GBP/JPY Price Analysis: Further upside hinges on 159.50 breakout

- GBP/JPY extends Friday’s recovery moves to attack short-term key resistances.

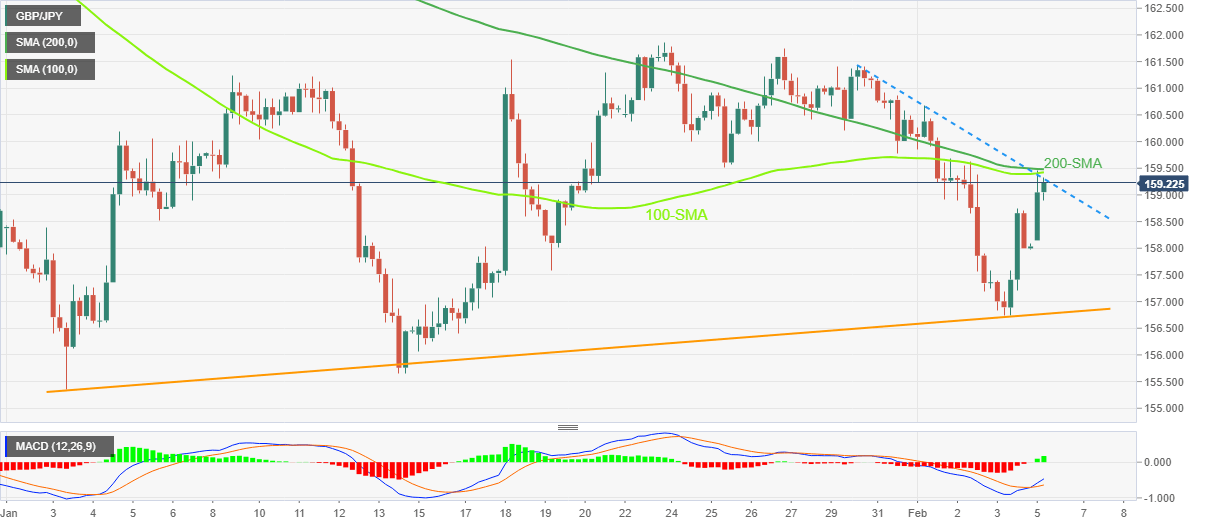

- One-week-old descending trend line precedes key SMAs to challenge bulls.

- Upbeat MACD signals, U-turn from monthly support line keeps buyers hopeful.

GBP/JPY remains firmer around 159.20 as it stretches the previous day’s rebound from a three-week low during early Monday. In doing so, the cross-currency pair also jostles with the short-term key hurdles to keep the reins.

That said, bullish MACD signals join the quote’s sustained bounce off an upward-sloping support line from early January, around 156.75 by the press tie, to keep the GBP/JPY buyers hopeful.

It’s worth noting that the weekly resistance line appears the immediate hurdle for the GBP/JPY bulls to cross, near 159.30 at the latest. Following that, the 100-bar Simple Moving Average (SMA) and the 200-SMA could challenge the pair buyers around 159.40 and 159.50 respectively.

It should be observed that the 160.00 psychological magnet may act as an extra filter towards the north before directing the GBP/JPY upside to the previous monthly peak near 161.85.

Meanwhile, pullback moves could aim for the January 19 swing low surrounding 157.60 before challenging the aforementioned support line close to 156.75.

In a case where GBP/JPY bears keep the reins past 156.75, the mid-January low and the yearly bottom, respectively around 155.65 and 155.35, could test the bears.

To sum up, GBP/JPY is likely to regain the buyer’s confidence but the upside break of 159.50 appears necessary.

GBP/JPY: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.