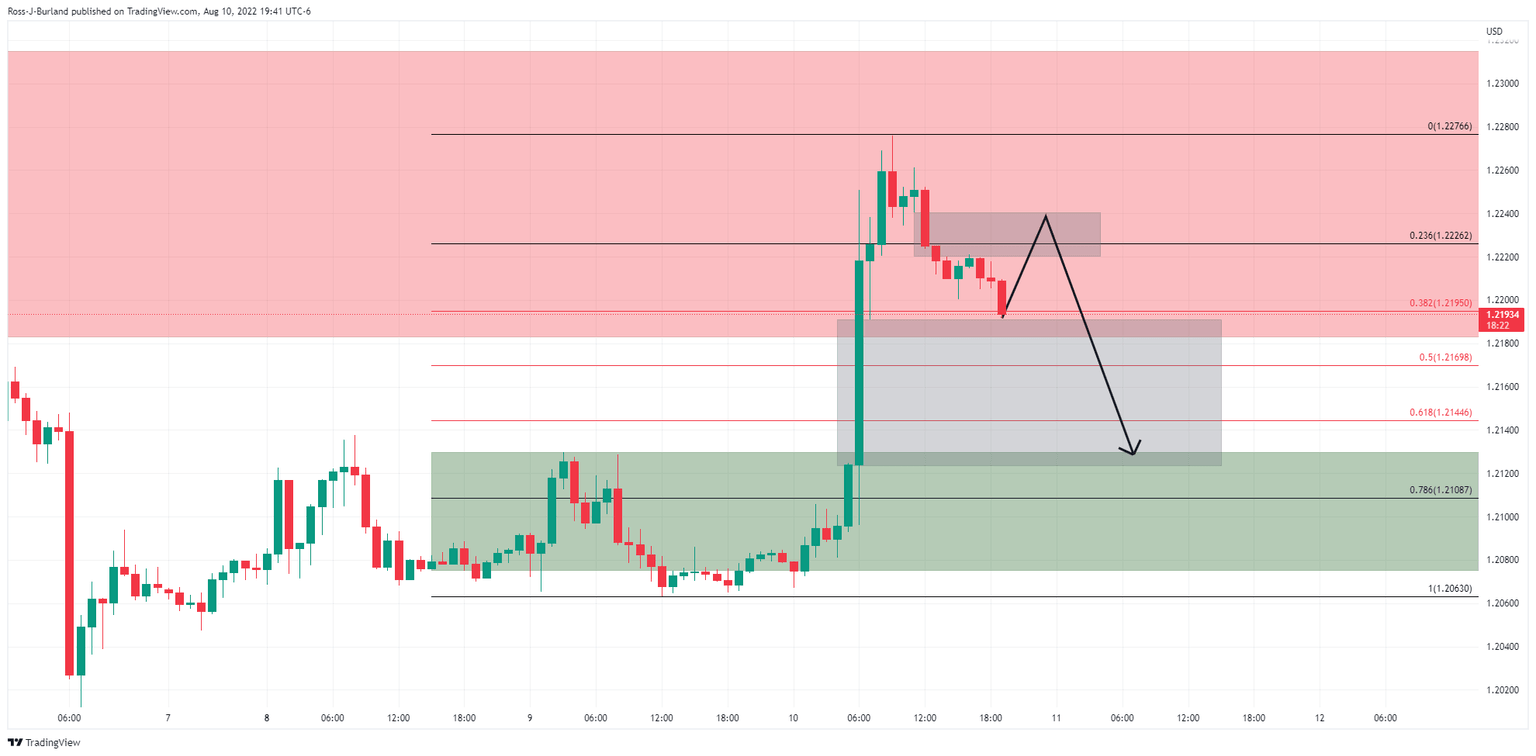

GBP/USD H1 scenarios

The price is moving to the downside following a strong rally to the upside on the back of the US inflation data. The Fibonaccis are in view for a move to mitigate the price imbalance to the downside that the rally has left behind on the hourly chart.

The price has left behind an imbalance to the upside on the hourly chart that could be mitigated prior to the next significant move lower.

On the other hand, the price could well just fall through a low volume area if the session lows are broken in the coming hours.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.