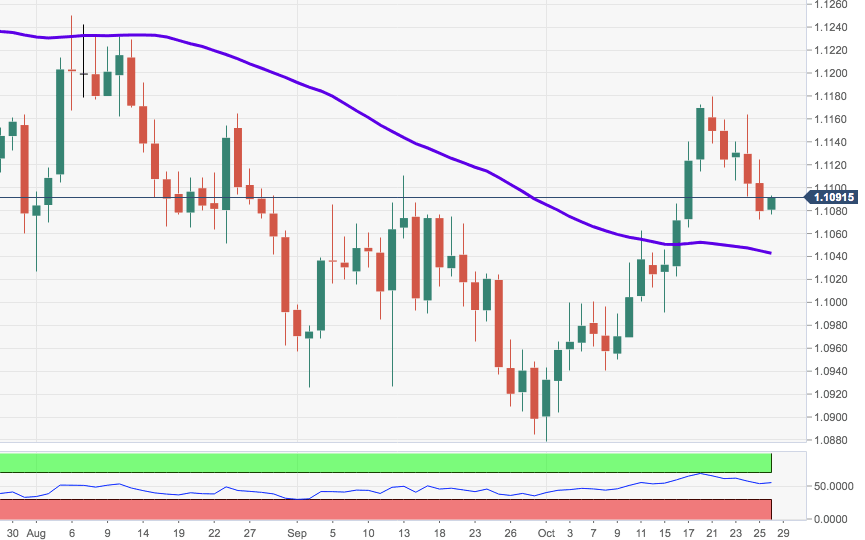

EUR/USD Technical Analysis: recovery could extend to the 100-day SMA at 1.1128

- EUR/USD is rebounding from recent lows in the 1.1070 region after two consecutive daily pullbacks.

- Despite the ongoing recovery, Thursday’s bearish ‘outside day’ remains well in place and still points to further losses in the near term.

- That said, a deeper pullback should see the 55-day SMA at 1.1042 retested. This area of support is reinforced by the proximity of the 21-day SMA, today at 1.1036.

- On the upside, the 100-day SMA at 1.1128 emerges as the initial target.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.