Euro advances to fresh tops just ahead of 1.1200

- Euro climbs to new tops vs. the US Dollar.

- Stocks in Europe end Thursday's session with decent gains.

- EUR/USD appears well bid and targets the 1.1200 zone.

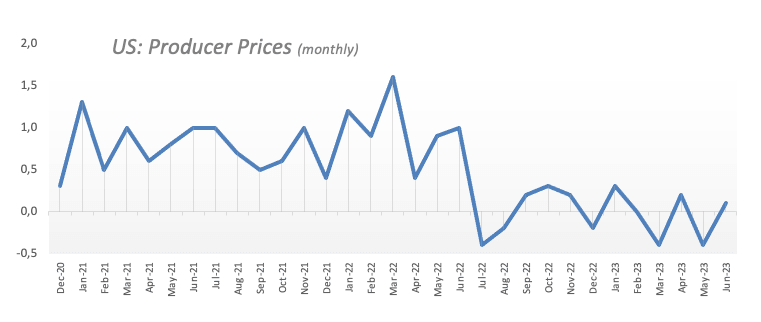

- US Producer Prices surprised to the downside in June

The Euro (EUR) accelerates its gains vs. the beleaguered US Dollar (USD) and lifts EUR/USD to levels just shy of 1.1200 the figure on Thursday, an area last visited in late February 2022.

The strong upside impulse in the pair has been reinvigorated in response to lower-than-expected US inflation figures for the month of June, which, firstly, confirm that disinflationary forces remain well in place in the US economy and, secondly, underpin expectations that the Federal Reserve might end its ongoing hiking campaign sooner rather than later.

Back to US inflation: While it is inspiring that inflationary pressures are cooling off, it is unclear how much further prices can slow down in the current context of a still tight labour market and robust wage growth. This ongoing resilience in the domestic economy should still bolster another rate hike by the Fed at its July 26 gathering, although the intense disinflationary pressures could encourage market participants to think that the next hike will be the last of the tightening cycle.

In the maentime, further weakness hits the Greenback after US Producer Prices also disappointed consensus in June, showing a monthly gain of 0.1% and 0.1% over the last twelve months.

The same can be said of the European Central Bank (ECB), where a 25 bps rate raise is largely anticipated at its meeting later in the month. However, the central bank is unlikely to halt its hiking bias in the near term, as highlighted by President Christine Lagarde and other Board members in past comments.

Still around the ECB, the Accounts of the June 15 meeting stated that the Governing Council could consider raising interest rates beyond July, if necessary. In addition, the view was widely held that core inflation has not shown a turning point, while members also assessed the level and persistence of underlying inflation as a source of concern. Members also added that tightening was gradually felt in real activity.

Looking at the broader picture, the potential future actions of the Fed and the ECB in normalizing their monetary policies continue to be a topic of discussion, especially with increasing concerns about an economic slowdown on both sides of the Atlantic.

Data-wise in the region, final June inflation figures in France saw the CPI gain 0.2% MoM and 4.5% YoY, while Industrial Production in the euro bloc expanded at a monthly 0.2% and contracted by 2.2% from a year earlier.

Additional US data saw Initial Jobless Claims rise by 237K in the week ended on July 8.

Daily digest market movers: Euro in 16-month peaks vs. the Dollar

- The EUR marches north and flirts with the 1.1200 region vs. USD on Thursday.

- France’s final CPI rose 0.2% MoM in June and 4.5% YoY.

- Chinese trade balance figures came in short of expectations in June.

- Lower US Producer Prices add to the Dollar's weakness.

- The IEA said global demand for oil will reach record levels in 2023.

- ECB Accounts do not rule out extra hikes beyond July.

- US Weekly Claims rose less than expected in the previous week.

Technical Analysis: Euro faces the next up-barrier at 1.1495

The ongoing price action in EUR/USD hints at the idea that further gains might be in store in the short-term horizon. However, the current pair’s overbought condition opens the door to some near-term corrective move.

The continuation of the uptrend now targets the round level at 1.1200, while the surpass of this level in a sustainable fashion could open the door to a test of the 2022 top at 1.1495 recorded on February 10.

On the downside, the weekly low at 1.0833 (July 6) appears reinforced by the proximity of the interim 100-day SMA. The breakdown of this region should meet the next contention area not before the May low of 1.0635 (May 31), which also looks underpinned by the crucial 200-day SMA (1.0643). South from here emerges the March low of 1.0516 (March 15) prior to the 2023 low of 1.0481 (January 6).

Furthermore, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.