Euro bounces off daily lows near 1.0520 following Lagarde

- The Euro keeps the offered stance unchanged against the US Dollar.

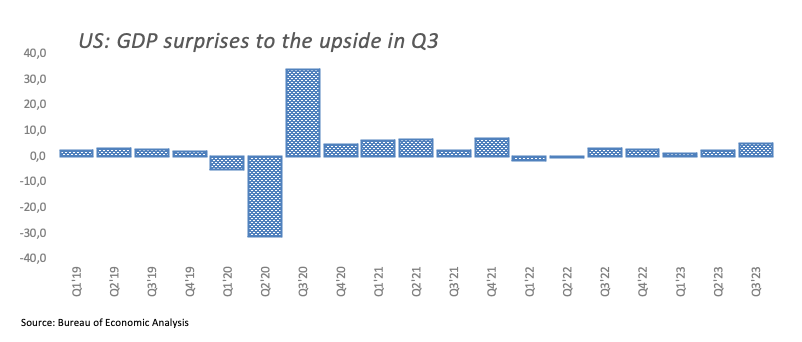

- Flash US Q3 GDP Growth Rate surprises to the upside.

- EUR/USD meets some contention around 1.0520 so far.

- The ECB left its interest rates unchanged, as widely anticipated.

The Euro (EUR) manages to regain some composure vs. the US Dollar (USD), inducing EUR/USD to trim part of the initial drop to the 1.0520 region on Thursday.

On the other hand, the Greenback gives away some of the earlier advance to three-week highs around 106.90 when tracked by the USD Index (DXY), amist some corrective move in US yields over divergent maturities.

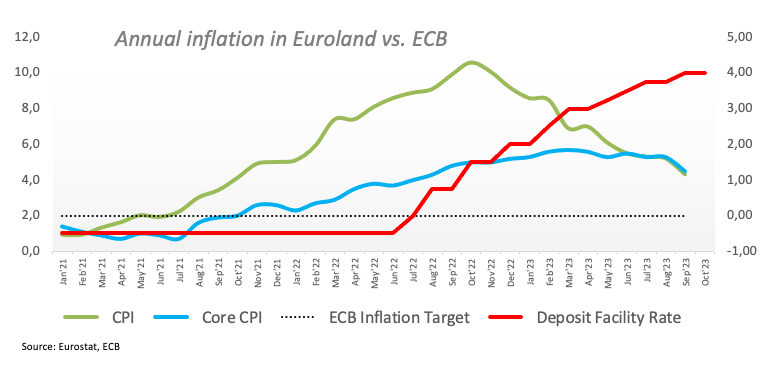

The offered bias prevails around the single currency after the European Central Bank (ECB) matched expectations and left its interest rates unchanged at its event on Thursday. At its statement, the ECB reiterated that inflation is seen higher for longer, at the time when the Council stated that current rate levels must be maintained for a sufficiently long period.

At her press conference and Q&A session, ECB President Christine Lagarde acknowledged that the region's economy is anticipated to remain undermined in the forthcoming months, while structural reforms have the potential to lessen inflationary pressures. She added, that risks to growth are disproportionately inclined downward and discussions pertaining to interest rate deductions are premature at this juncture. Lagarde also reiterated that long term monetary policy determinations will continue to rely on incoming data and suggested that elevating yields constitute a spillover effect that must be considered due to its capacity to drive inflation downward.

Still around monetary policy, there is a growing consensus among market participants that the Federal Reserve (Fed) will maintain its current stance of keeping interest rates unchanged at the meeting on November 1. This view has been reinforced by remarks made by Fed Chair Jerome Powell in his recent speech at the Economic Club of New York on October 19.

Data-wise, in the US, the flash Q3 GDP Growth Rate expanded 4.9% YoY, weekly Initial Jobless Claims increased by 210K in the week ended on October 21, Durable Goods Orders expanded markedly by 4.7% MoM in September and preliminary Goods Trade Balance see a deficit of $85.78B also in September.

Later in the session, Pending Home Sales will close the daily calendar.

Daily digest market movers: Euro gathers some traction post-ECB

- The EUR partly trims initial losses against the USD on Thursday.

- US and German yields trade amidst a broad-based decline.

- A 25 bps rate hike by the Fed remains on the table for December.

- No news at the ECB event on Thursday. Lagarde remained neutral

- Geopolitical concerns in the Middle East remain steady.

- The move above 150.00 in USD/JPY reignites intervention talk.

- Investors’ attention will also be on Lagarde’s press conference.

- US GDP figures are expected to show further resilience of the economy.

Technical Analysis: Euro's recovery remains capped by 1.0700

EUR/USD extends the bearish note to fresh weekly lows and shifts its attention to a potential visit to the 1.0500 neighbourhood.

If the selling trend continues, immediate support may be located near the October 13 low of 1.0495, followed by the 2023 low of 1.0448 seen on October 3 before hitting the round level of 1.0400. If this zone is crossed, the pair may continue to fall towards the lows of 1.0290 (November 30, 2022) and 1.0222 (November 21, 2022).

If bulls retake control, EUR/USD will find initial resistance around the Wednesday's top of 1.0694, which looks underpinned by the vicinity of the temporary 55-day Simple Moving Average (SMA). The breakout of this zone reveals the September 12 high of 1.0767, which precedes the significant 200-day SMA at 1.0813. Once this level is cleared, it might signal a further push towards the August 30 peaks of 1.0945, prior to the psychological milestone of 1.1000. If the rising trend continues, the August 10 peak of 1.1064 might be challenged, seconded by the July 27 high of 1.1149, and possibly even the 2023 top of 1.1275 seen on July 18.

As long as the EUR/USD continues below the 200-day SMA, the pair may face persistent negative pressure.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.