GBP/USD holds gains above 1.2700 amid Fed divergent views

- US economy growth for Q3 was reported at 5.2%, above forecasts, indicating robust investment but reduced household spending.

- Federal Reserve officials are divided on future monetary policy, with some suggesting a more dovish approach.

- GBP/USD pair's outlook remains bullish in light of recent comments from Fed Governor Christopher Waller, suggesting the possibility of rate cuts.

The British Pound (GBP) clings to minimal gains vs. the Greenback (USD) in the mid-North American session after data from the United States (US) showed the economy remains resilient and growing above trend. Nevertheless, some Federal Reserve (Fed) officials remained dovish, while investors began to price in a dovish Fed. The GBP/USD is trading at 1.2703, slightly above the 1.2700 figure.

Pound Sterling remains underpinned by expectations for more than 100 bps of rate cuts by the Fed in 2024

Before Wall Street opened, a report by the US Bureau of Economic Analysis (BEA) revealed the US economy grew faster than the 5.0% expected, rising by 5.2% in Q3, above the second quarter's 2.1%. The data showed investment picked up while households cut expenses, which could pave the way for a slower reading in the next quarter. Even though the country grows above trend, Fed policymakers split views of policy sufficiently restrictive or keeping the door open for rate increases.

Atlanta Fed President Raphael Bostic said he sees slower growth and declining inflation pressures within the current monetary policy stance. Meanwhile, Richmond Fed President Thomas Barkin expressed skepticism about inflation, reaching the Fed's target and keeping the option of higher interest rates open.

Across the Atlantic, the Pound Sterling failed to gain traction after UK consumer credit data showed that British increased the pace of borrowing by the most in five years, along with hawkish comments of the Bank of England’s (BoE) Governor Andrew Bailey, who said the “will do what it takes” to get inflation to its 2% target.

Given the backdrop, the GBP/USD must likely remain bullish after yesterday’s remarks of Fed Governor Christopher Waller, who opened the door for rate cuts. Since then, money market interest rate futures foresee 115 bps of rate cuts by the Fed next year, higher than yesterday morning’s 85 bps. That said, if the major stays above 1.2700, a challenge of 1.2800 is on the cards.

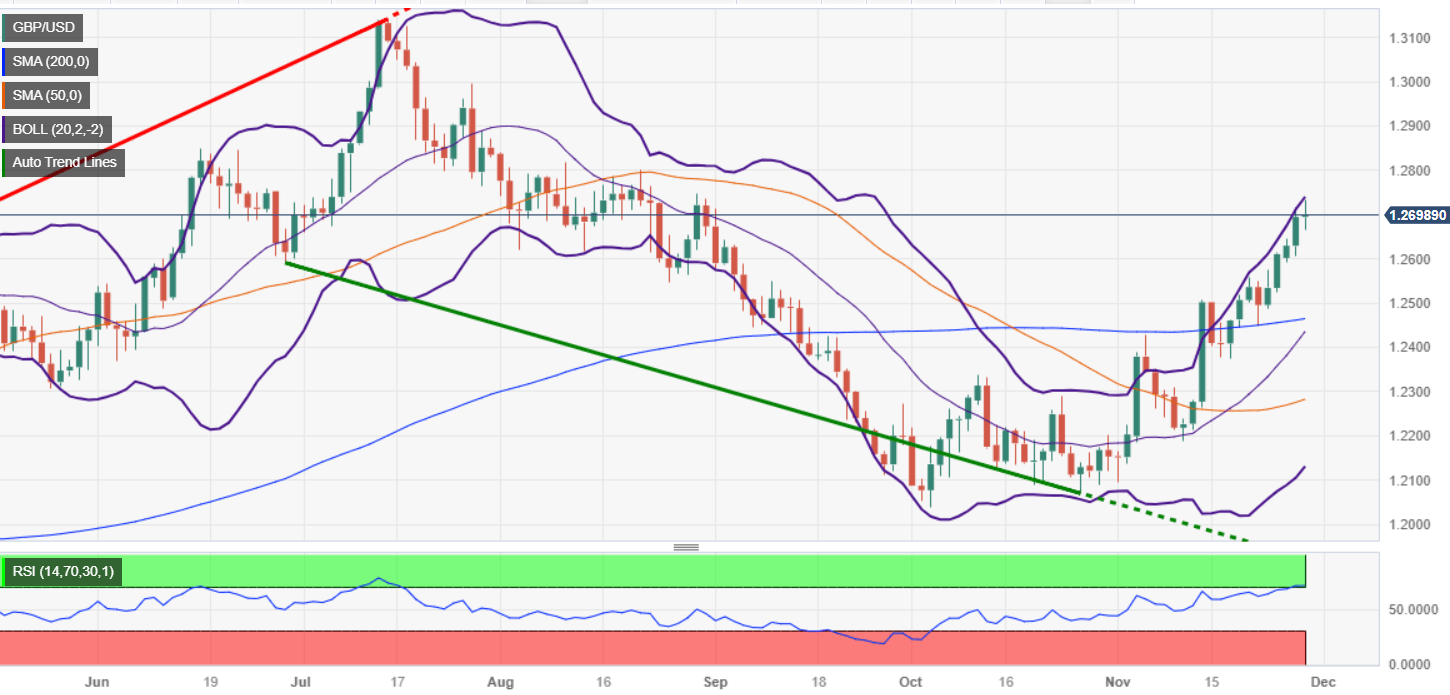

GBP/USD Price Analysis: Technical outlook

After printing a multi-month high at 1.2733, the GBP/USD retreated below the 1.2700 figure, opening the door for a pullback. As of writing, the pair is forming a ‘doji,’ suggesting indecision amongst traders. Furthermore, a daily close below 1.2690 could exacerbate a pullback to the November 28 low of 1.2606, ahead of the 1.2600 figure. A bullish scenario is seen if buyers lift the exchange rate above 1.2700 and achieve a daily close above that level. The following critical resistance level to test will be 1.2733, followed by the 1.2800 mark.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.