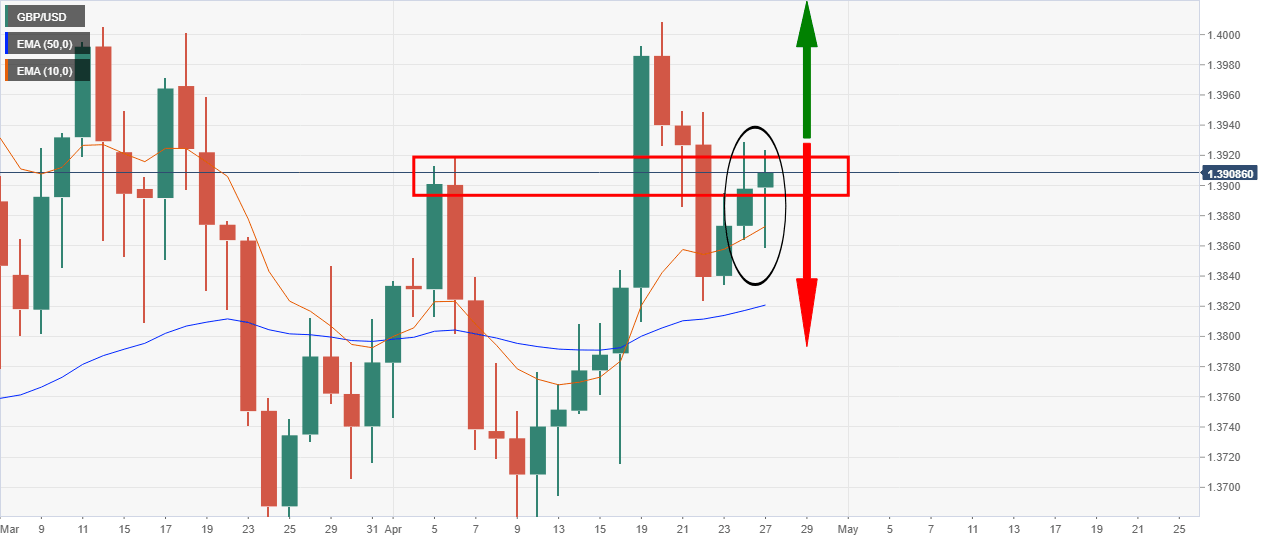

GBP/USD Price Analysis: All eyes on 4-hour resistance

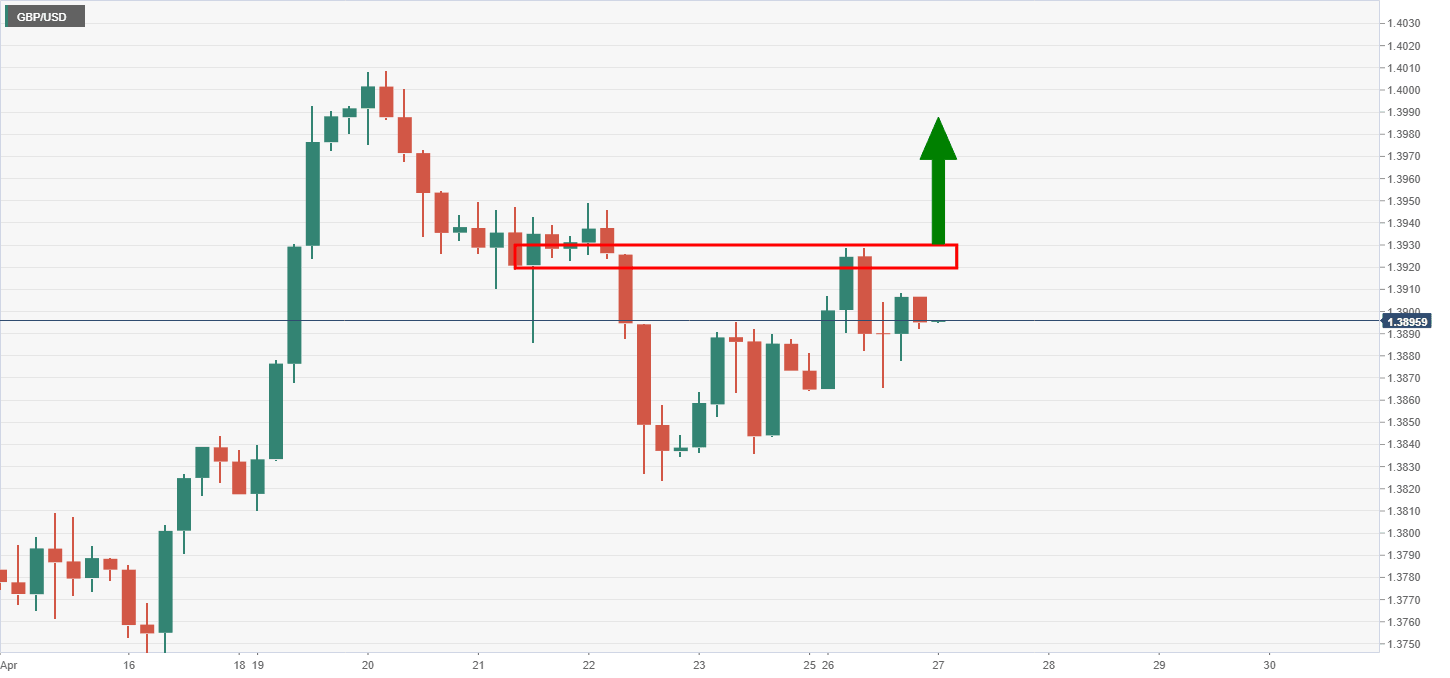

- GBP/USD coming back for more and test commitments at critical 4-hour resistance.

