GBP/JPY Price Analysis: Bullish flag dominates until break of structure

- GBP/JPY is a complicate mix between USD/JPY and GBP/USD.

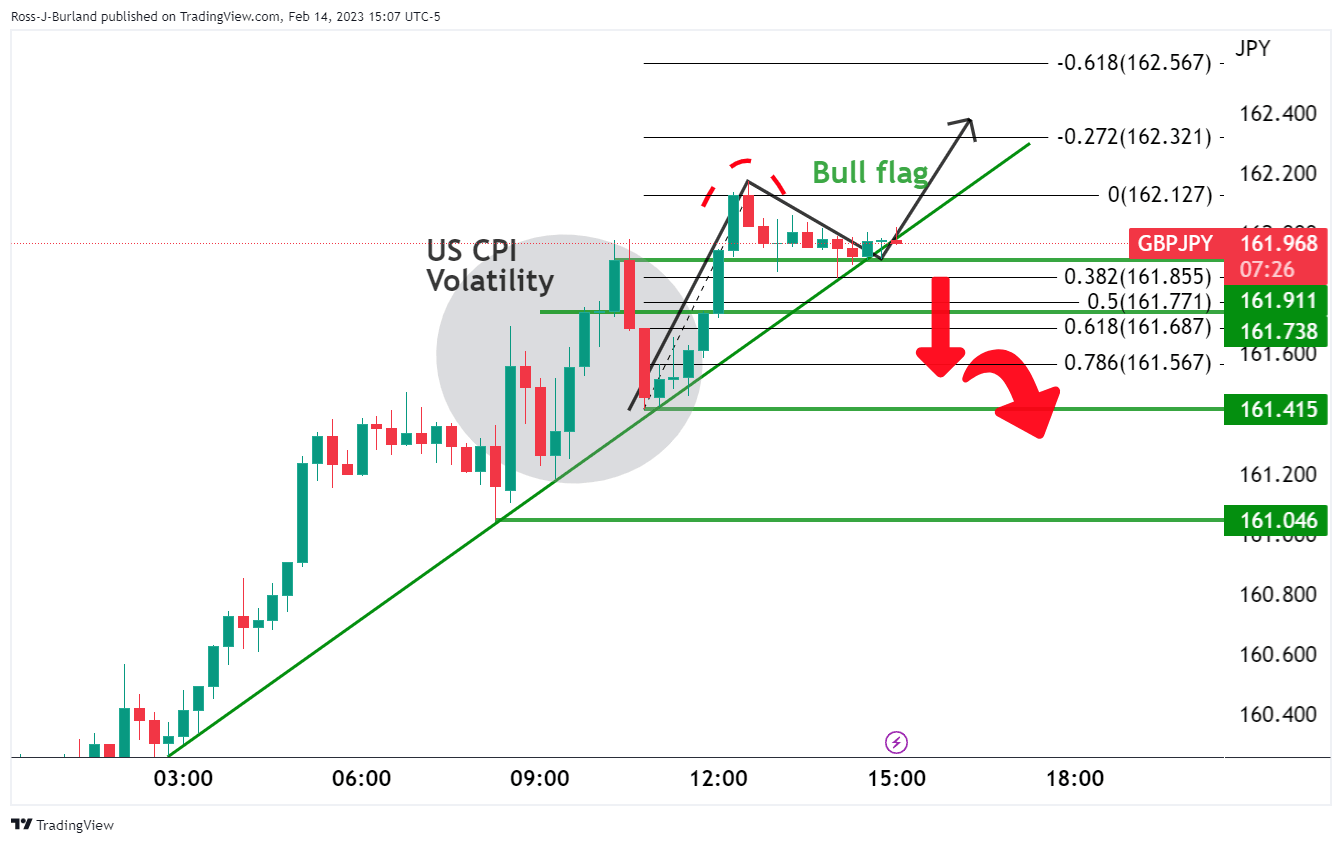

- There are prospects of a move higher rin GBP/JPY as per the bull flag, but bears are lurking.

