GBP/JPY continues to battle 200.00 region with BoJ in the pipeline

- GBP/JPY pinned to 200.00 handle in rough price action.

- Japan GDP disappointment gives way to BOJ rate call on Friday.

- UK labor figures due Wednesday, unemployment claims expected to rise.

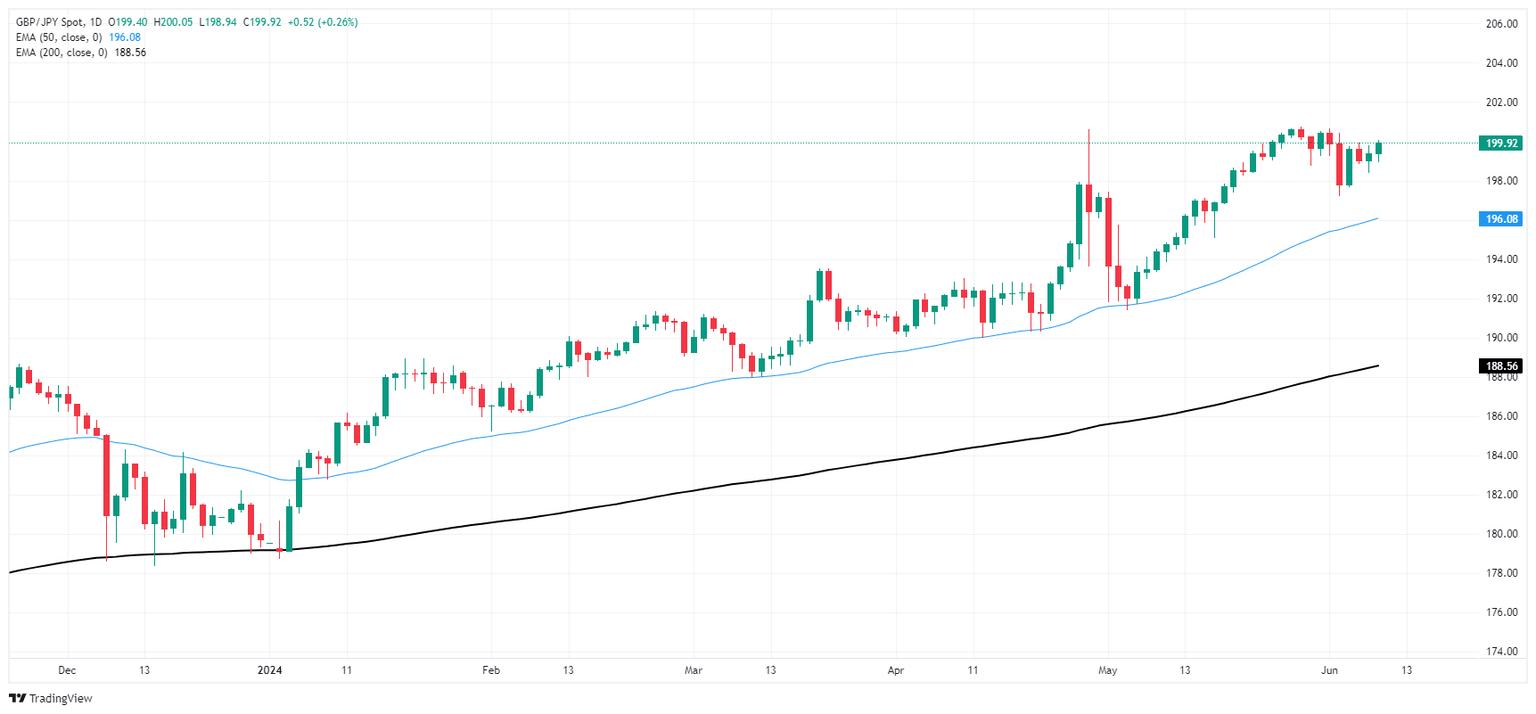

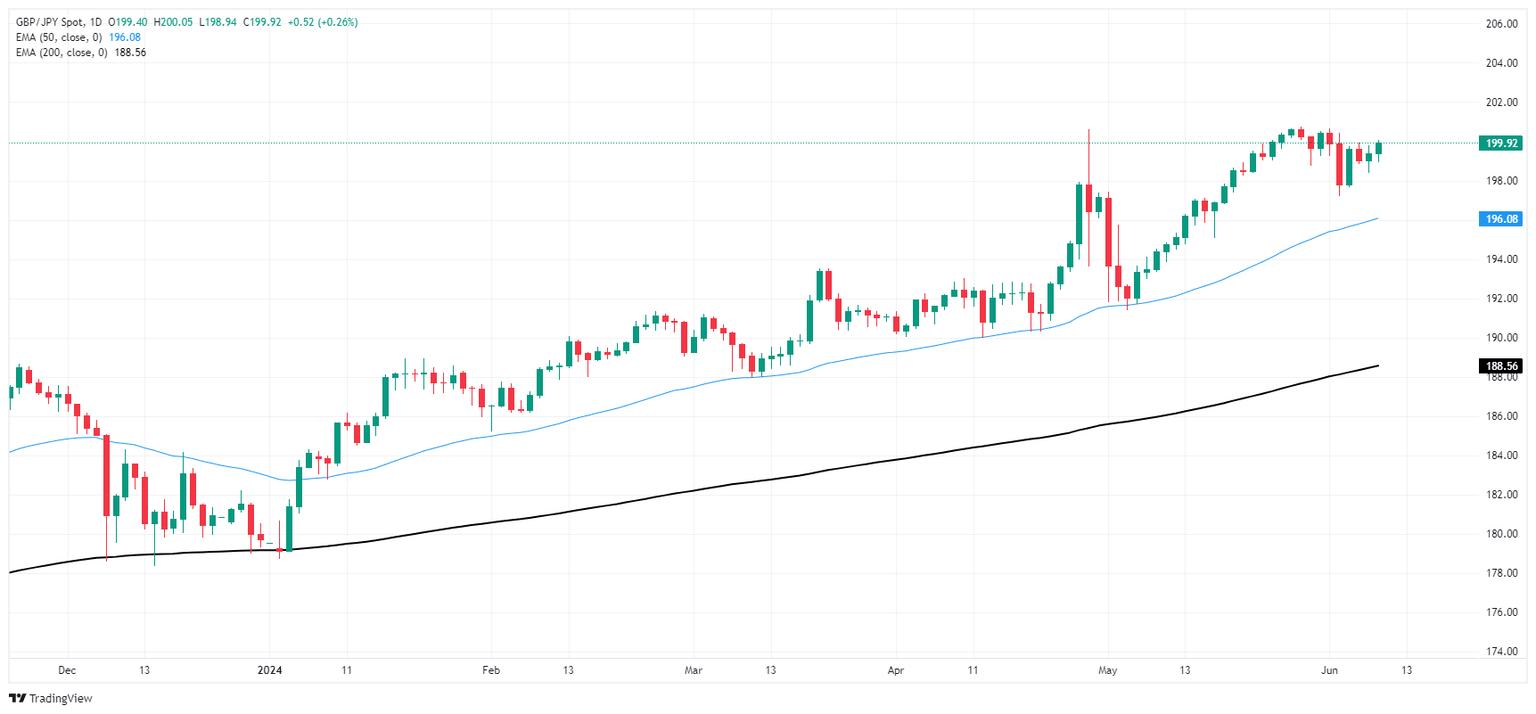

GBP/JPY continues to churn around 200.00 in choppy intraday action on Monday, extending a near-term consolidation phase as both currencies grapple with disappointment in economic data.

Japanese Gross Domestic Product (GDP) growth declined in Q1, contracting -0.5% QoQ. Easing economic figures will make it even more difficult for the Bank of Japan (BoJ) to unglue itself from a hyper-easy monetary policy stance, and investors will be focusing down the BoJ’s rate call and policy statement due early Friday.