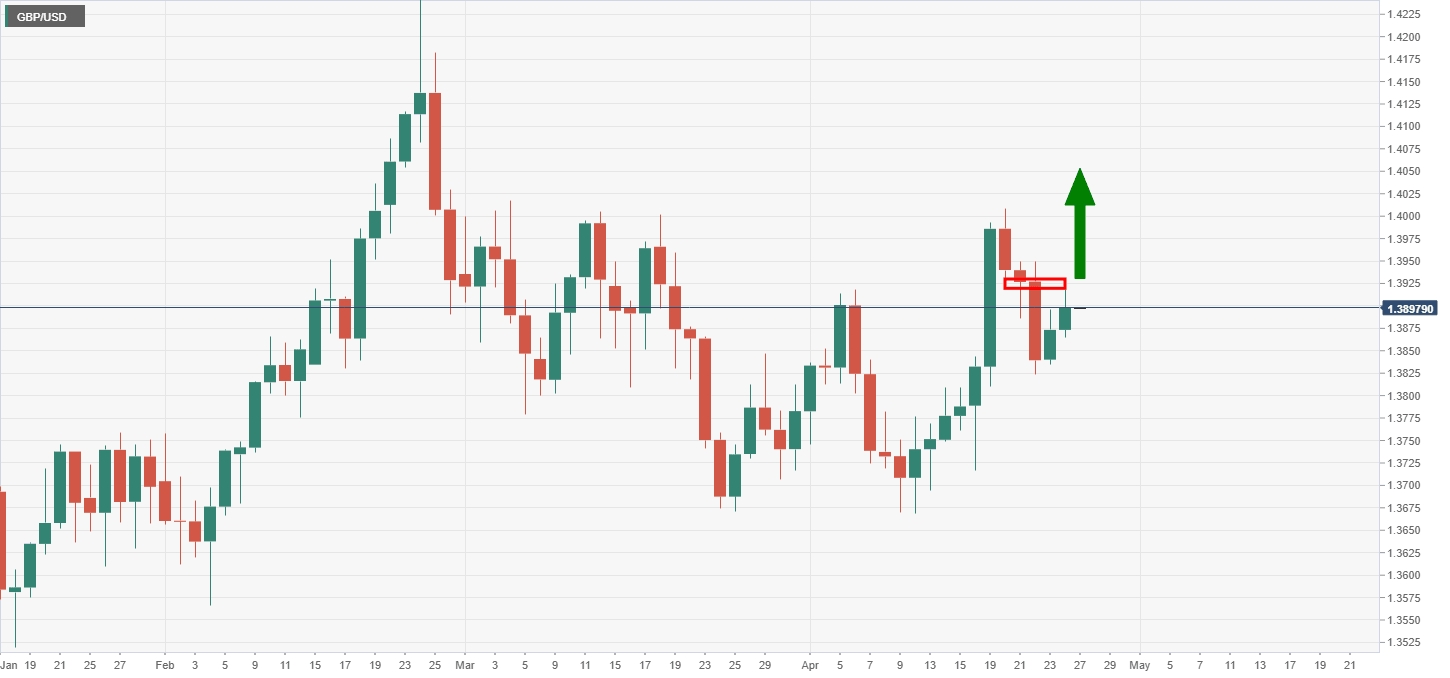

- The daily chart's price action is bullish, so far, on the day.

As per the prior analysis, GBP/USD Price Analysis: Bulls retreat but will be back for more, the bulls have indeed come back for more and have crucially held above a key 4-hour 21-EMA.

While there are prospects of an advance to test the midpoint of the 1.39 