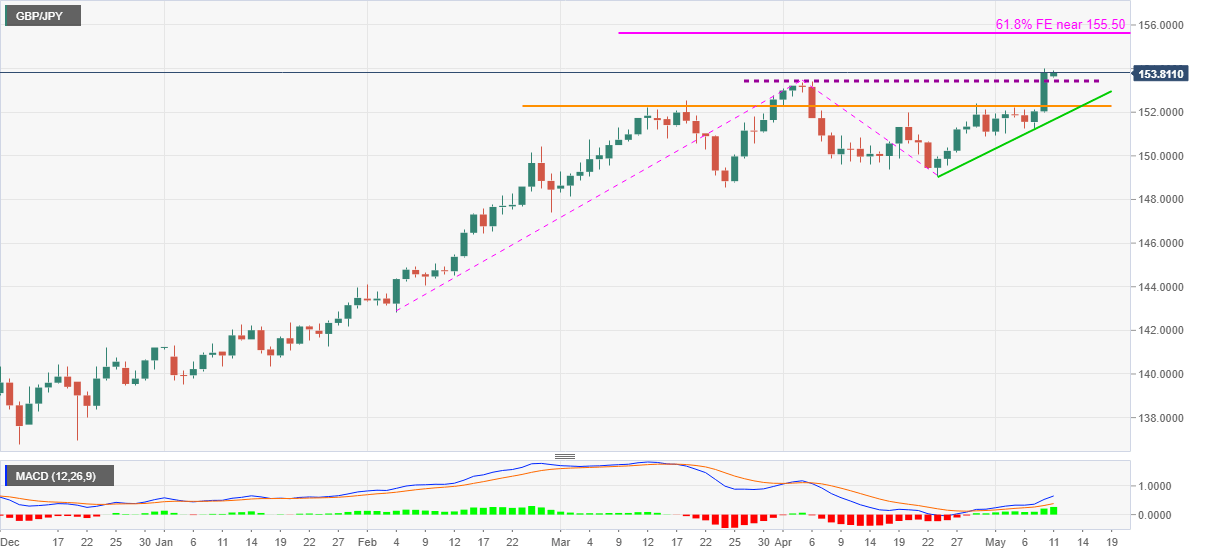

GBP/JPY Price Analysis: Mildly bid near 39-month high on the way to 155.50

- GBP/JPY stays on the front foot near February 2018 top.

- Bullish MACD, sustained break of previous key hurdle back the bulls.

- 61.8% FE lure buyers, bumpy road for the bears.

GBP/JPY remains strong near 153.85-90, up 0.15% intraday, amid Tuesday’s Asian session. The pair refreshed the multi-month top by crossing April’s top the previous day.

Given the strong MACD and a sustained breakout of the key hurdle, now support, GBP/JPY remains on the bull’s radar unless dropping back below April’s high near 153.35.

Even if the quote slips beneath the 153.35 immediate support, multiple tops marked since March 12 around 152.40-35 can test the sellers before dragging them to a two-week-old rising trend line, near 151.65.

Alternatively, Monday’s peak surrounding the 154.00 and late January 2018 highs close to 154.60 may act as nearby resistance during the quote’s further upside.

However, major attention will be given to the 61.8% Fibonacci Expansion (FE) of the pair’s run-up from February, also considering the April month’s fall, near 155.50.

GBP/JPY daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.