EUR/USD strengthens amidst slowing US economy, hawkish ECB comments

- Euro rises on weakening US factory orders and a mixed ISM reading, with EUR/USD trading above the opening price.

- Wall Street displays mixed sentiment as fears of recession loom following 7th straight month of contracting Manufacturing PMI.

- Hawkish comments from ECB officials, boost the Euro against the backdrop of a sluggish US economy.

EUR/USD erases some of its previous losses, sponsored by weaker orders in factories in the United States (US), alongside mixed ISM readings. European Central Bank President Christine Lagarde and other policymakers’ hawkish comments also lifted the Euro (EUR). The EUR/USD is trading at 1.0710, above its opening price by 0.01%.

Factory orders in the US falter while European Central Bank hints at continued interest rate hikes, sending the EUR/USD higher

Market sentiment is fragile, as shown by Wall Street trading mixed. Factory Orders in the United States slowed down in April, from 0.6% in the prior month, to 0.4%, beneath expectations for a solid 0.8% figure. Excluding transportation, plunged -0.2%, a slight improvement from March -0.7% fall. That, alongside further economic data from the US, underpinned the EUR/USD, which gained 27 pips in the latest 50 minutes of trading, claiming the 1.0700 mark.

The Institute for Supply Management (ISM) revealed that the Non-Manufacturing PMI, also known as the Services PMI, dropped to 50.3 in May from April 51.9, clung to expansionary territory amidst a slowdown in orders. Given that the PMI decelerated, increased fears for a possible recession after the last week’s Manufacturing PMI contracted for the seventh straight month.

Meanwhile, the US Dollar Index (DXY), a measure of the buck’s value vs. a basket of currencies, pairs earlier losses at 104.060, positive by 0.02%, capping the EUR/USD’s rally amidst falling US Treasury bond yields. The US 10-year benchmark note rate sits at 3.693%, almost flat.

On the European front, business activity in May, particularly the S&& Global Services PMI, decelerated but offset the plunge in manufacturing activity. Meanwhile, ECB speakers crossed newswires, led by its President Lagarde, who said that the central bank would stop all reinvestments in APP. Lagarde added that although there are signs of moderation, “there is no clear evidence that underlying inflation has peaked,” told European lawmakers.

At the same time, her colleague Joachim Nagler added the ECB needs to keep raining rates beyond the summer. Money market futures have priced in a 25 bps rate hike by the ECB, contrarily to the US Federal Reserve (Fed), which is seen pausing in June, but if data proves them wrong, another interest rate increase is expected in July.

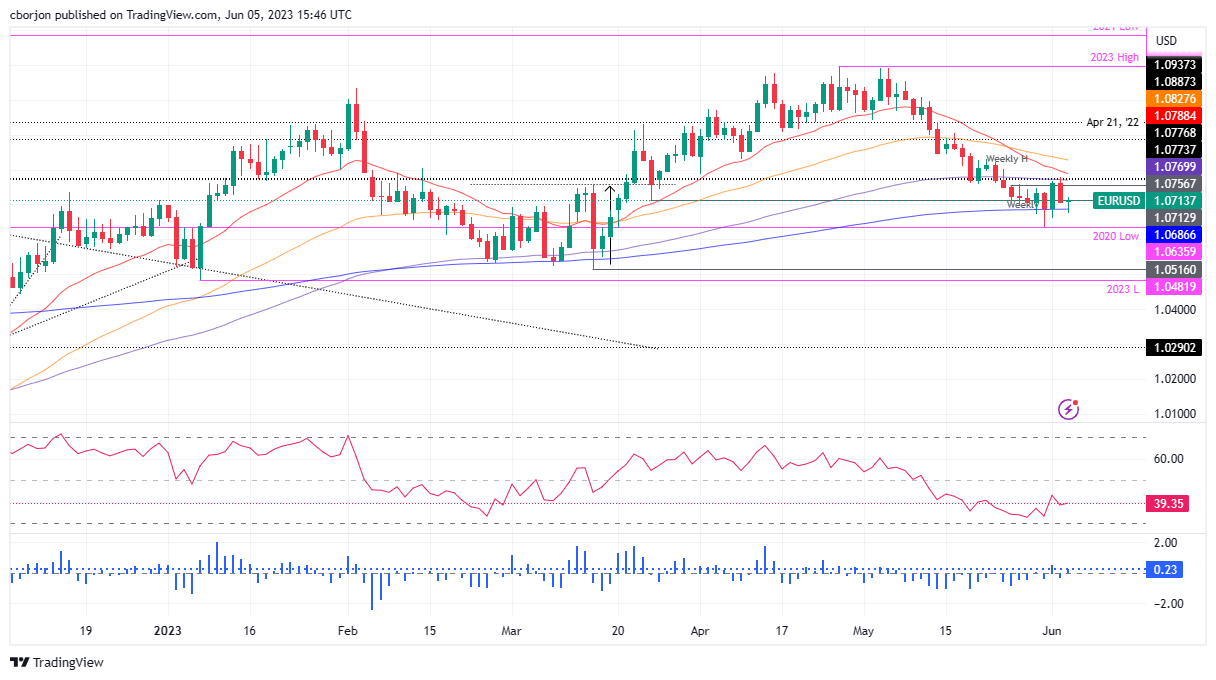

EUR/USD Price Analysis: Technical outlook

From a technical perspective, the EUR/USD is neutral to downward biased, though testes briefly the 200-day Exponential Moving Average (EMA) at 1.0687, though bounced for the third time. Nevertheless, the Relative Strength Index (RSI) and the 3-day Rate of Change (RoC) are bearish, suggesting sellers remain in charge.

Downside risks lie at the 1.0700 figure. Break below will expose the 200-day EMA, followed by the May 31 low of 1.0635. on the flip side, the EUR/USD first resistance would be the 100-day EMA at 1.0769, the 20-day EMA at 1.0788, and the 1.0800 figure.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.