GBP/JPY Price Analysis: Subdued, trades flat above 201.00

- GBP/JPY remains upward biased with support from a bullish yet trendless RSI, hinting at stable rates.

- Key resistance at YTD high of 201.61 and the 202.00 mark.

- Key support levels include 201.00, Tenkan-Sen at 200.26, Senkou Span A at 199.71, and Kijun-Sen at 199.15.

The GBP/JPY remained subdued on Thursday yet finished up 0.06%, virtually unchanged. As Friday’s Asian Pacific session begins, the cross trades at 201.11, flat.

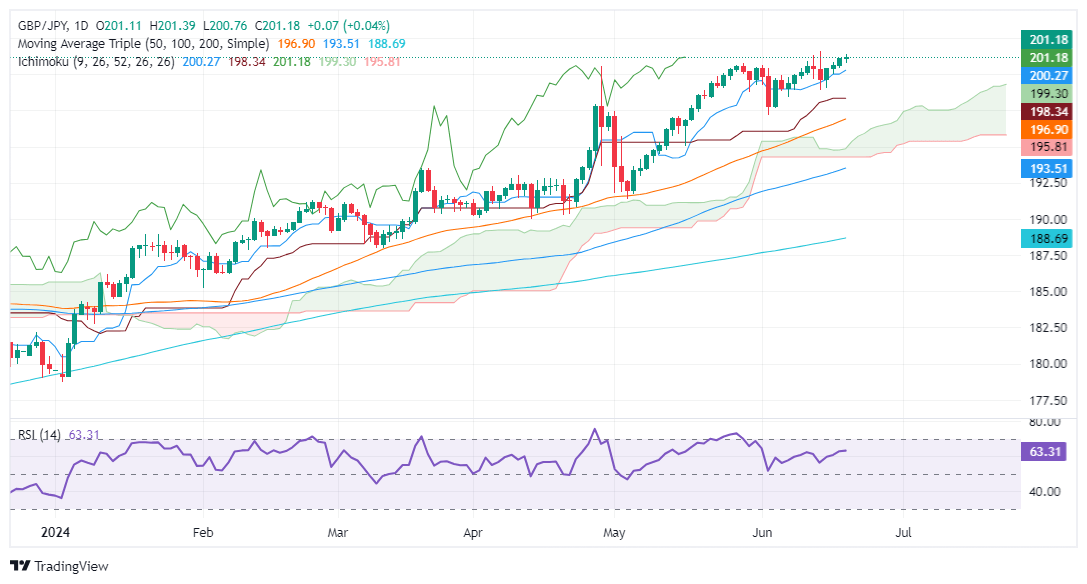

GBP/JPY Price Analysis: Technical outlook

According to the daily chart, the GBP/JPY remains upward biased and is backed by momentum as the Relative Strength Index (RSI) is bullish, though trendless. This hints that the cross might remain at around current exchange rates amid the lack of catalysts and fears of Japanese authority's intervention.

On the upside, the GBP/JPY first resistance would be the year-to-date (YTD) high at 201.61, ahead of the 202.00 mark.

On further weakness, the cross could tumble below 201.00 and test the Tenkan-Sen at 200.26, the first support level, followed by the Senkou Span A at 199.71. Once surpassed, the next stop would be the Kijun-Sen at 199.15.

GBP/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.