GameStop Stock News and Forecast: Can GME keep going up?

- GME stock surges on meme stock Monday as retail rides again.

- GameStop stock closed up 24% but lagged AMC and HYMC.

- GME stock is down slightly in Tuesday's premarket.

Back to the future then for Monday as the meme stock madness returned to a trading screen near you. While it was easy to pinpoint the reasons for some of last year's meme stock spikes, such as in GME and AMC, this move yesterday was widespread and so harder to pin down. Certainly, the two main protagonists – AMC CEO Adam Aron and GME savior Ryan Cohen – had something to do with it. The widespread return of risk assets was the session's notable feature. It is as if the market has now totally discounted all of its fears over Ukraine, oil and rate hikes and just carried on as if we are back in late 2020. Strange environment, but the momentum is certainly hard to argue with.

GameStop Stock News

The move was sparked in GameStop stock itself when news broke of Ryan Cohen buying more GME stock via RC Ventures, his investment company. Ryan Cohen had also done the same for Bed Bath & Beyond earlier, which also saw the stock spike sharply. Bed Bath & Beyond was another retail or meme stock favored in 2021. Cohen certainly started the move, but it was cross-stock momentum that kicked things into action on Monday. First, Hycroft Mining (HYMC) announced it has completed its successful share offering. This meant that AMC stock spiked as it had invested in HYMC. Where AMC goes, GME tends to follow or vice versa, and so it proved. AMC Adam Aron heated things with some bullish commentary on the future for AMC as an investment vehicle, and that further stoked risk appetites among AMC apes and retail traders. This then spread from AMC and HYMC to GME and others.

GameStop Stock Forecast

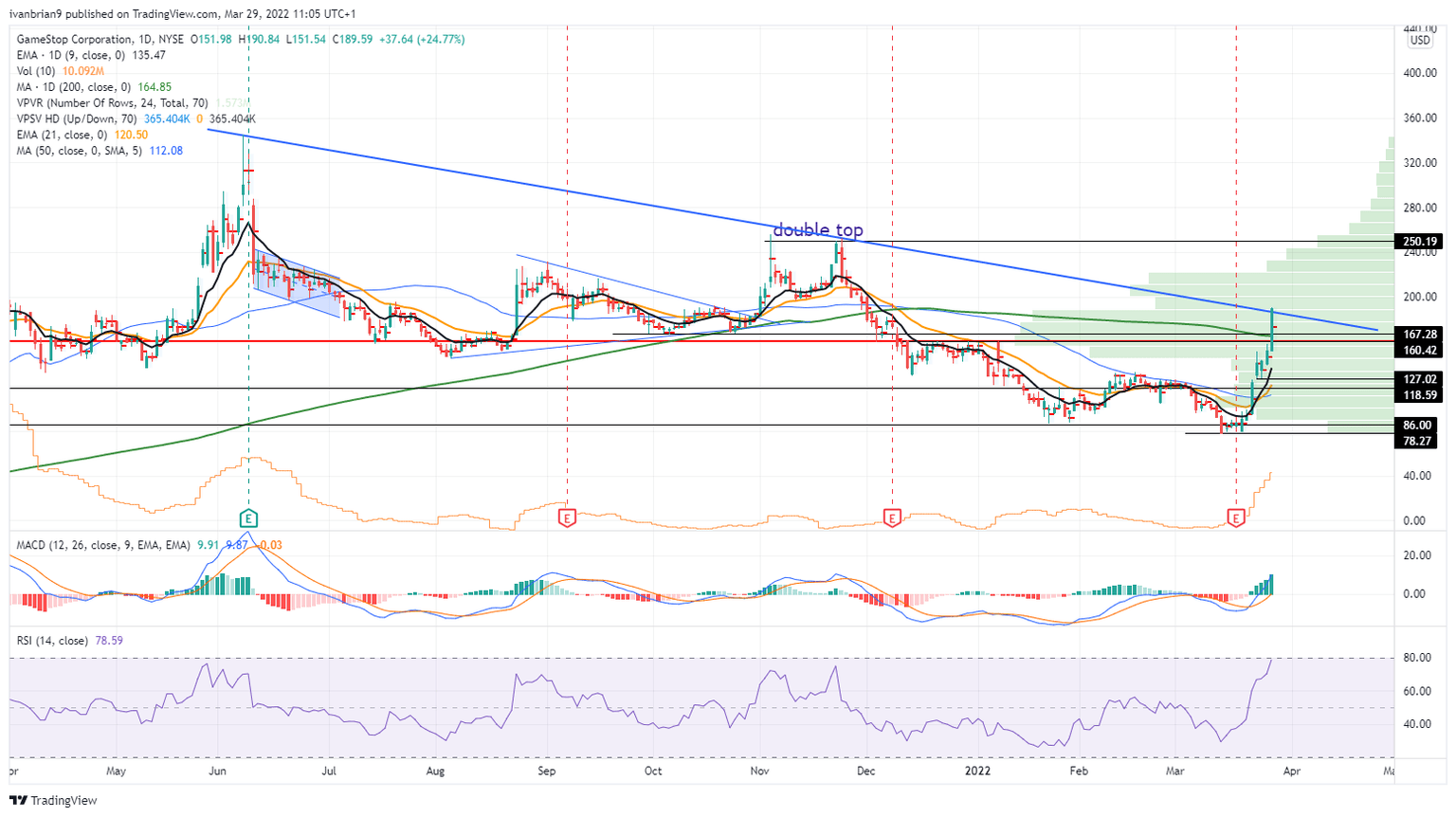

So you need to be aware that this probably will not last. I know many of you will not want to hear that, but the odds are stacked that way. Each super spike usually fades after a few weeks. For simplicity, we have drawn a neat descending trend line from the spike highs on June 8, 2021 to the double top in November and now to this current spike. This makes for a bit more sobering viewing. However, that does not mean all doom and gloom, rather just be aware that this is the bigger picture at play here. This is momentum trading, but momentum always fades.

For a long-term trend to establish, the momentum should fade to consolidation, but this has not been happening with GME stock. Holding above $160 is what is needed to keep GME stock bullish on the medium to long-term view. This is where the consolidation phase should be around. Below there is strong support at $127 from the first breakout.

GME stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.