GBP/USD continues to slide below 1.2000 and the coil

- Markets are risk-off and that is sending GBP below 1.2000.

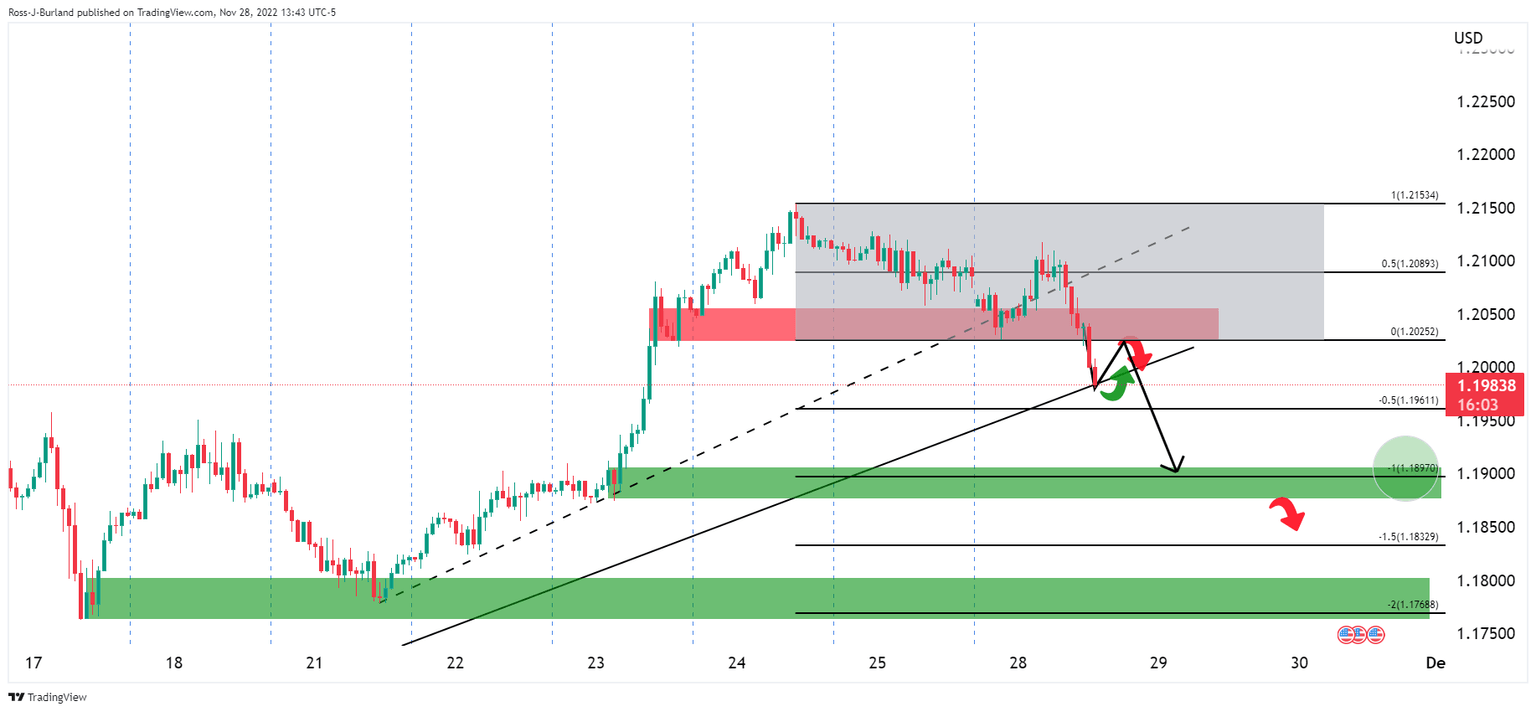

- GBP/USD is breaking out of a coil which is significant.

- A 100% measured move of the range will target the prior structure at 1.1900.

At the time of writing, GBP/USD is down some 0.9% falling to a low of 1.1976 from a high of 1.2111. Risk currencies, such as the British pound, are under pressure as protests against COVID restrictions in China knocked market sentiment.

GBP/USD is falling below the psychological 1.2000 level and meeting short-term dynamic support. Additionally, fears of a lengthy UK recession were seen weighing on sentiment. Investors await to see what the Bank of England's (BoE) next move will be. There will be several BoE members due to speak this week, including BoE governor Andrew Bailey on Tuesday and chief economist Huw Pill on Wednesday.

The Old Lady has been trying to combat soaring inflation without damaging the economy too much in the process. ''Inflation pressures will remain elevated during 2023, forcing the Bank of England to deliver further hikes,'' analysts at Danske Bank explained. ''We do however see the peak rate well below market pricing and we expect the first cut to be delivered during 2024.''

Ears out for Fed speakers

Meanwhile, Federal Reserve speakers will be key this week. On Monday, New York Federal Reserve Bank President John Williams said that he believes the Fed will need to raise rates to a level sufficiently restrictive to push down on inflation, and keep them there for all of next year:

"I do think we're going to need to keep the restrictive policy in place for some time; I would expect that to continue through at least next year," Williams said at a virtual event held by the Economic Club of New York, adding that he does not expect a recession.

James "Jim" Bullard, president and CEO of the Federal Reserve Bank of St. Louis, has said that rates need to go higher to bring inflation down. ''We've got a ways to go to get restrictive on policy.'' He also said the Fed ''will have to keep rates at a sufficiently high level all through 2023 and into 2024.''

GBP/USD technical analysis

The bears are moving on the trendline support. However, a correction could be on the cards first as illustrated on the hourly chart above. Nevertheless, the price is breaking out of a coil and a 100% measured move of the range will target the prior structure at 1.1900 and then a 200% measure move aligns with 1.1800.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.