GBP/USD edges higher despite soaring UK borrowing as Dollar slips further

- GBP/USD rises to 1.3504 as Greenback weakens for second consecutive session.

- UK borrowing hits £20.7B in June, raising concerns over Reeves' fiscal plans.

- Markets await UK PMIs and key US data, including Jobless Claims and Durables.

The GBP/USD advances modestly during the North American session as the US dollar extends its losses for two straight days, despite data showing that UK government borrowing soared in June. At the time of writing, the pair trades at 1.3504 up 0.12%.

Sterling supported by US trade deal, while investors eye potential tax hikes amid growing UK fiscal pressures

Sterling remains underpinned by the trade agreement signed with the US, amid uneasy times of trade talks between the US and its largest trading partners: the European Union (EU), Canada, and Mexico. These three countries received letters from the White House that imposed levies between 30% to 35%, effective August 1.

UK’s official data revealed that public sector net borrowing totaled £20.7 billion last month, exceeding the foreseen £17.1 billion for June, projected by the Office for Budget Responsibility (OBR). The data increased investors’ speculation that Chancellor Rachel Reeves might have to raise taxes at the Autumn budget, so she can meet her targets to fix the public finances.

Ahead of the week, the UK economic docket will feature the S&P Global Flash PMIs for July, providing a preliminary reading. Across the pond, housing data, Initial Jobless Claims, and durable goods orders will be eyed.

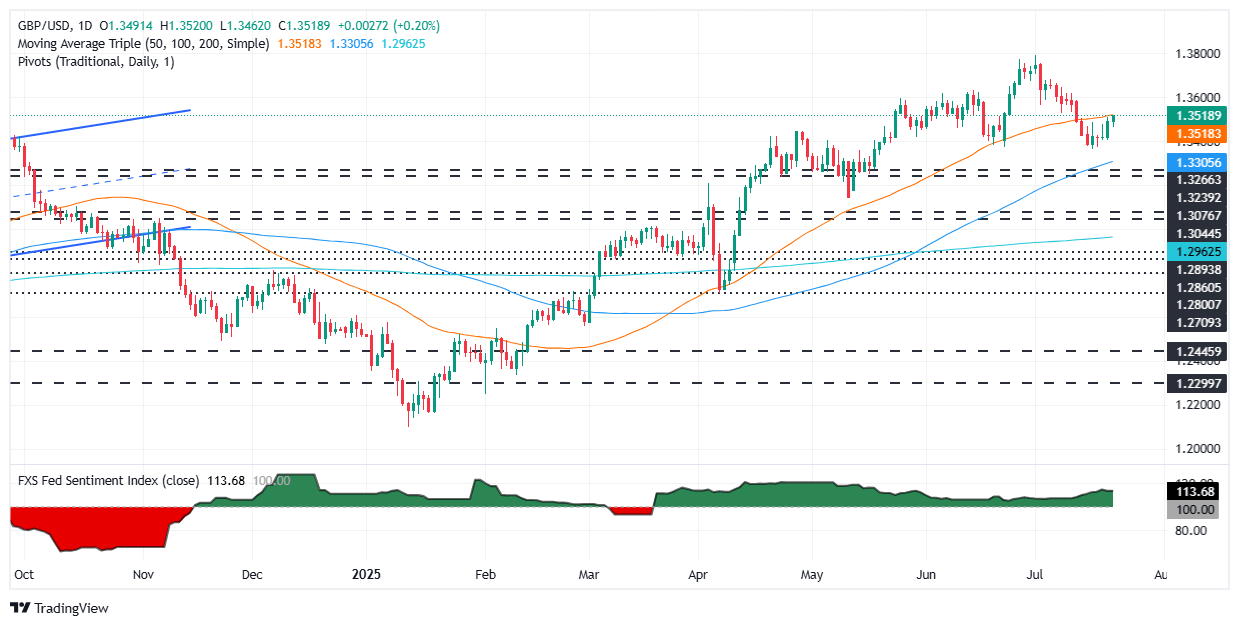

GBP/USD Price Forecast: Technical outlook

The GBP/USD is neutral biased, but it’s showing signs of recovery as the pair climbs above 1.3500. Despite this, a daily close above the 50-day SMA at 1.3514i is needed, so buyers could challenge the 20-day SMA at 1.3568. Further gains are seen above the latter at 1.3600.

On the flipside, a daily close below 1.3500 would pave the way for some range-bound trading within the 1.3400 – 1.3500 in the near term.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.98% | -0.74% | -1.07% | -0.71% | -0.58% | -0.44% | -1.07% | |

| EUR | 0.98% | 0.32% | -0.09% | 0.25% | 0.37% | 0.36% | -0.13% | |

| GBP | 0.74% | -0.32% | -0.59% | -0.01% | 0.08% | 0.26% | -0.25% | |

| JPY | 1.07% | 0.09% | 0.59% | 0.37% | 0.54% | 0.58% | 0.17% | |

| CAD | 0.71% | -0.25% | 0.01% | -0.37% | 0.19% | 0.27% | -0.41% | |

| AUD | 0.58% | -0.37% | -0.08% | -0.54% | -0.19% | 0.07% | -0.36% | |

| NZD | 0.44% | -0.36% | -0.26% | -0.58% | -0.27% | -0.07% | -0.51% | |

| CHF | 1.07% | 0.13% | 0.25% | -0.17% | 0.41% | 0.36% | 0.51% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.