EUR/USD Technical Analysis: Strangled between key indicators at 1.1400

- The past twenty-four hours see the EUR/USD drifting higher, but remains constrained underneath Thursday's peak at 1.1434.

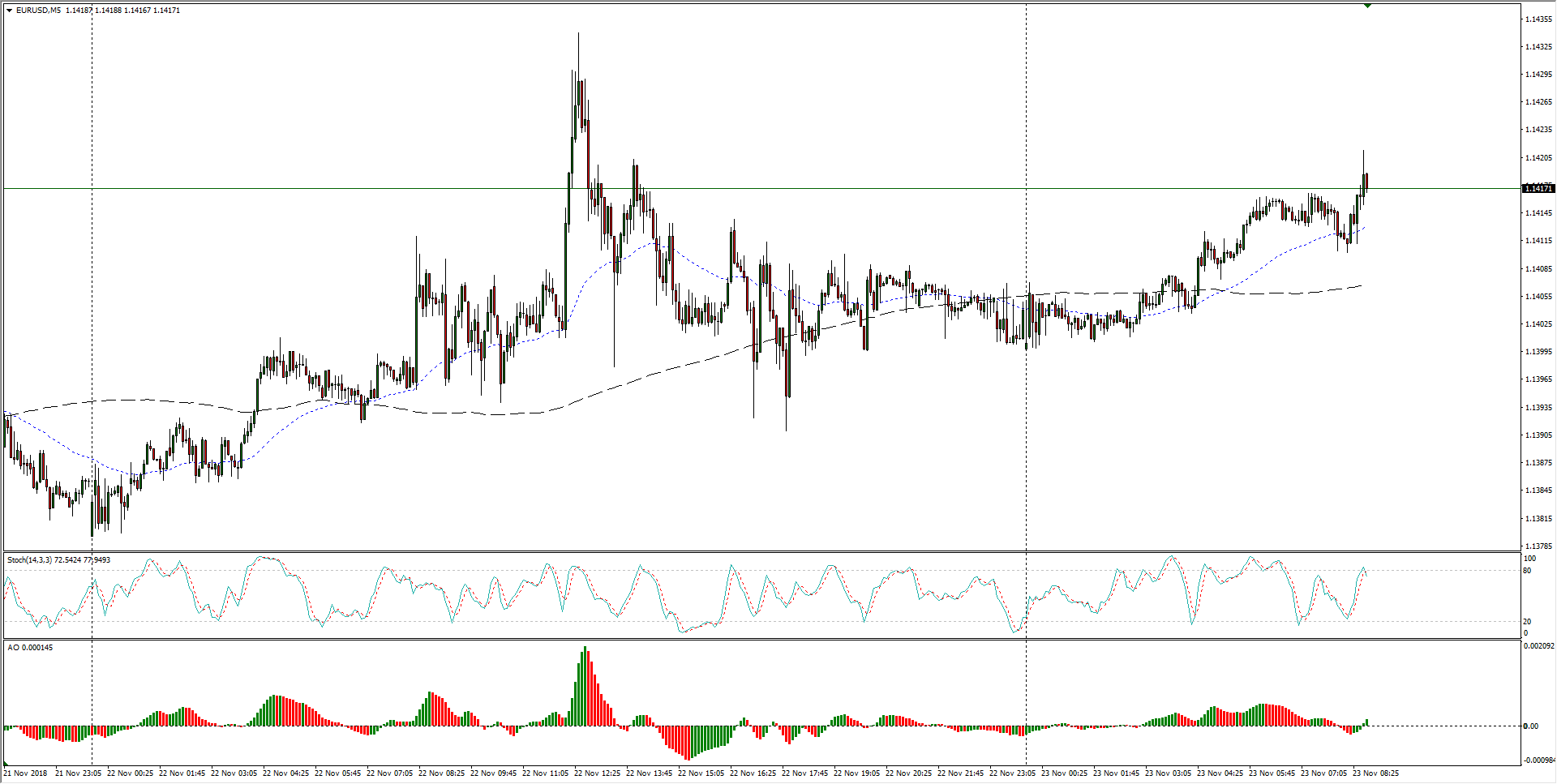

EUR/USD Chart, 5-Minute

- Although the Fiber sees highs on the lower side of November 20th's peak, support is still being found and the pair is putting in an effort to reclaim the 1.1400 handle.

EUR/USD Chart, 30-Minute

- The EUR/USD is teasing a soft break of a descending trendline, but the pair does remain overall constrained underneath lower highs, and the 200-period moving average is providing near-term resistance.

EUR/USD Chart, 4-Hour

EUR/USD

Overview:

Last Price: 1.1419

Daily change: 13 pips

Daily change: 0.114%

Daily Open: 1.1406

Trends:

Daily SMA20: 1.137

Daily SMA50: 1.1494

Daily SMA100: 1.1553

Daily SMA200: 1.1797

Levels:

Daily High: 1.1434

Daily Low: 1.1381

Weekly High: 1.142

Weekly Low: 1.1216

Monthly High: 1.1625

Monthly Low: 1.1302

Daily Fibonacci 38.2%: 1.1414

Daily Fibonacci 61.8%: 1.1402

Daily Pivot Point S1: 1.138

Daily Pivot Point S2: 1.1354

Daily Pivot Point S3: 1.1327

Daily Pivot Point R1: 1.1433

Daily Pivot Point R2: 1.1461

Daily Pivot Point R3: 1.1487

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.