EUR/USD reverses earlier gains with trade uncertainty dampening market mood

- The Euro ticks up from lows but maintains its broader bearish trend intact.

- Hopes of progress on the Eurozone-US trade talks are providing some support to the Euro.

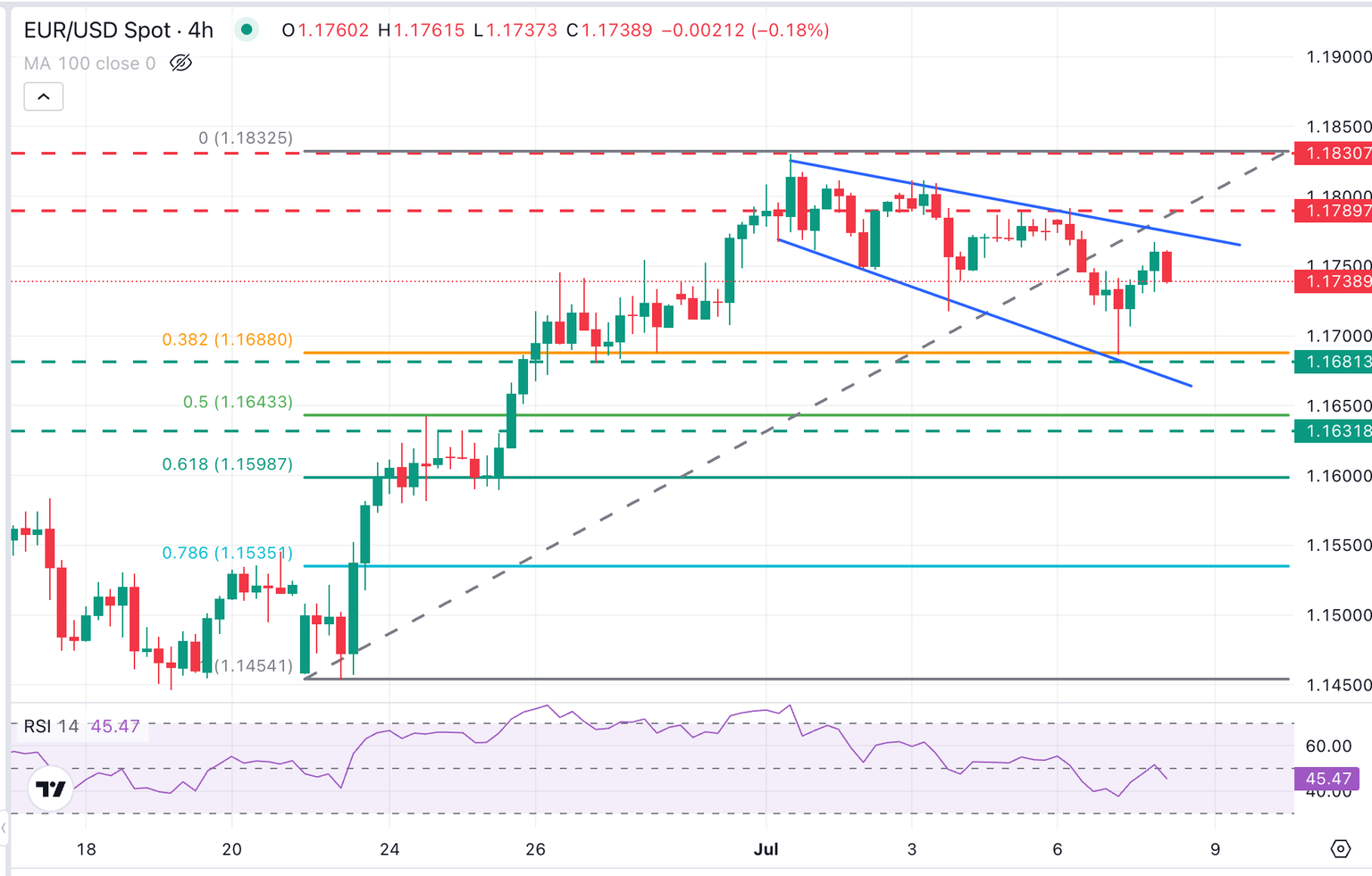

- EUR/USD is moving within an expanding wedge, a potentially bearish formation.

