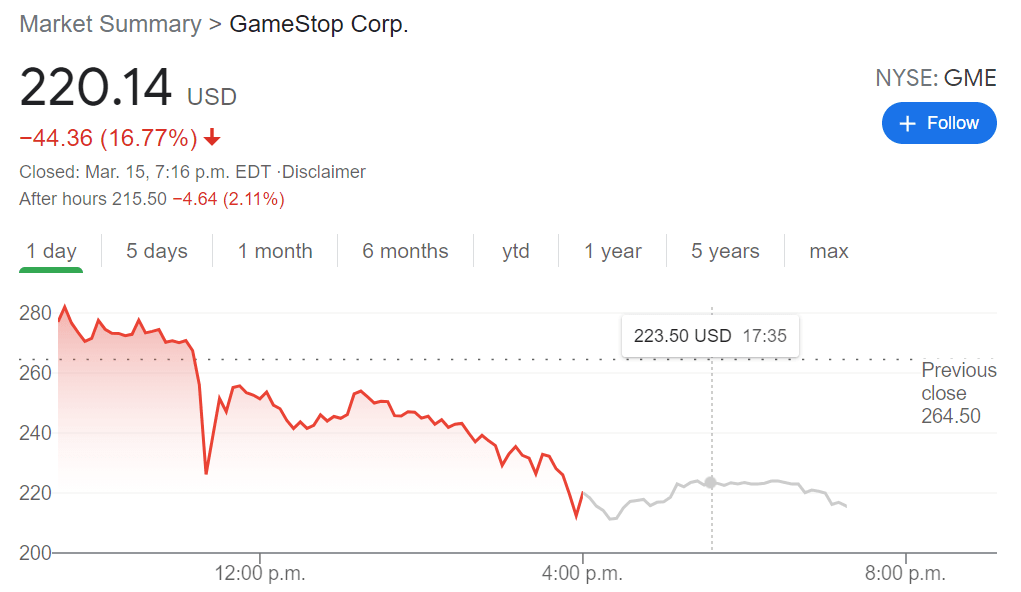

Gamestop (GME) Stock Price and Forecast: Halted due to volatility, plummets to start the week

- NYSE:GME drops by 16.77% even as broader markets start the week strong.

- GameStop 2.0 is gaining more steam with investors as Ryan Cohen takes the reins.

- Another meme stock surges on news of locations reopening around the country.

NYSE:GME investors did not have the start to the week that they were anticipating after mostly positive movement over the past three weeks. On Monday, the first trading day after the recent $1.9 trillion stimulus package began to make its way to investors, GameStop plunged by 16.77% to close the trading session at $220.14. Shares were momentarily halted at one point due to a massive spike in volatility that caused GameStop to fall by nearly 20% within a few minutes. It is definitely not the first time that GameStop has been halted due to trading volatility, but it is interesting to note that Monday’s drop came with half of its normal average trading volume.

Stay up to speed with hot stocks' news!

Now former Chewy(NYSE:CHWY) founder Ryan Cohen is heading a special task force to rebuild GameStop into an eCommerce platform to take on the likes of Amazon (NASDAQ:AMZN). While this is obviously a daunting task and at this point seems a little far fetched, there is definitely positive investor sentiment surrounding the news. GameStop will eventually need to remove the ‘meme stock label’ before being taken seriously as a viable eCommerce business once again.

Gamestop Stock news

Another meme stock, AMC (NYSE:AMC) headed in the opposite direction from GameStop on Monday as reopening orders in the state of California means that all 53 locations may be open by the end of the week. AMC’s stock surged by over 26% on Monday to close the day at $14.04, it’s highest price since the short squeeze event in late January.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet