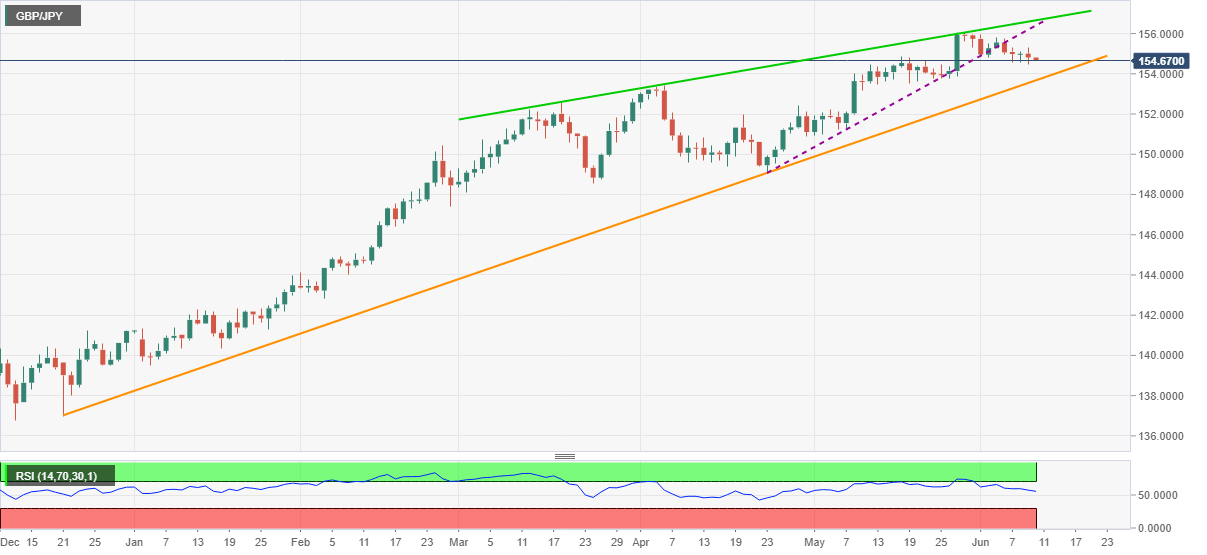

GBP/JPY Price Analysis: Pressured towards 154.50, Brexit woes highlight yearly support

- GBP/JPY extends the last Friday’s breakdown of short-term key support, down for second consecutive day.

- Brexit headlines post downside risk, RSI conditions also favor sellers.

- April’s top adds to the downside filters ahead of recalling the sub-150.00 area.

GBP/JPY refreshes intraday low near 154.65, down 0.10% intraday, amid the initial hour of Thursday’s Tokyo open. The cross-currency pair recently dropped amid Brexit-negative headlines concerning the EU-UK policymakers’ failure to tackle the Northern Ireland (NI) issue.

Read: GBP/USD sellers attack 1.4100 amid Brexit doldrums ahead of Biden-Johnson talks

Technically, the quote remains on the back foot following its downside break of an ascending trend line from late April. The same joins descending RSI line to keep sellers hopeful.

However, the yearly support line near 153.65, followed by April month’s high close to 153.40, become crucial challenges for GBP/JPY bears.

It’s worth noting that a daily closing below 153.40 will make the pair vulnerable to retest April’s low at around 149.00.

On the flip side, May 18 peak near 154.85 and the 155.00 threshold may test the corrective pullback before directing GBP/JPY buyers to 155.50 and the recent multi-month high of 156.06.

During the pair’s run-up beyond 156.06, the previous support line around 156.35 and an ascending resistance line from March 18, close to 156.65-70 will be tough nuts to crack for GBP/JPY bulls.

GBP/JPY daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.