Fed Kaplan: He will revise down 3Q GDP because of covid

Dallas Fed President Robert Kaplan says that the covid resurgence is having an impact on travel hospitality leisure and said he will be downwardly revising third-quarter Gross Domestic product estimate because of covid.

Key comments

Says will be downwardly revising third-quarter GDP estimate because of covid.

Says now see full-year GDP growth at 6%, vs prior 6.5%.

Says he expects to see slower job growth ahead.

Says he expects headline PCE reading to be in range of 4%.

Says expects PCE inflation to be 2.6% next year.

Says still expects next year's GDP growth to be 3%.

Says economic recovery will occur in fits and starts because of covid.

Says he is struck by the resilience of the consumer, adapting through covid.

Further comments

Says if no fundamental change to outlook by the Sept Fed meeting he would support starting taper in Oct.

Says it is not our expectation you will see a prolonged slowing due to delta surge.

Says there is plenty of fiscal stimulus in the economy.

Says fed's asset purchases are not well-suited to the current situation.

Says expect to continue to run at above 2% inflation next year.

Says wearing a mask is good for the economy.

Says he encourages people to get vaccinated and get boosters if it's their turn.

Market implications

He is airing on the side of caution which is what is being factored into the markets.

However, an October taper is leaning more hawkish which should be supportive of the US dollar.

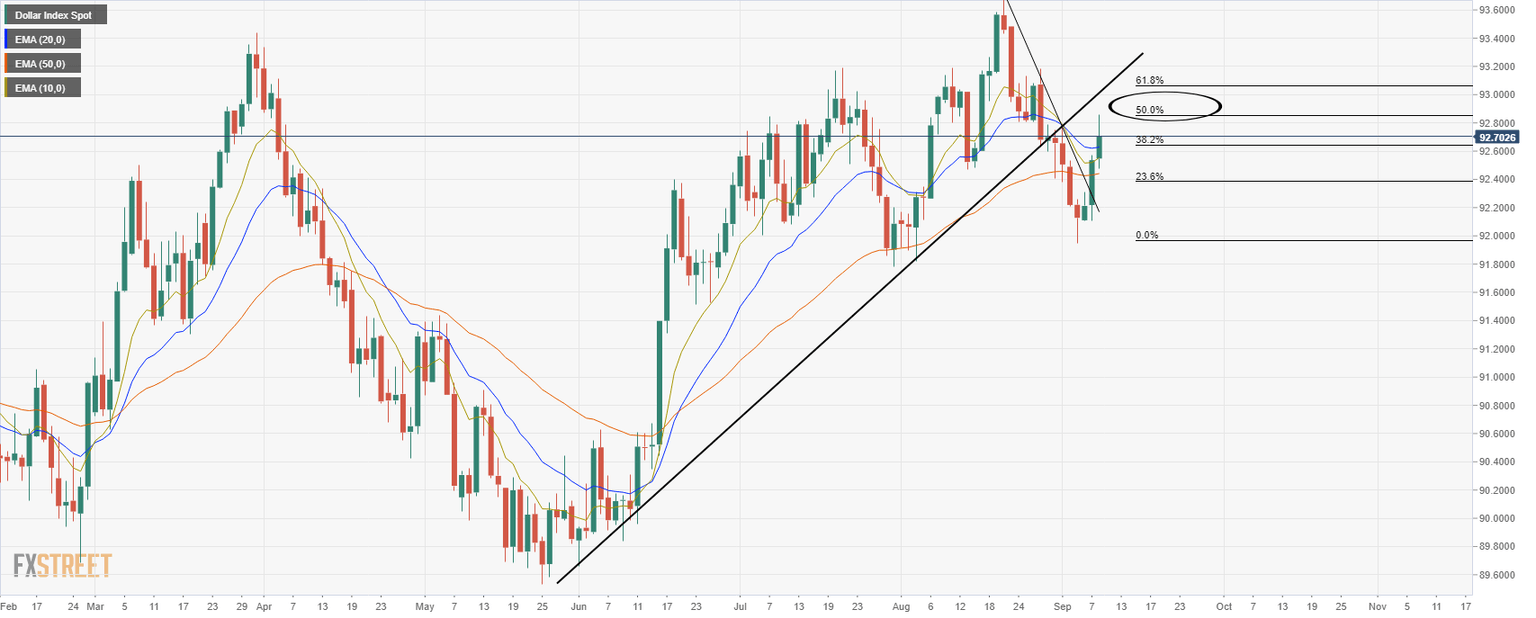

The greenback is bid mid-week, with the DXY eyeing the counter trendline and the 61.8 % golden ratio as follows:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.