GBP/JPY Price Forecast: Continues to face selling pressure around 200.00

- GBP/JPY falls sharply to near 199.30 after upbeat Japan’s Q2 GDP data.

- The Japanese economy grew by 0.3%, faster than estimates of 0.1%.

- The BoE is expected to maintain its “gradual and careful” monetary easing outlook.

The GBP/JPY pair slides 0.3% to near 199.30 during the Asian trading session on Friday. The cross faces a sharp selling pressure as the Japanese Yen (JPY) has strengthened, following the release of the surprisingly upbeat preliminary Q2 Japan’s Gross Domestic Product (GDP) data.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.13% | -0.11% | -0.54% | -0.10% | -0.15% | -0.07% | -0.15% | |

| EUR | 0.13% | 0.01% | -0.33% | 0.03% | -0.05% | 0.05% | -0.02% | |

| GBP | 0.11% | -0.01% | -0.34% | 0.02% | -0.06% | 0.04% | -0.03% | |

| JPY | 0.54% | 0.33% | 0.34% | 0.35% | 0.30% | 0.42% | 0.28% | |

| CAD | 0.10% | -0.03% | -0.02% | -0.35% | -0.00% | 0.02% | -0.05% | |

| AUD | 0.15% | 0.05% | 0.06% | -0.30% | 0.00% | 0.02% | 0.02% | |

| NZD | 0.07% | -0.05% | -0.04% | -0.42% | -0.02% | -0.02% | -0.07% | |

| CHF | 0.15% | 0.02% | 0.03% | -0.28% | 0.05% | -0.02% | 0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Earlier in the day, the Japanese Cabinet Office reported that the GDP expanded by 0.3% after remaining flat in the previous quarter. Economists expected a moderate growth of 0.1%. On an annualized basis, the economy grew strongly by 1% after a GDP contraction of 0.2% in the previous quarter.

Upbeat GDP data has increased hopes of more interest rate hikes by the Bank of Japan (BoJ) in the near term. On Wednesday, United States (US) Treasury Secretary Scott Bessent said that the BoJ is behind the curve and would tighten its monetary policy further.

Meanwhile, the Pound Sterling (GBP) trades broadly calm on expectations that the Bank of England (BoE) will stick to its “gradual and careful” monetary easing outlook as elevated inflation and better-than-projected Q2 GDP data would offset the impact of labor market concerns.

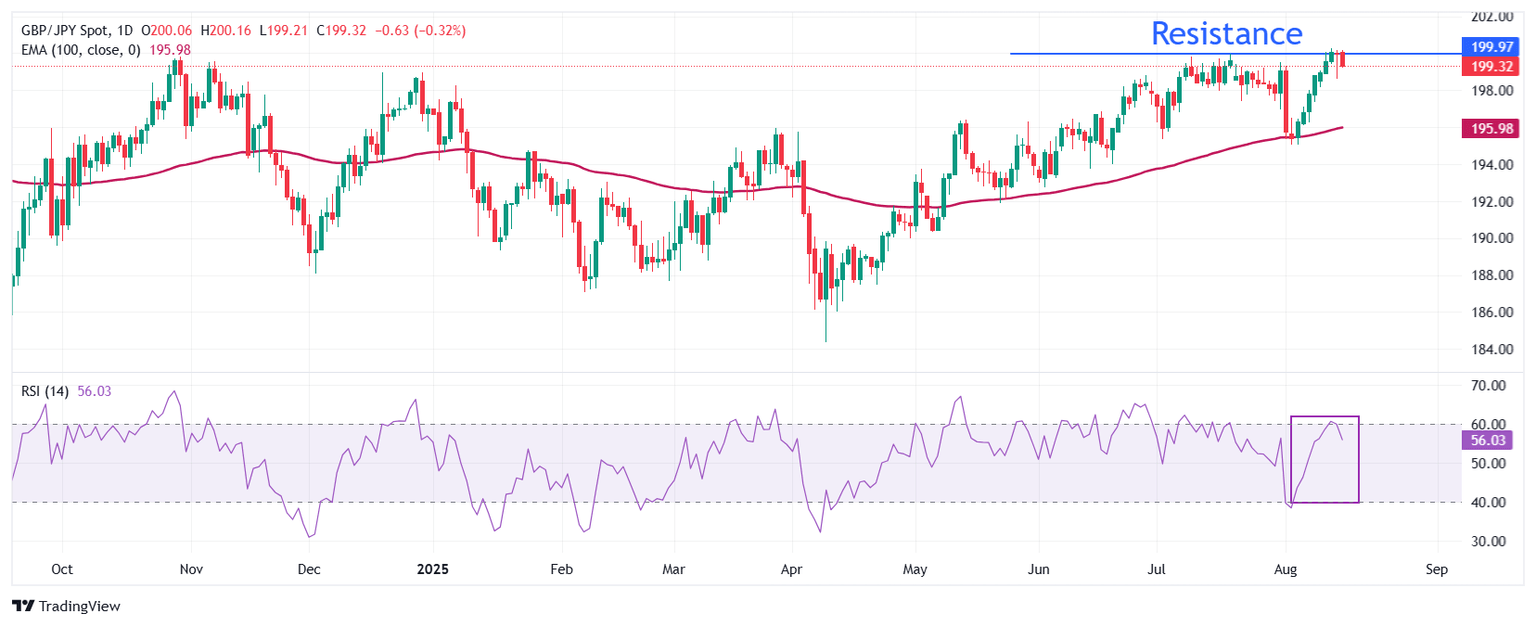

GBP/JPY continues to face selling pressure near the psychological level of 200.00. However, the near-term trend of the cross remains bullish as the 100-day Exponential Moving Average (EMA) slopes higher around 195.95.

The 14-day Relative Strength Index (RSI) struggles to break above 60.00. A fresh bullish momentum would emerge if the RSI manages to do so.

The pair could extend its upside towards the 23 July 2024 high of 203.16 and the 19 July 2024 high of 204.23, if it stabilizes above the psychological level of 200.00.

On the flip side, a downside move by the pair below the May 6 low of 190.33 will expose it to the March 11 low of 188.80, followed by the February 7 low of 187.00.

GBP/JPY daily chart

Economic Indicator

Gross Domestic Product (QoQ)

The Gross Domestic Product (GDP), released by Japan’s Cabinet Office on a quarterly basis, is a measure of the total value of all goods and services produced in Japan during a given period. The GDP is considered as the main measure of Japan’s economic activity. The QoQ reading compares economic activity in the reference quarter to the previous quarter. Generally, a high reading is seen as bullish for the Japanese Yen (JPY), while a low reading is seen as bearish.

Read more.Last release: Thu Aug 14, 2025 23:50 (Prel)

Frequency: Quarterly

Actual: 0.3%

Consensus: 0.1%

Previous: 0%

Source: Japanese Cabinet Office

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.