UK labor data is due in the Tuesday market session, and markets are expecting an uptick in monthly Claimant Count Change figures in May. Median market forecasts expect a rise to 10.2K from the previous 8.9K. The ILO Unemployment Rate is expected to hold steady at 4.3% for the three-month period through April, while investors will be keeping a close eye on the 3-month Employment Change through April which last showed a -177K contraction in UK employed positions.

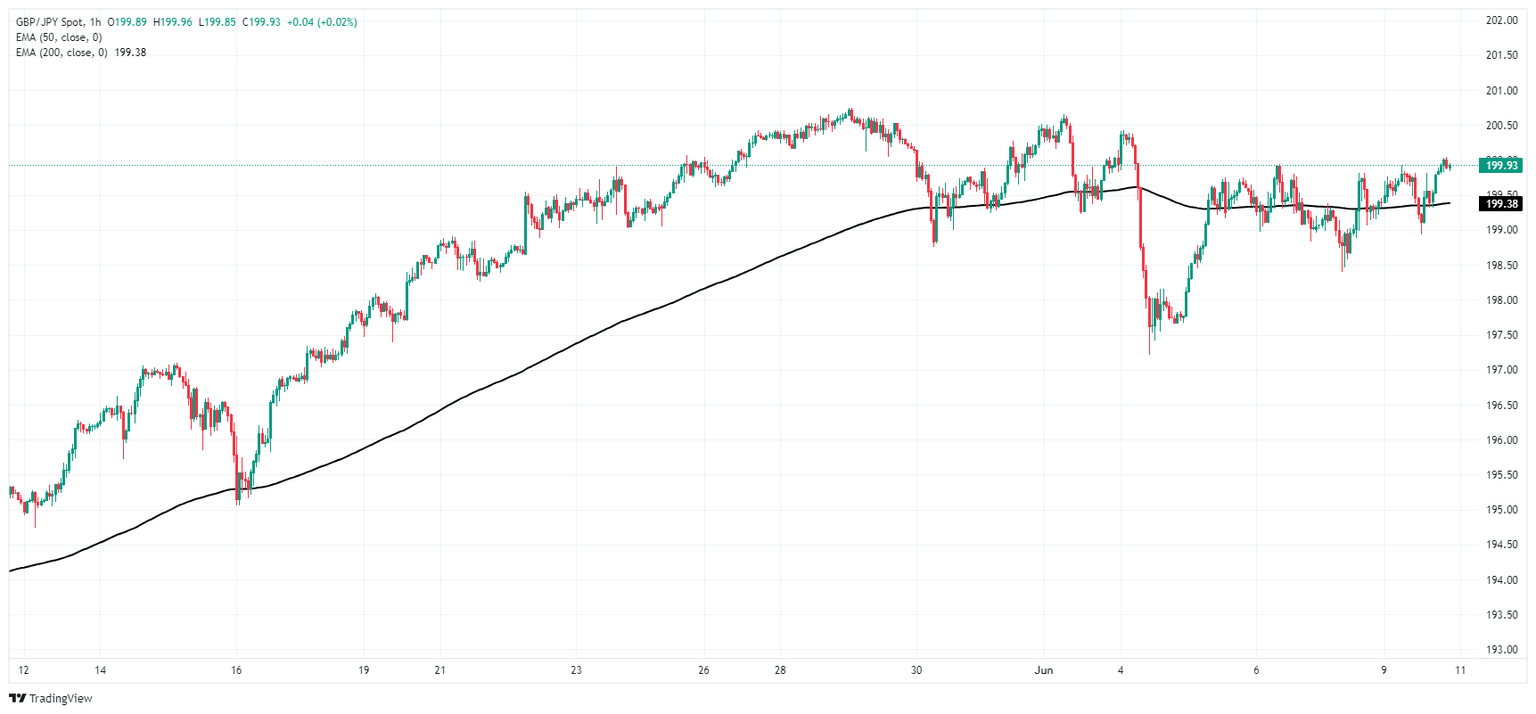

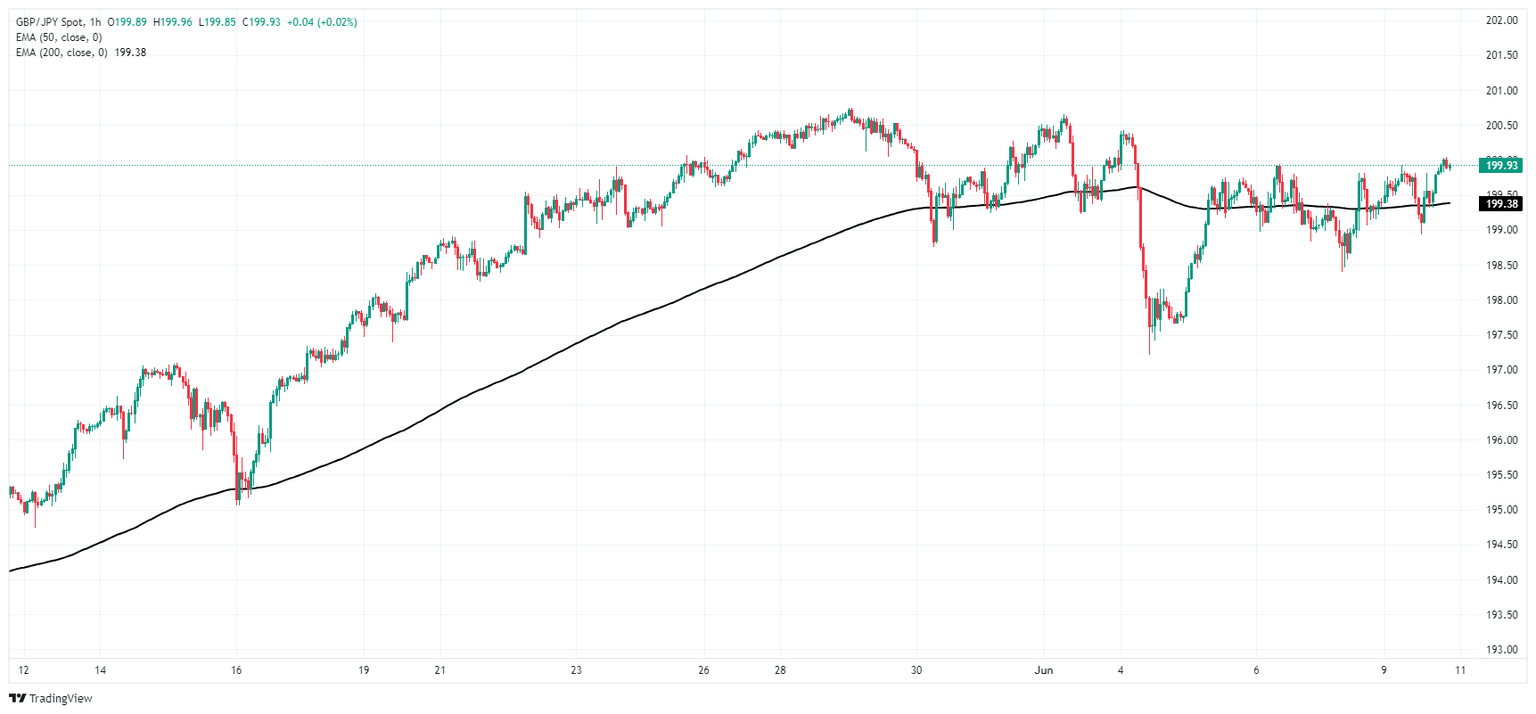

GBP/JPY technical outlook

Hourly candles have turned into a sideways affair, driving into a rough consolidation pattern around the 200-hour Exponential Moving Average (EMA) at 199.38. The pair recovered from a recent dip to June’s lows near 197.50, but the Guppy still remains down from multi-decade highs above 200.60.

GBP/JPY hourly chart

GBP/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.