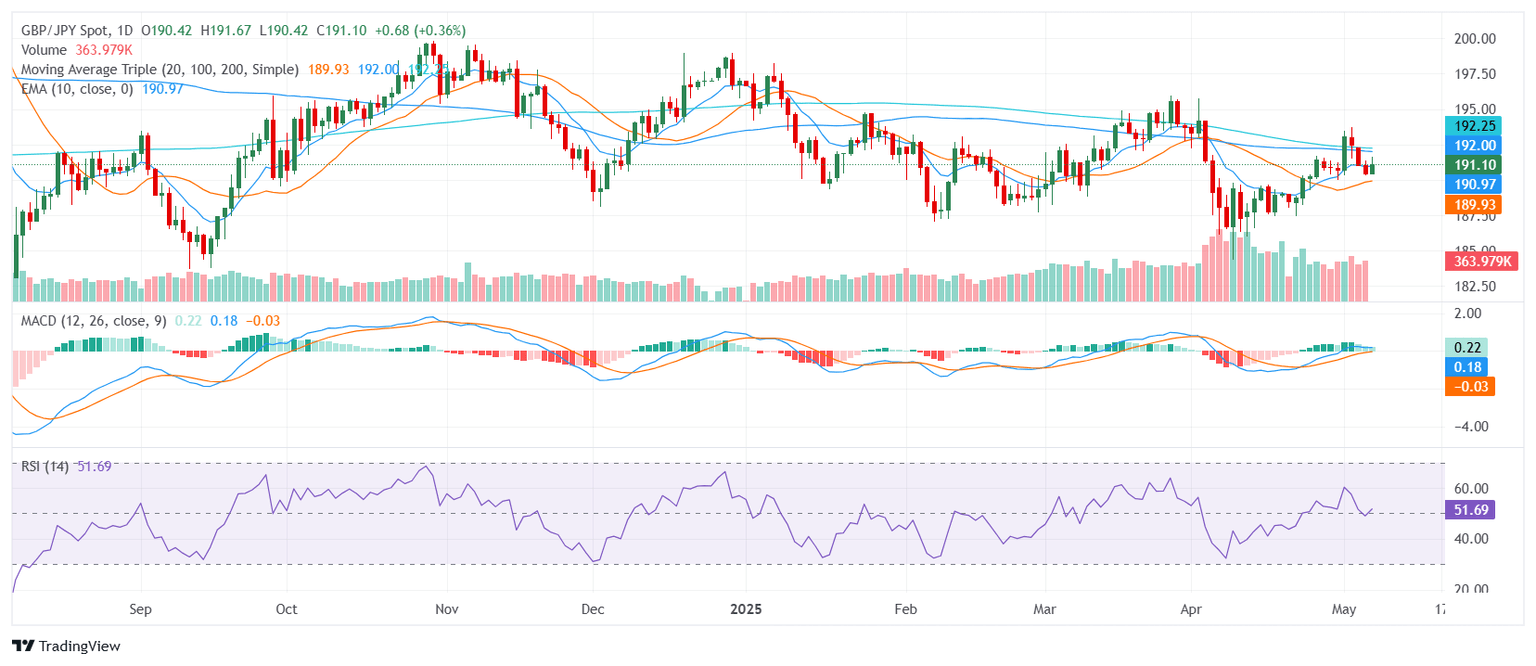

GBP/JPY Price Analysis: Pound holds near 191.00 as bullish tone strengthens

- GBP/JPY trades near the 191.00 zone after steady gains in Wednesday’s session.

- Overall bias remains bullish, supported by short-term moving averages despite mixed momentum.

- Key support levels hold just below, while longer-term resistance remains a barrier overhead.

The GBP/JPY pair edged higher on Wednesday, trading around the 191.00 zone as buyers maintained control. The pair remains supported by a series of rising short-term moving averages, reinforcing the broader bullish structure despite some mixed momentum signals that may limit immediate upside potential.

Technically, the pair maintains a bullish outlook. The Relative Strength Index remains neutral near 52, indicating balanced momentum without clear directional conviction. The Moving Average Convergence Divergence confirms a buy signal, aligning with the broader uptrend, while the Stochastic RSI Fast also sits in neutral territory, reflecting the absence of immediate overbought conditions. However, the Momentum indicator flashes a sell signal, suggesting that the recent rally may be losing steam in the short term.

From a trend perspective, the 20-day Simple Moving Average, along with the 10-day and 30-day Exponential Moving Averages, all sit below the current price and continue to slope upward, providing dynamic support. In contrast, the 100-day and 200-day Simple Moving Averages remain positioned above the market, acting as significant overhead resistance that may cap further gains unless breached decisively.

Support levels are noted at 191.12, 191.10, and 190.97. Resistance stands at 191.20, 191.67, and 192.00. A push above this resistance cluster could confirm the broader bullish bias, while failure to hold immediate support might lead to a short-term correction without necessarily disrupting the broader trend.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.