handle and beyond, 4-hour resistance still needs to give as follows:

Prior analysis, 4-hour & daily charts

''...if the price breaks 4-hour resistance then the bulls will be in play for a daily upside continuation:''

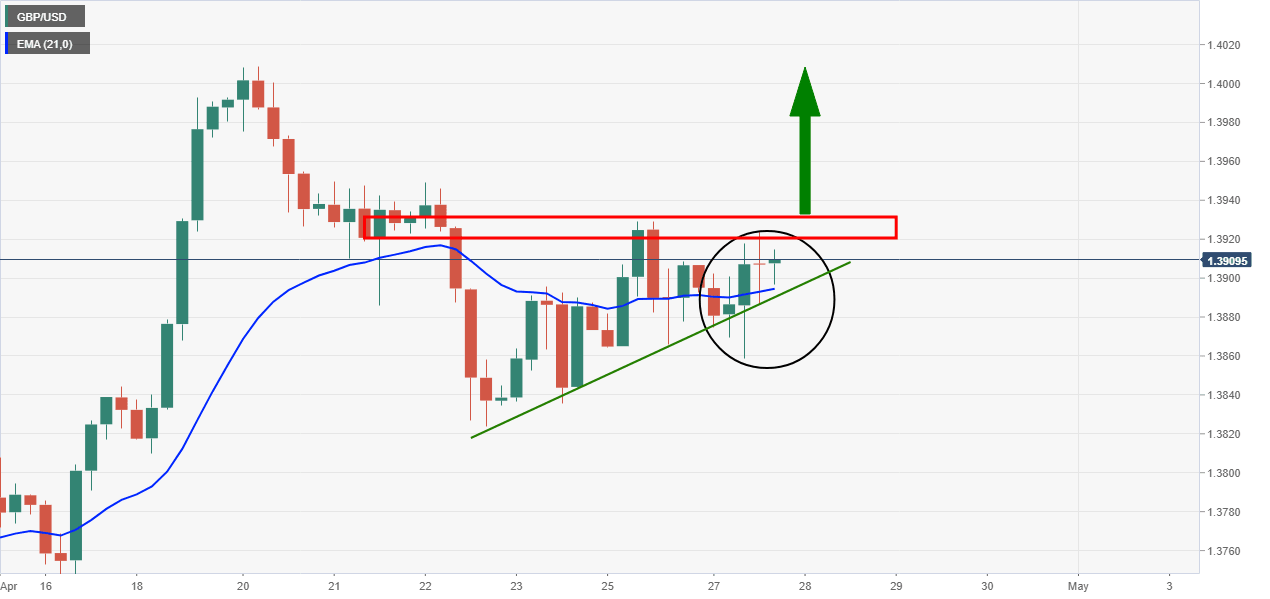

Live market 4-hour chart

As can be seen, the price is riding dynamic support and is closing above the 21-EMA.