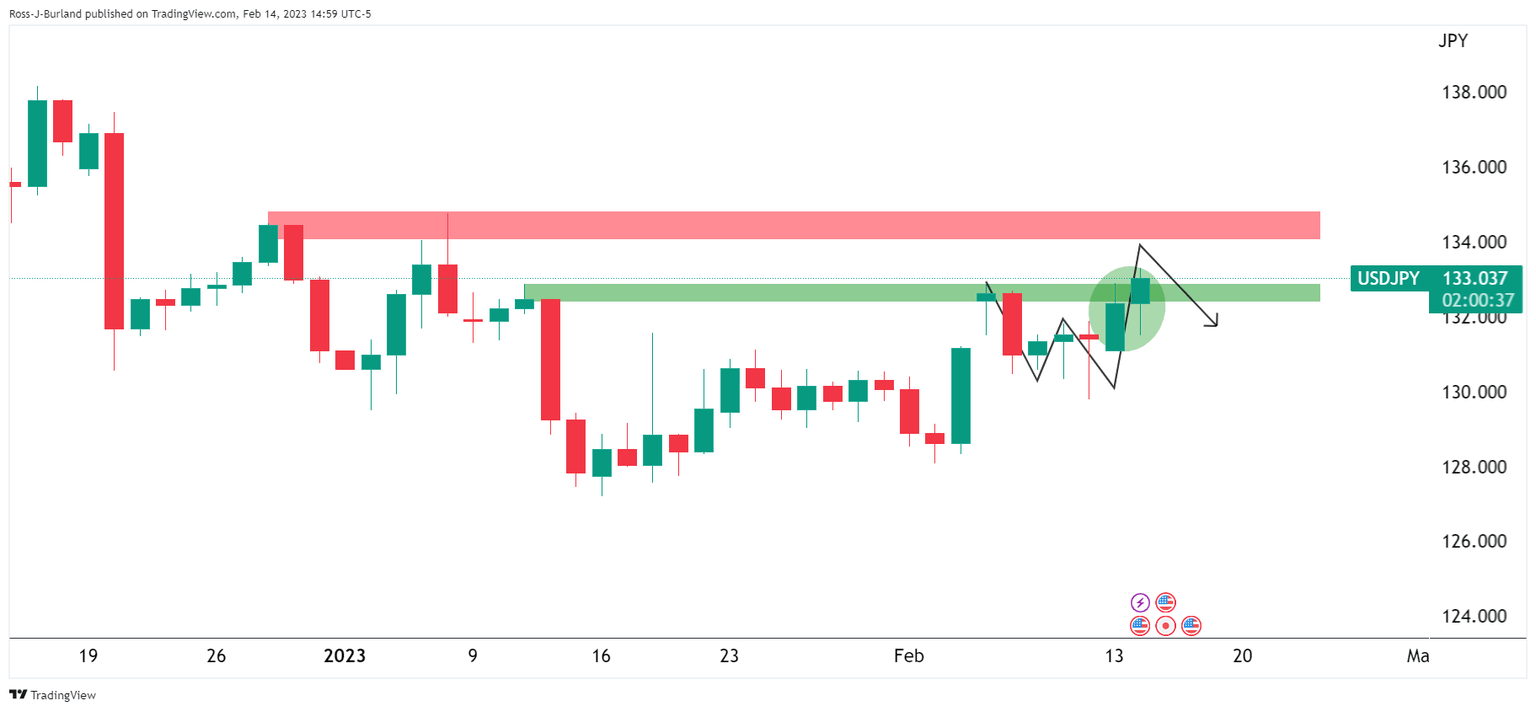

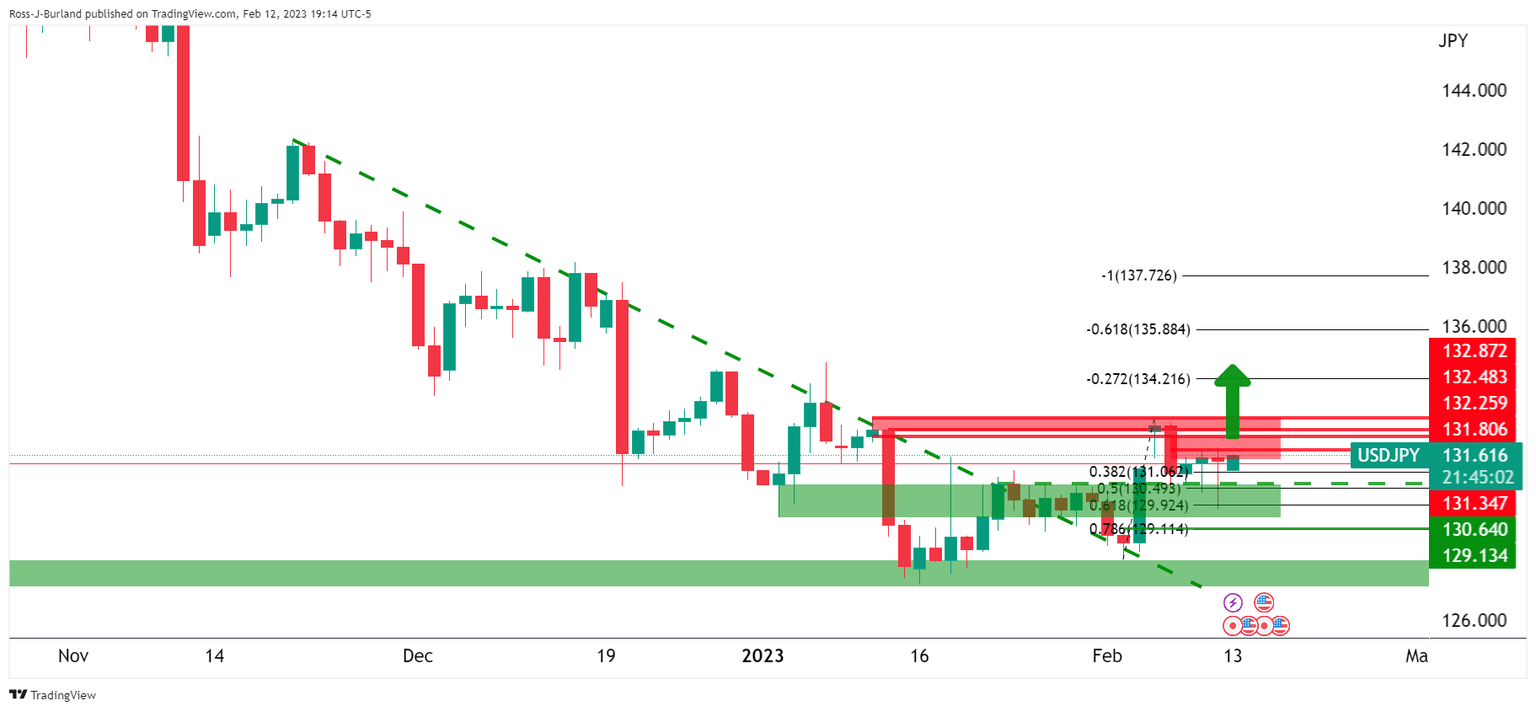

As per the prior analysis on the Yen, USD/JPY Price Analysis: Bullish fundamentals meet a technically bullish chart bias, the Japanese currency has indeed weakened and that is playing out through the crosses such as GBP/JPY.

USD/JPY daily charts, before & after

As seen, the Yen fell and USD/JPY is now above an old resistance. However, the W-formation is a reversion pattern sp this could keep the pair hamstrung, stalling the advance. Also, there has been as surprise pick in Kazuo Ueda who was nominated as the Bank of Japan's next governor and market chatter suggests he’s a pragmatist rather than a hawk or a dove.

