GBP/USD cools momentum as Pound traders weigh next options

- GBP/USD held steady near 1.2900 on Monday as a new week gets underway.

- PMI figures for both the UK and the US came in mixed to start the new week.

- Cable has flubbed a technical grab for the 1.3000 handle, putting a further backslide on the cards.

GBP/USD rankled on Monday, kicking off the new week with a fresh bout of indecision as the pair floats near the 1.2900 handle. Economic data from both the UK and the US came in mixed on Monday, as surveyed businesses waffle on their Purchasing Managers Index (PMI) expectations.

US President Donald Trump has again hit investors with a fresh batch of on-again, off-again tariff threats. Investors have latched onto the suggestion that Donald Trump might be looking at tariff exemptions for his own trade policy “strategy”, bolstering market sentiment enough to keep the Greenback under wraps.

UK PMI data came in mixed early Monday, with the Manufacturing PMI component falling to a fresh 18-month low of 44.6 in March. The Services component rose more than expected, hitting a seven-month high of 53.2, but overall business activity expectations remain tepid at bast amid a wobbling UK economic outlook.

US Manufacturing PMI survey results sank faster than expected in March as tariff threats take a bite out of the physical production outlook. The Manufacturing PMI for March sank to a three-month low of 49.8, slipping back into economic contraction territory as businesses grow increasingly worried about the economic landscape. The Services PMI came in better than expected, rising to 54.3, it’s own three-month high as services operators expect to be able to fully pass on tariff cost increases to consumers.

A data-light economic calendar awaits Tuesday’s market participants, but Cable traders will be looking ahead to Wednesday’s UK Consumer Price Index (CPI) inflation print from February. Headline UK CPI inflation is expected to tick down slightly to 2.9% from 3.0% YoY.