The EUR/USD pair is pulling back from intra-day highs and keeps its broader bearish trend from last week's highs intact. Investors remain wary of taking excessive risk after US President Donald Trump started sending tariff letters to batches of countries, reviving concerns about the global trade outlook.

The Euro (EUR) bounced up from nearly two-week lows at 1.1690 during Tuesday's Asian session, but was capped at 1.1770 during Tuesday's early European session and, before returning to the 1.1730 area ahead of Wall Street's opening bell.

The Eurozone was not among the recipients of Trump's tariff letters and is not expected to receive one for the time being. Trade talks with the US are apparently showing progress and, according to market sources, a deal might be announced as soon as Wednesday.

This news has contributed to easing some pressure on the Euro, although upside attempts are likely to remain limited with concerns about global trade weighing on risk appetite. The economic calendar is light this Tuesday, and market concerns about a significant disruption of international trade are likely to support the safe-haven US Dollar to the detriment of riskier currencies, such as the Euro.

On the macroeconomic front, international trade figures from France and Germany have shown mixed figures, but the lower imports and exports point to a softer domestic demand and a weakening economic activity.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.15% | 0.21% | 0.34% | -0.23% | -0.76% | -0.28% | -0.12% | |

| EUR | 0.15% | 0.36% | 0.52% | -0.08% | -0.62% | -0.13% | 0.04% | |

| GBP | -0.21% | -0.36% | 0.18% | -0.44% | -0.98% | -0.49% | -0.33% | |

| JPY | -0.34% | -0.52% | -0.18% | -0.58% | -1.11% | -0.58% | -0.37% | |

| CAD | 0.23% | 0.08% | 0.44% | 0.58% | -0.56% | -0.05% | 0.11% | |

| AUD | 0.76% | 0.62% | 0.98% | 1.11% | 0.56% | 0.50% | 0.66% | |

| NZD | 0.28% | 0.13% | 0.49% | 0.58% | 0.05% | -0.50% | 0.16% | |

| CHF | 0.12% | -0.04% | 0.33% | 0.37% | -0.11% | -0.66% | -0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The safe-haven US Dollar remains firm in risk-off markets

- EUR/USD maintains a broader bearish tone with the US Dollar recovering from multi-year lows. Uncertainty about Trump's levies remains high and is likely to maintain the US Dollar bid, at least until Wednesday, when the minutes of the last Federal Reserve (Fed) meeting might provide some distraction from trade tariffs.

- Data from Germany released on Tuesday revealed that the trade surplus increased by EUR 18.4 billion in May, from EUR 15.8 billion in April, against expectations of a slight decline to EUR 15.5 billion. The main reason for these figures, however, has been a larger-than-expected decrease in the number of imports, which points to a slower domestic demand.

- In France, the trade deficit increased to EUR 7.76 billion in May from EUR 7.68 billion in April, slightly above the EUR 7.7 billion anticipated by market forecasts.

- On Monday, Eurozone Retail Sales contracted by 0.7% in May, the largest decline in almost two years, showing that US tariffs and the uncertain economic outlook in the Eurozone are starting to hurt consumer confidence.

- The German Statistics Office also reported on Monday that Industrial Production grew 1.2% in May, against market expectations of a flat reading and following a 1.6% contraction in April. The impact on the Euro, however, was marginal.

- The US economic calendar is light on Tuesday. The highlight of the week will be the FOMC Minutes, which will be released on Wednesday and might reflect the diverging views about monetary policy recently shown by some committee members, potentially throwing a spanner in the US Dollar's recovery.

EUR/USD remains trapped within the corrective channel

EUR/USD is picking up from Monday's lows right below 1.1700 but maintains the corrective structure from last week's highs. Price action shows an expanding wedge pattern, a figure that tends to develop at major market tops.

Technical indicators show a hesitant market, as the Relative Strength Index (RSI) moves back and forth around the 50 level on the 4-hour chart. In the meantime, the trendline resistance from July 1 highs, now at 1.1780, is keeping the immediate corrective structure in place. Above here, the pair should extend beyond the 4 and 7 July highs, at the 1.1790 area, to cancel the bearish view.

On the downside, the pair has a significant support area at the confluence of the trendline support with the 38.2% Fibonacci retracement level of the June 24 - July 1 rally, at 1.1685. Below here, the pair might find support at 1.1630 - 1.1645, where previous highs meet the 50% Fibonacci retracement level of the mentioned late June rally.

corrective

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.