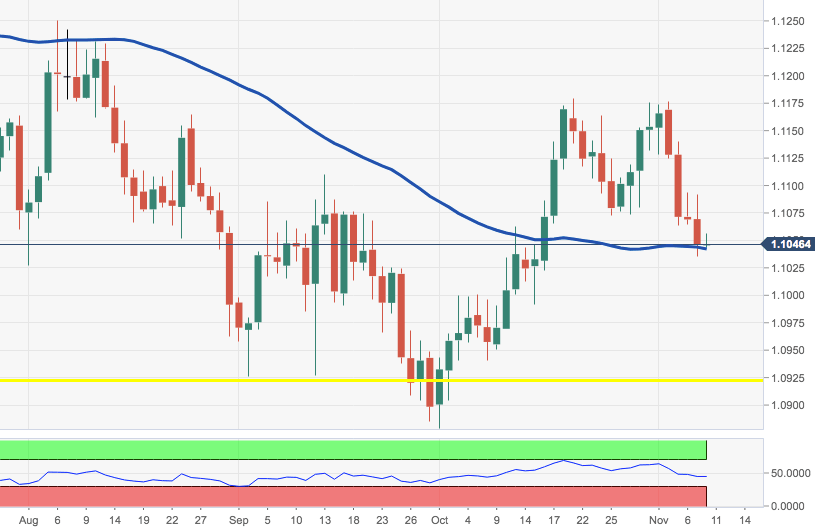

EUR/USD Technical Analysis: rising odds for a test of 1.1000 (and below)

- EUR/USD remains under pressure and is now flirting with the key 55-day SMA in the 1.1040 region.

- A breach of this key area of contention should pave the way for a move to the psychological support at 1.1000 the figure in the short-term horizon.

- Further south aligns the 1.0920 region ahead of the 2019 low at 1.0879.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.