EUR/USD steady as Powell comments and slowing PMIs highlight Fed-ECB divergence

- EUR/USD unmoved as Powell said that policy remains modestly restrictive but flexible.

- Flash PMIs in US and Eurozone show slowing activity, raising concerns over GDP prints later this week.

- Fed expected to cut in October while ECB seen on hold, favoring EUR/USD’s upside.

The EUR/USD holds firm above the 1.1800 figure on Tuesday after the Federal Reserve Chair Jerome Powell remained neutral and business activity data in Europe and the United States, hints that both economies are slowing down. The pair trades with modest gains of 0.09%.

Dollar stays pressured by risk appetite; Fed-ECB policy divergence underpins Euro

Risk appetite keeps the Dollar pressured, yet the Euro failed to capitalize on its weakness. The Fed Chair Jerome Powell crossed the newswires and nearly repeated what did he said at the Federal Open Market Committee (FOMC) press conference.

He said that the policy path is difficult as the central bank must look at both goals of the dual mandate “equally.” He reiterated the downside risks in the labor market hhad risen, though that inflation remains “somewhat elevated,” despite coming into better balance. He added that the current monetary policy stance remains “modestly restrictive, leaves us well positioned to respond to potential economic developments.”

Data-wise, Flash Purchasing Managers’ Index (PMI) in the US and the Eurozone showed that business activity slowed, which could weigh on the release of economic growth figures, with the US Gross Domestic Product (GDP) set to be released in the week.

Fed vs. ECB monetary policy divergence, favors Euro’s appreciation

Despite this, the Federal Reserve is expected to reduce interest rates at the October meeting, as revealed by the Prime Market Terminal interest rate probability tool. The European Central Bank (ECB) is foreseen to hold rates firm, following remarks by President Lagarde after the last ECB’s meeting, who said “The disinflation process is over.”

On Wednesday, the docket will feature Germany’s IFO Business Climate, Current Assessment and Expectations for September. In the US, traders await for housing data and Fed speakers.

Daily market movers: Euro consolidate despite US, EZ economic slowdown

- Earlier, US S&P Global Manufacturing PMI dipped in September to 52.0 from 53.0 reported in the previous print. Meanwhile, the Services PMI fell to 53.9 from 54.5 in August. S&P Global revealed that prices paid rose to 62.6 in September, up from 60.8 last month as business mentioned tariffs “as the principal cause of further cost increases.”

- Fed Chair Jerome Powell mentioned that “downside risks to employment shifted balance of risks, prompting to last week’s rate cut,” and that the rate cut moved policy to a more neutral stance. Despite acknowledging employment risks, he said that “two-sided risks mean there is no risk-free path.”

- Atlanta Fed President Raphael Bostic said he is open to adopting an inflation target range and warned of further inflationary pressures ahead.

- Fed Governor Michelle Bowman signaled she anticipates three rate cuts in 2025 to support the labor market. Meanwhile, Chicago Fed President Austan Goolsbee emphasized the need for the central bank to bring inflation back to its 2% target.

- The Eurozone HCOB Manufacturing PMI in September dipped from 50.7 to 49.5, below forecasts for an expansion of 50.9. The Services PMI for the same period rose by 51.4 up from August’s and estimates of 50.5.

- The US Dollar Index (DXY) which tracks the American currency value against a basket of six peers, tumbles 0.09% down at 97.21.

- The Federal Reserve is expected to cut rates 25 bps at the October 19 meeting, as revealed by data from Prime Market Terminal. Odds are at 91%.

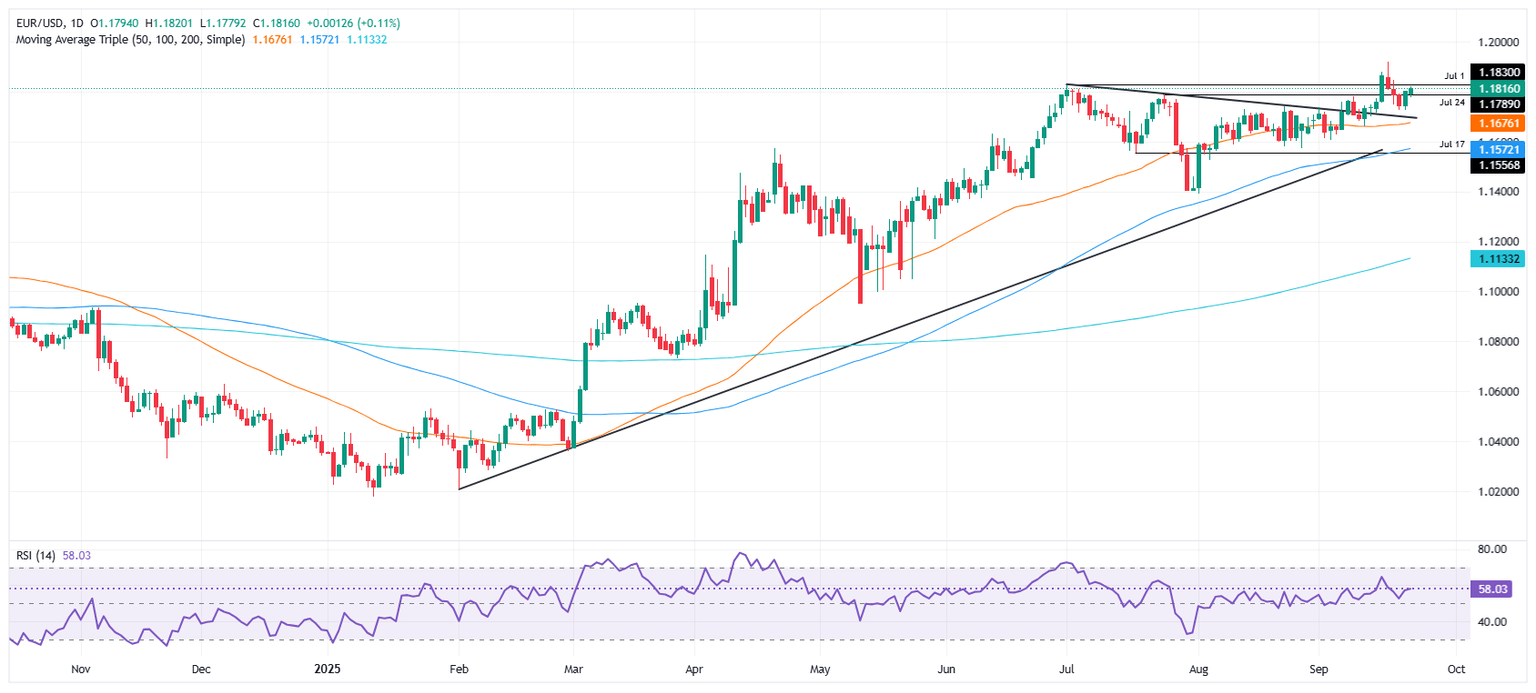

Technical outlook: EUR/USD climb back above 1.1800

EUR/USD uptrend remains intact as a ‘bullish engulfing’ candle chart pattern emerged and pushed prices back above 1.1800. Although the pair reached a weekly peak of 1.1820, price action is muted, with buyers unable to push prices towards testing 1.1850, followed by the yearly peak at 1.1918.

The Relative Strength Index (RSI) is flat at bullish territory. Although it is positive, the lack of movement could weigh on the EUR/USD to remain trading sideways.

On the downside, If drops below 1.1800, the next key support level would be 1.1750. The next support would be 1.1700, ahead of the confluence of the 100-day SMA and the August 27 swing low near 1.1560–1.1574.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.