EUR/USD gains after ECB announces interest rate cut, US annual PPI slows

- EUR/USD recovers from 1.1000 after the ECB cuts its key borrowing rates by 25 bps, as expected.

- This is the second interest rate cut decision by the ECB in its current policy-easing cycle.

- Soft US annual PPI weighs on the US Dollar.

EUR/USD bounces back from more than a three-week low around 1.1000 in Thursday’s North American session. The major currency pair rebounds strongly on multiple tailwinds. The asset gains after the European Central Bank’s (ECB) cut the Rate On Deposit Facility by 25 basis points (bps) to 3.5%, as expected, and the US Dollar (USD) corrects on softer-than-expected United States (US) Producer Price Index (PPI) data for August. The ECB also reduced its Main Refinancing Operations Rate expectedly by 60 bps to 3.65%.

This is the second interest rate cut by the ECB in its current policy easing cycle, which it started in June after gaining confidence that inflationary pressures in the Eurozone will return to the central bank’s target of 2% in 2025. The ECB left its key borrowing rates steady in July as officials seemed worried that an aggressive monetary stance could revamp price pressures again.

The Eurozone central bank was almost certain to cut its key borrowing rates due to a sharp decline in Eurozone price pressures and growing risks to Germany’s economic growth, the largest nation of the old continent. The German economy contracted by 0.1% in the second quarter of the year and is exposed to a recession due to a poor demand environment.

Meanwhile, ECB President Christine Lagarde continued to remain data-depenpent and refrained from providing a specific interest rate guidance. Lagarde said, "The interest rate decisions will be based on its assessment of inflation outlook in light of incoming economic and financial data, dynamics of underlying inflation and strength of monetary policy transmission." at the press conference.

Daily digest market movers: EUR/USD rises as US Dollar corrects

- EUR/USD rises as the US Dollar (USD) corrects after refreshing its weekly high, during North American trading hours on Thursday, post release of the US PPI data for August. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls to near 101.50 from the weekly high of 101.80.

- The US PPI report showed that the annual headline producer inflation rose at a slower-than-expected pace of 1.7% from the estimates of 1.8% and July's print of 2.1%. In the same period, the core PPI – which excludes volatile food and energy prices – grew steadily by 2.4%, slower than the forecast of 2.5%. Monthly headline and core PPI rose at a faster than expected pace.

- The producer inflation has not impact market expectations for Federal Reserve (Fed) interest rate path, which currently indicates that the central bank will start reducing its key borrowing rates from the next week. The Fed is expected to deliver a 25-basis point (bps) interest rate cut as the Consumer Price Index (CPI) data for August, released on Wednesday, showed signs of stickiness.

- Wednesday’s CPI data showed that the annual core inflation rose by 3.2%, as expected. The monthly core CPI rose by 0.3%, faster than estimates and the prior release of 0.2%. However, the annual headline CPI grew by 2.5%, slower than the expected 2.6% and July’s print of 2.9% due to lower energy prices. Historically, Fed officials have given more weight to core inflation as it excludes volatile items that are guided by global and environmental forces.

- The sticky US core inflation data cemented market expectations for the Fed to begin reducing its key borrowing rates gradually. According to the CME FedWatch tool, the probability of the Fed reducing interest rates by 50 basis points (bps) to 4.75%-5.00% in September has diminished to 13% from 40% a week ago.

Technical Analysis: EUR/USD finds buying interest near 1.1000

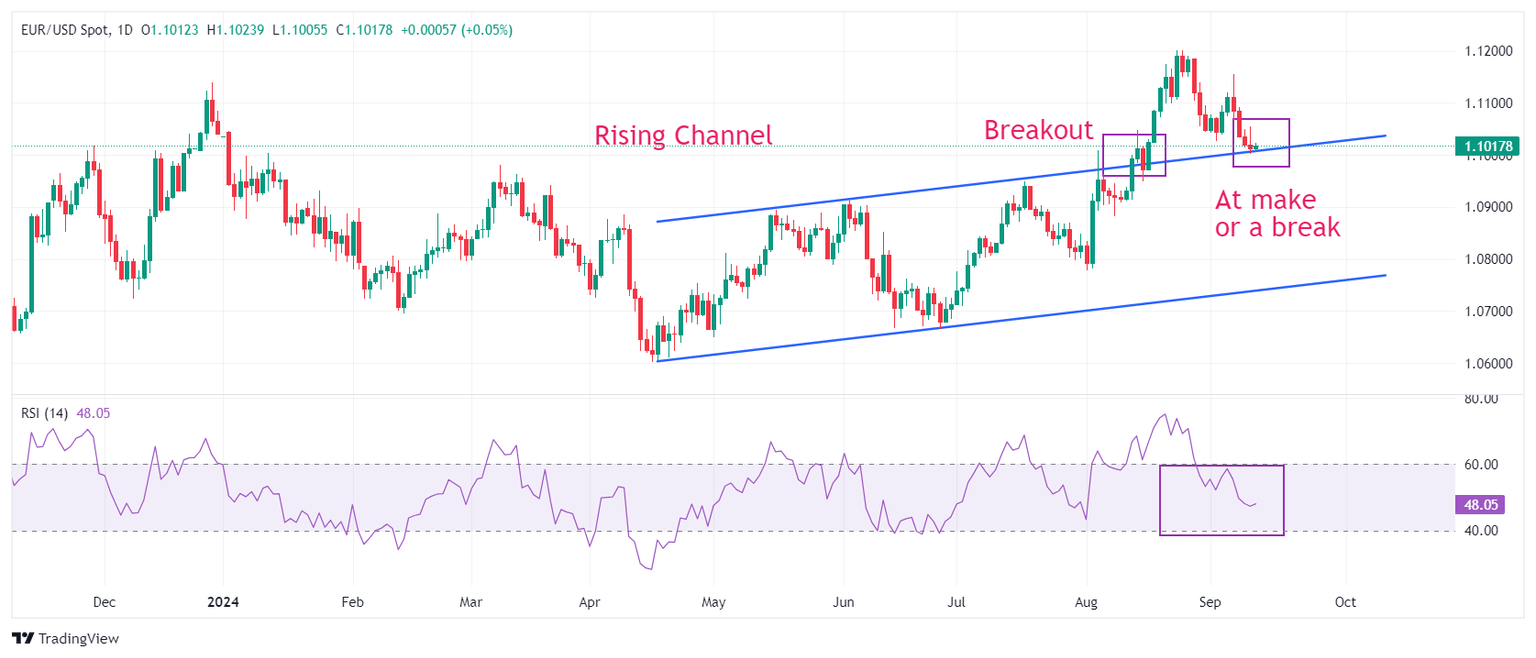

EUR/USD trades at make or a break near 1.1000 ahead of the ECB’s interest rate policy decision. The pair has corrected to near the upper line of a Rising Channel formation in the daily timeframe, from where it delivered a breakout on August 14, which resulted in a sharp upside move. The 20-day Exponential Moving Average (EMA) near 1.1047 acts as a major resistance for the Euro bulls.

The 14-day Relative Strength Index (RSI) falls further below 50.00, suggesting that the near-term outlook is uncertain.

The pair continues to hold the psychological level of 1.1000. A downside move below the same would drag the asset toward the July 17 high near 1.0950. On the upside, last week’s high of 1.1155 and the round-level resistance of 1.1200 will act as major barricades for the Euro bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.