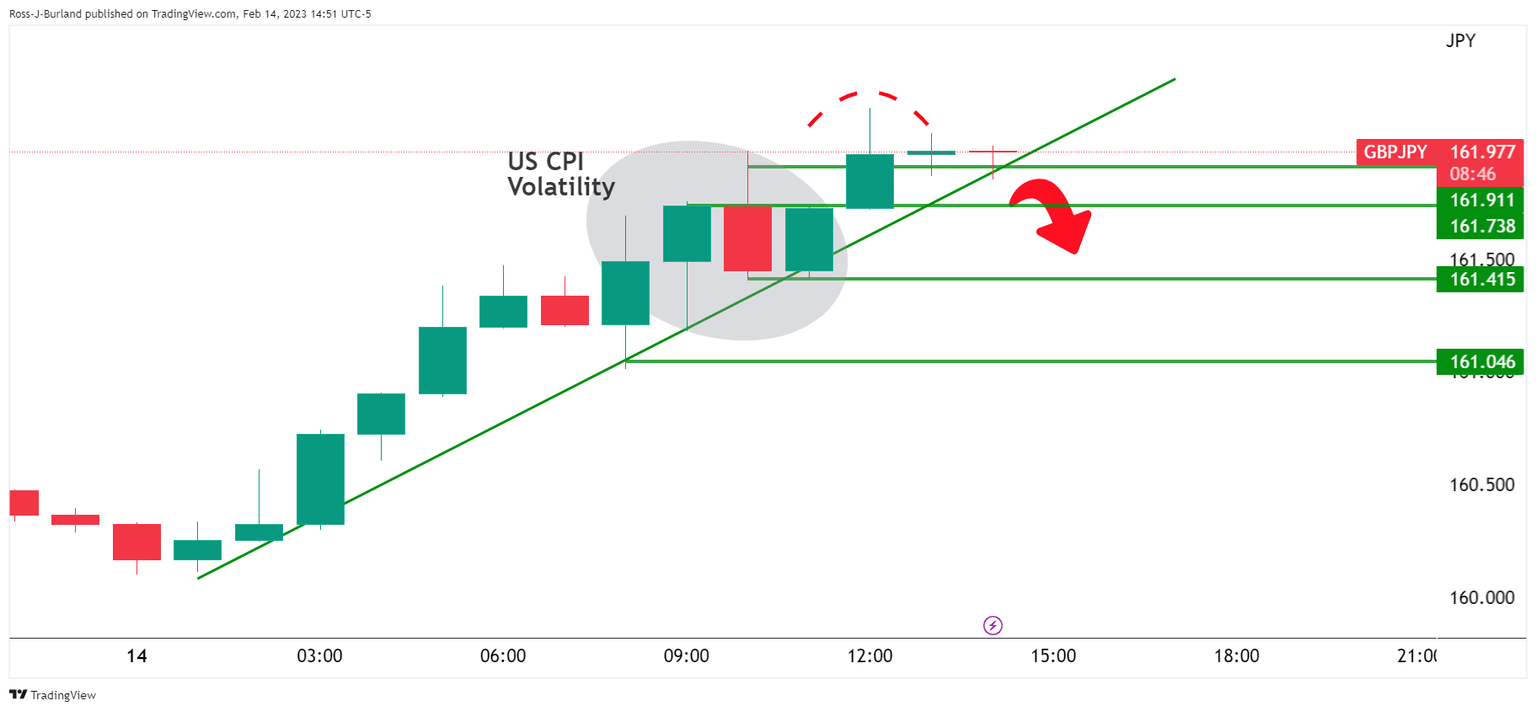

Meanwhile, the following illustrates the bias at this point for a move lower given how far the Pound has rallied and Yen has fallen.

GBP/JPY H1 chart

a break of the trendline support opens risks of a move lower below 162.00.