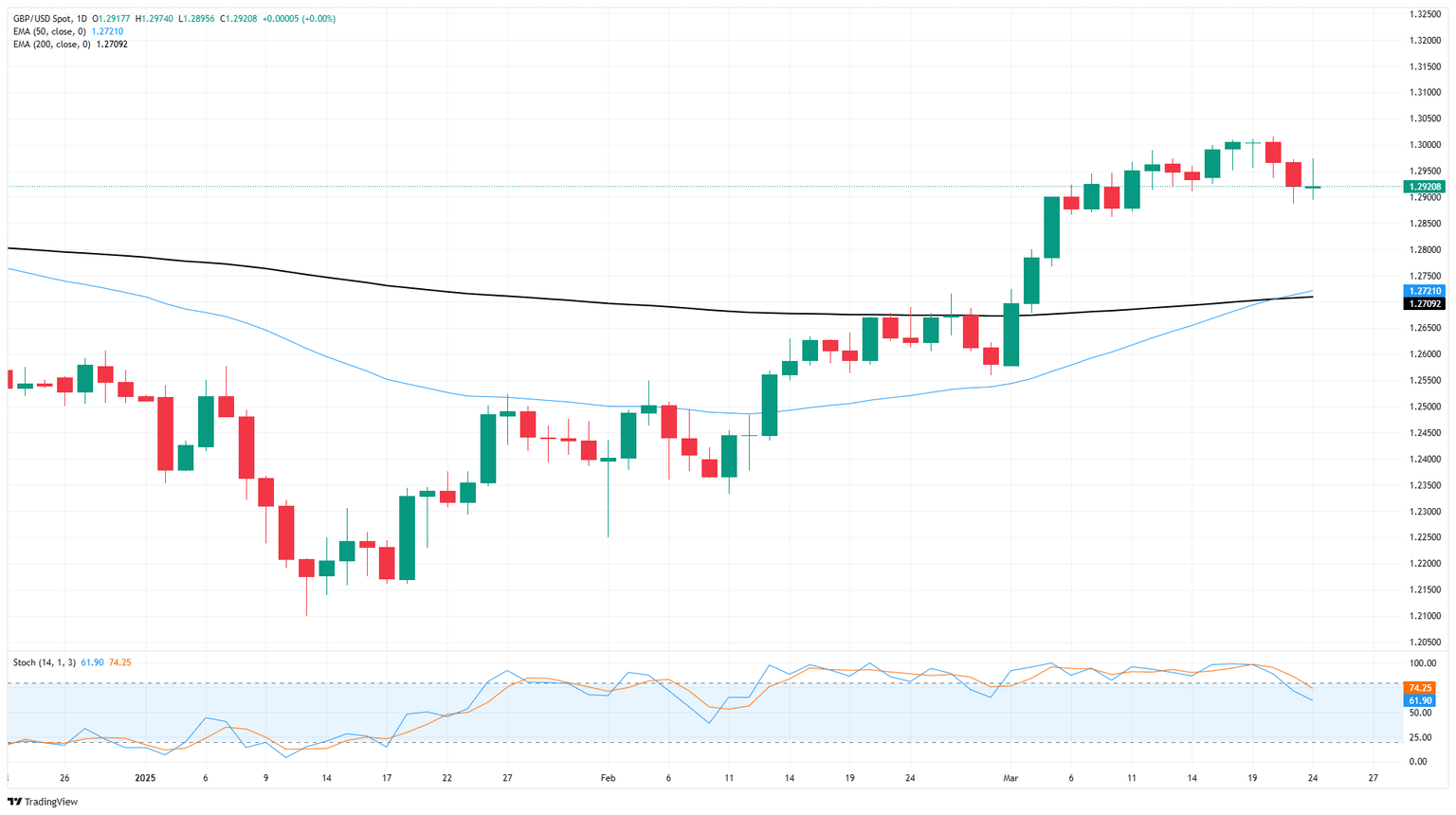

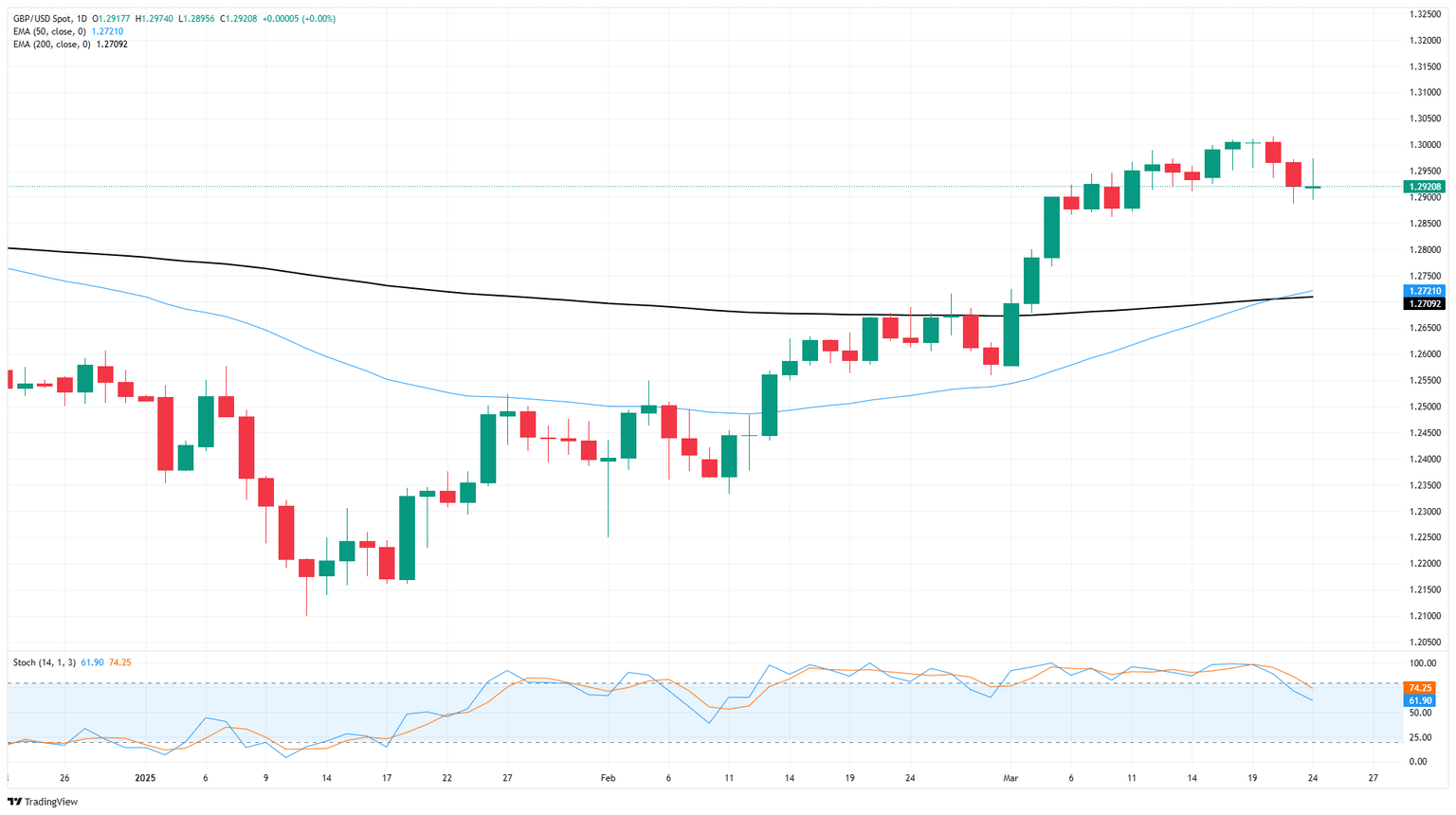

GBP/USD price forecast

GBP/USD has pumped the brakes on a technical decline from recent highs, snapping a two-day losing streak. However, the pair remains on the wrong side of the 1.3000 handle as price action chalks in a new technical ceiling at the key handle.

Cable is still trading well above the 200-day Exponential Moving Average (EMA) at 1.2700, but bullish momentum looks poised to evaporate further as bidders run out of gas. Technical oscillators have been pinned in overbought territory since January, and it may be time for an extended backslide.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.