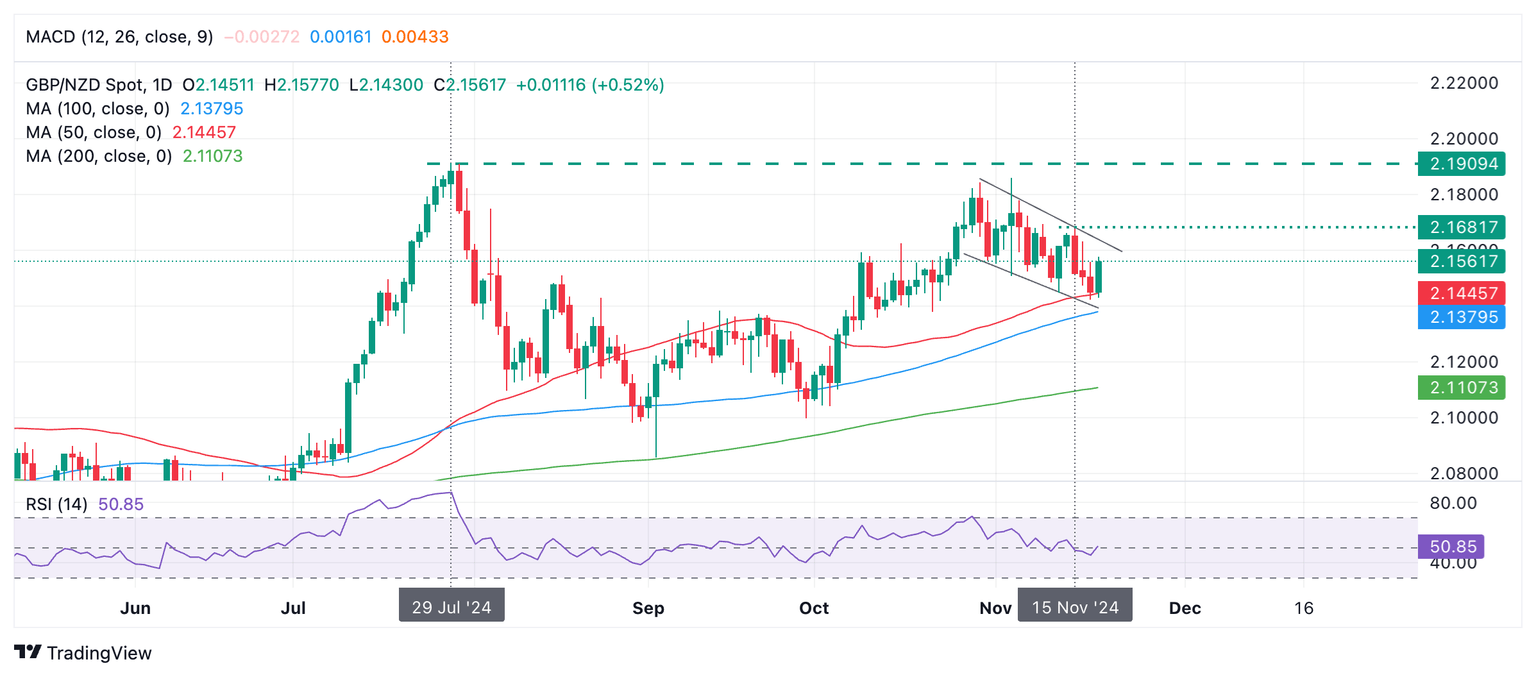

GBP/NZD Price Forecast: Correction reaches support at 50-day SMA

- GBP/NZD channels down during November and reaches support at the 50-day SMA.

- This could be a turning point for the pair and lead to a breakout and continuation of the trend higher.

GBP/NZD has been correcting back in a mini channel during November after peaking at the October 30 high. It has now reached support at the 50-day Simple Moving Average (SMA) at 2.1446 and made a strong recovery, evidenced by the long green candlestick so far, on Wednesday.

GBP/NZD Daily Chart

If GBP/NZD keeps rallying and breaks above the upper channel line of the channel it will probably continue rising towards a target at 2.1900, just below the July 29 high.

A break above 2.1675 – the November 15 high – would probably confirm a breakout from the channel and follow-through towards the aforesaid upside target.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.