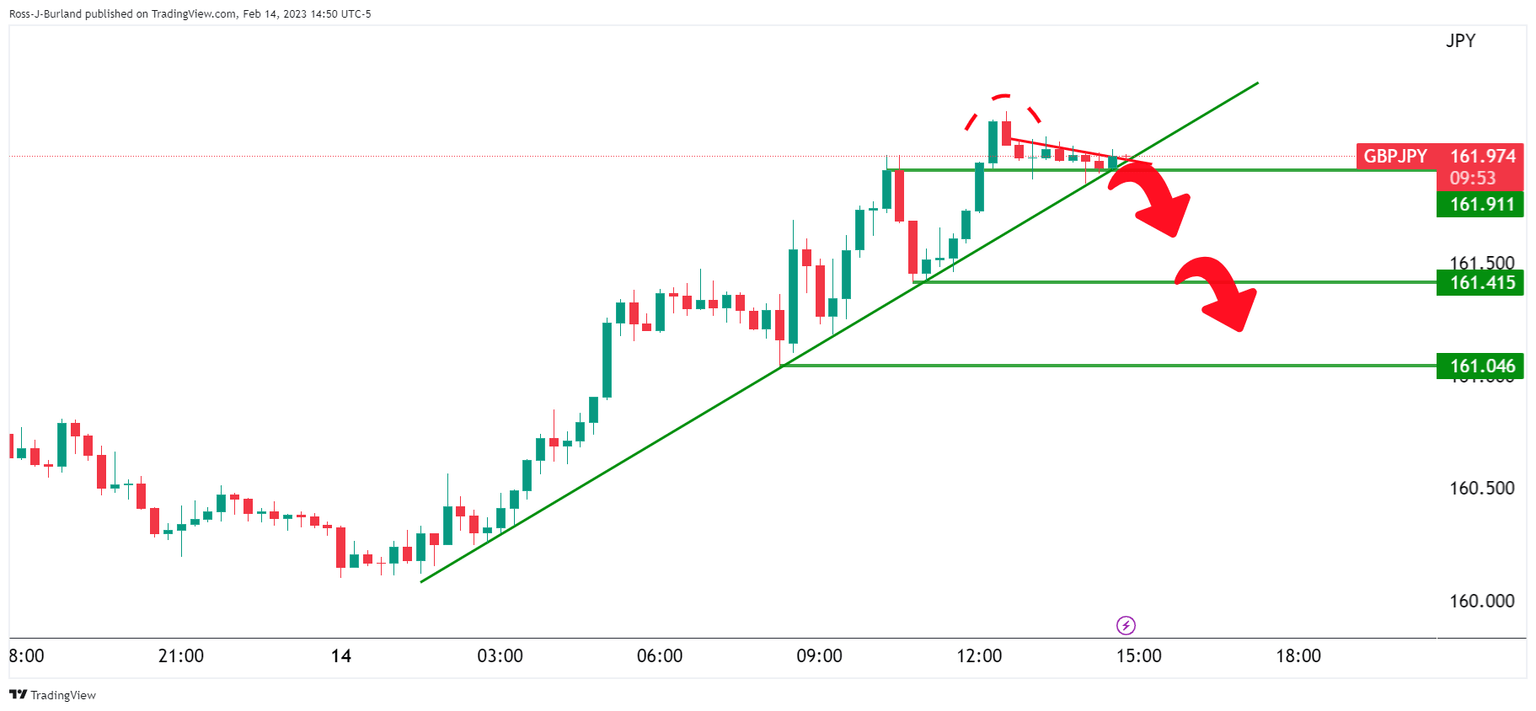

GBP/JPY M15 chart

We have a potential topping pattern but the price needs to close sharply lower or it may otherwise be regarded as a bullish flag:

The 78.6% Fibonacci near 161.50 could be the trap door that the bears will want to break through to invalidate the bull flag thesis.

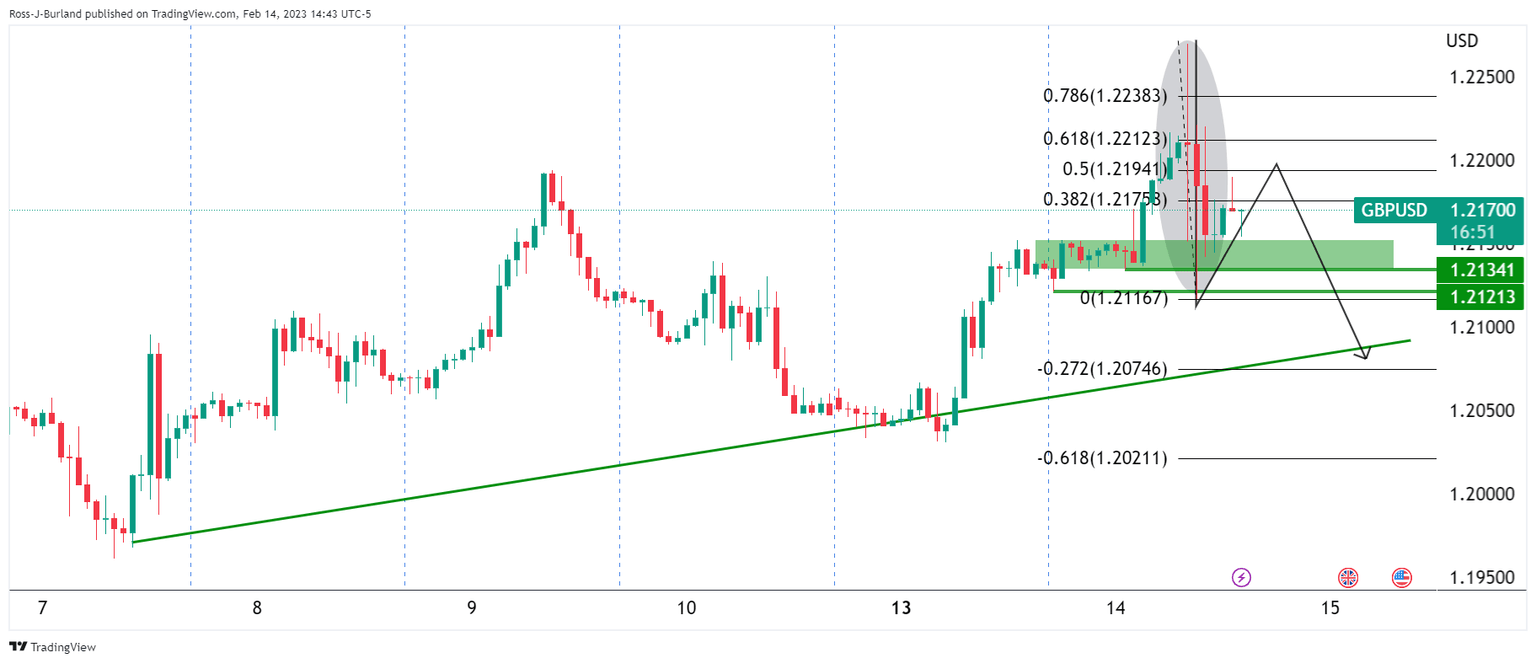

GBP/USD Price Analysis

Looking to GBP/USD, if the bears commit, then we could see a move below support and that could trigger a deep correction in GBP/JPY.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.