GBP/USD establishes above 1.2250 amid cheerful market mood, UK/US Inflation eyed

- GBP/USD has shifted its business profile comfortably above 1.2250 as the risk-on mood has strengthened.

- Federal Reserve is set to calm down the pace of the interest rate hike next week.

- A hawkish policy stance is expected from the Bank of England despite the recession in the United Kingdom.

- GBP/USD is likely to accelerate its upside journey as the RSI (14) is looking to conquer the bullish range.

GBP/USD has comfortably shifted its auction profile above the crucial resistance of 1.2250 in the early European session. The Cable has climbed to near 1.2270 and is expected to extend its upside journey amid a stellar improvement in the risk appetite of the market participants. The risk aversion theme has lost its traction as investors are cheering expectations of a slowdown in the policy tightening pace by the Federal Reserve (Fed) rather than focusing on recession fears led by higher interest rate peak guidance belief.

Meanwhile, the US Dollar Index (DXY) has refreshed its four-day low at 104.50 and is expected to re-test the weekly low at 104.11 ahead. A significant recovery in S&P500 futures after a cautious start in early Tokyo is portraying an upbeat risk impulse. The alpha delivered by the US Treasury bonds has returned to a negative trajectory. The 10-year US Treasury yields have dropped to 3.46%.

Investors seek clarity on Federal Reserve’s policy outlook

Federal Open Market Committee (FOMC) in its October monetary policy meeting cleared that the Federal Reserve is actively discussing on slowing down the pace of policy tightening as escalating financial risks cannot be ignored now. Analysts at Danske Bank see a further hike in interest rates by 50 basis points (bps) and a hawkish message from Federal Reserve chair Jerome Powell for CY2023. Also, the neutral rate is expected at 5.00-5.25%.

The termination of the 75 basis points (bps) rate hike spell is going to provide a sigh of relief to the firms. No doubt, interest payment obligations after a 50 bps rate hike will escalate but signs of reaching to neutral rate will be cemented.

Bank of England needs to tight policy further despite a recession in the United Kingdom

The United Kingdom Consumer Price Index (CPI) is setting the bar higher with support from multiple tailwinds. Food price inflation soared to 12.4% in November led by accelerating prices of basic food items. Adding to that, the recent food supply crisis led by a shortage of labor and rising input cost has added fuel to the fire. The United Kingdom's economy is facing the heat of the recession, reporting a contraction in the growth rate. In spite of more downside risks to the economy, Bank of England (BOE) Governor Andrew Bailey is set to hike interest rates further.

A poll on Bank of England’s interest rate hike expectations taken by Reuters states that the central bank will add another 50 basis points (bps) next week and take borrowing costs to 3.50%, despite the economy falling into recession. The rampant inflation in the United Kingdom needs further policy tightening to bring exhaustion in the inflationary pressures.

United Kingdom/United States Consumer Price Index eyed

Next week, the release of the inflation figures will remain in the spotlight. In the United States economy, the headline CPI is expected to remain unchanged at 7.7% while the core inflation might inch higher to 6.4%. As payroll data and demand in the service sector have remained upbeat in November, the United States inflation could display a surprise rise, which could trigger volatility in the global market.

In the United Kingdom, rampant food price inflation could trigger upside momentum in overall inflation. Therefore, investors should brace for an upside release in inflation. As per the consensus, the headline inflation is expected to climb to 11.5% vs. the prior release of 11.1%. While the core inflation is seen higher at 6.6%. Higher consensus for headline inflation seems supported by bumper food price inflation.

Before US inflation data, investors will keep an eye on Producer Price Index (PPI) numbers. The headline factory-rate price index is seen at 7.4% from the prior release of 8.0% on an annual basis. Also, the core PPI is seen lower at 6.0% vs. the former figure of 6.7% in a similar period.

GBP/USD technical outlook

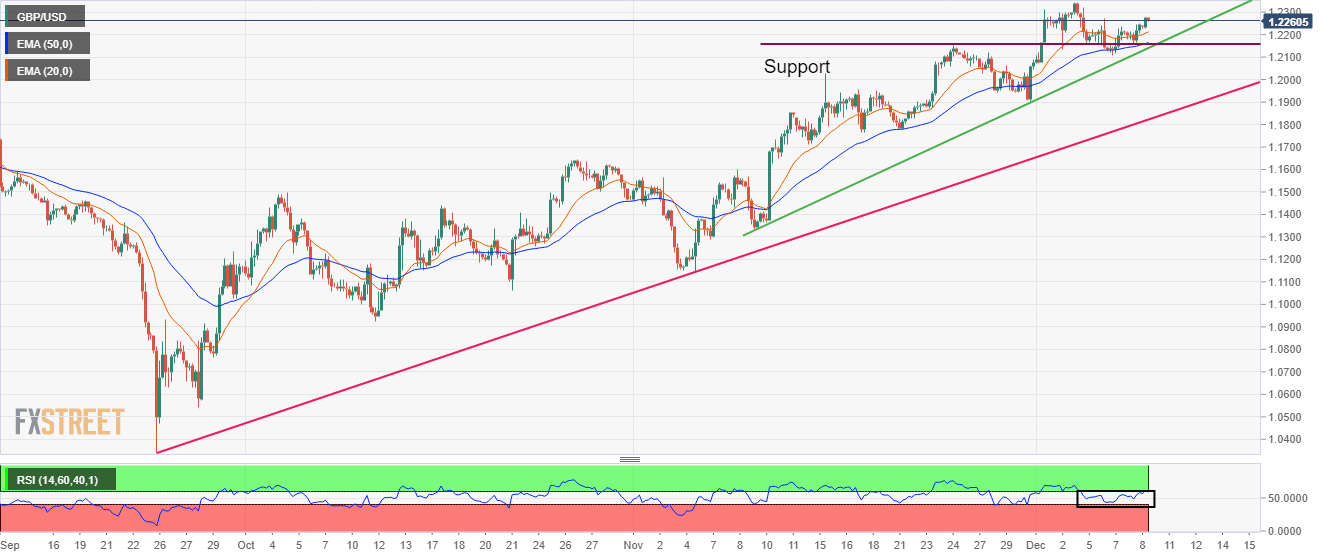

GBP/USD has recovered sharply after testing the horizontal support placed from November 24 high at 1.2153 on a four-hour scale. The secular and secondary upward-slopping trendlines plotted from September 26 low at 1.0339 and November 9 low at 1.1334 respectively will continue to support Pound Sterling.

Advancing 20-and 50-period Exponential Moving Averages (EMAs) at 1.2211 and 1.2263 respectively adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is looking forward to conquering the bullish range of 60.00-80.00, which will activate the upside momentum.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.