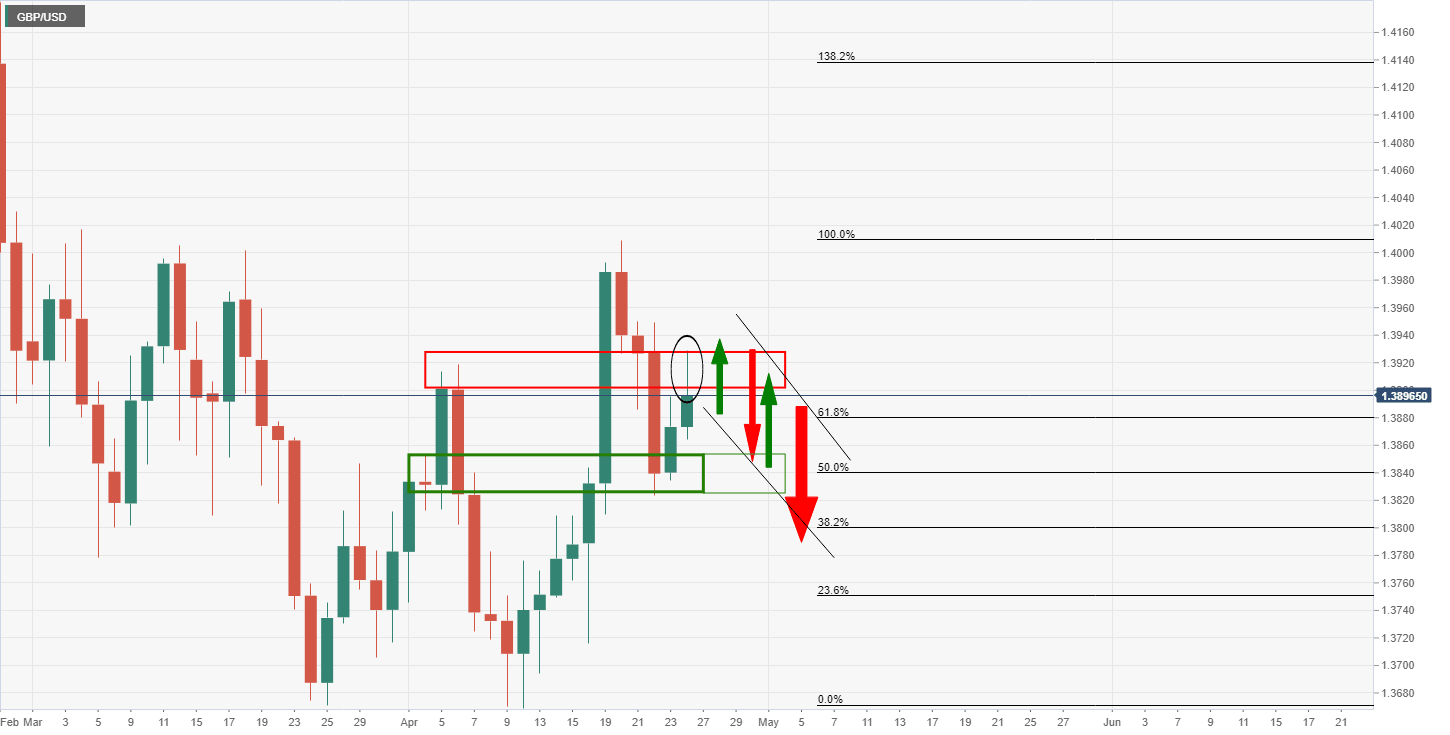

However, that is not to say that the 4-hour horizontal resistance will not hold and send the price lower, in line with the prior bearish analysis as follows:

Prior bearish analysis, daily chart

''Meanwhile, the downside on the daily chart may look something along the lines of the following if the 4-hour resistance gives and the daily tests at daily resistance fail over the course of the coming days:''

Live market analysis, daily

The price action on the day, so far, has been bullish.

A higher close will leave the bulls in good stead for the sessions ahead with the price holding above the 10 EMA and supported near to the 50 EMA.

Meanwhile, the focus remains on the 4-hour bullish drift testing resistance as first illustrated above and again, here:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.