GBP/JPY Price Forecast: Pound extends its reversal below 202.00

- The Pound extends losses on Monday and hits fresh one-week lows at the 201.35 area.

- Higher-than-expected UK employment sent the Pound tumbling across the board on Tuesday.

- GBP/JPY reversal from 203.50 keeps bears in control.

Pound’s reversal against the Yen extended to fresh one-week lows at 201.34, hammered by a downbeat UK employment report and the risk-averse sentiment stemming from a new chapter of the Sino-US trade feud.

Data from the UK released earlier on Tuesday revealed an unexpected increase in the jobless rate to 4.8% for the three months up to August, up from 4.7% in July, while net employment increased by 91K, down from 232K in July.

Technical analysis: Failure at 203.50 keeps the bears in control

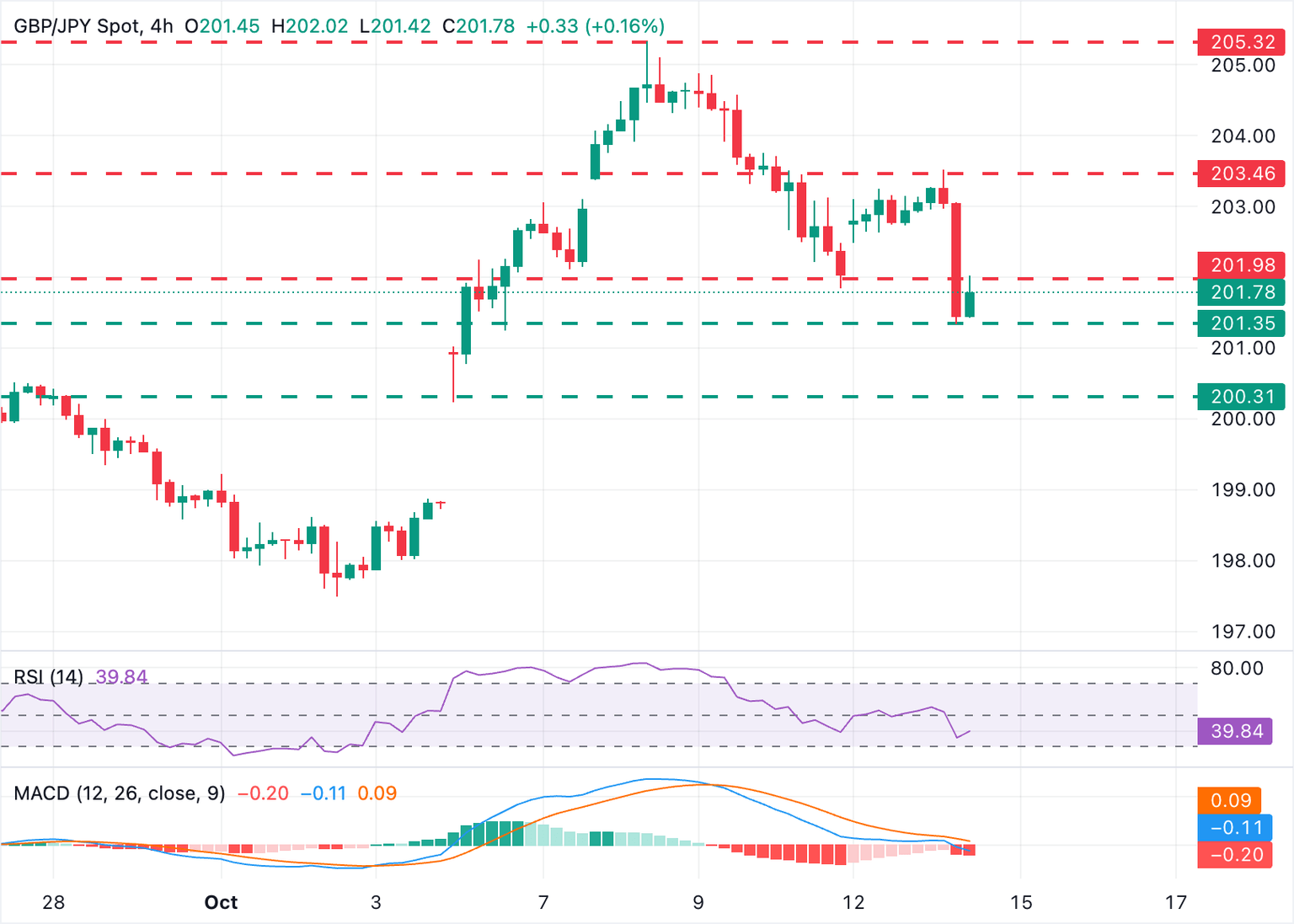

From a technical perspective, the impulsive reversal from 203.50 keeps the downside trend from the early October highs at 205.33 in play. The 4-hour RSI remains below the 40.00 level, highlighting the bearish momentum.

Price action remains close to the weekly lows at 201.35. Further down, the 200.40 level (September 26 highs and October 6 low) emerges as the next target ahead of Monday’s gap opening level, at 198.85.

On the upside, previous support, at the 202.00 level (October 10 low), has now turned into resistance. Above here, the daily high at the 203.50 area is closing the path towards the October 8 high, at 206.35.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.16% | 0.53% | -0.12% | 0.24% | 0.96% | 0.67% | 0.05% | |

| EUR | -0.16% | 0.38% | -0.26% | 0.07% | 0.85% | 0.51% | -0.10% | |

| GBP | -0.53% | -0.38% | -0.65% | -0.29% | 0.46% | 0.18% | -0.48% | |

| JPY | 0.12% | 0.26% | 0.65% | 0.37% | 1.07% | 0.76% | 0.13% | |

| CAD | -0.24% | -0.07% | 0.29% | -0.37% | 0.77% | 0.43% | -0.19% | |

| AUD | -0.96% | -0.85% | -0.46% | -1.07% | -0.77% | -0.33% | -0.94% | |

| NZD | -0.67% | -0.51% | -0.18% | -0.76% | -0.43% | 0.33% | -0.62% | |

| CHF | -0.05% | 0.10% | 0.48% | -0.13% | 0.19% | 0.94% | 0.62% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.