EUR/USD consolidates above 1.0900 with US inflation in focus

- EUR/USD remains in a tight range above 1.0900 with US inflation data in focus.

- Both US annual headline and core inflation are expected to have decelerated slightly in July.

- The ECB is expected to deliver two more interest-rate cuts this year.

EUR/USD stays in a tight range above the round-level support of 1.0900 in Monday’s New York session. The major currency pair struggles for direction as investors look for fresh cues at the start of a busy data week that will likely indicate how much the Federal Reserve (Fed) will cut interest rates in September.

For fresh interest rate cues, investors mainly await the United States (US) Consumer Price Index (CPI) data for July, which will be published on Wednesday. Economists expect that monthly headline and core inflation, which strips off volatile food and energy prices, rose by 0.2%. Annual headline and core CPI are estimated to have decelerated by one-tenth to 2.9% and 3.2%, respectively.

Currently, the Fed is widely anticipated to start reducing its key borrowing rates in September as Fed policymakers seem to have become confident that price pressures are on track to return to the desired rate of 2%. Also, officials have acknowledged that downside risks have now emerged for the labor market.

According to the CME FedWatch tool, 30-day Federal Funds Futures pricing data shows that traders see a 46.5% chance that interest rates will be reduced by 50 basis points (bps) in September, significantly from the 85% recorded a week ago. The expectations for a big Fed rate cut have waned as fears of potential US recession have eased.

Also, Fed officials have clarified that the size and timing of rate cuts will be driven by the economic data and not by the recent turmoil in equity markets.

Daily digest market movers: EUR/USD trades sideways ahead of US CPI report

- EUR/USD continues to trade sideways above the round-level support of 1.0900 in Monday's New York trading hours. The major currency pair remains in a tight range from the last week amid absence of Eurozone top-tier economic data. This week, the Eurozone economic calendar will report the revised estimates of flash Q2 Gross Domestic Product (GDP) and preliminary Employment Change data, which will be published on Wednesday.

- According to the expectations, the Eurozone economy expanded by 0.3% on quarter, in line with flash figures and the growth rate recorded in the first quarter of this year. Meanwhile, the Employment Change, a percentage measure that shows an increase in fresh payrolls, is expected to rise at a slower pace of 0.2% from the prior release of 0.3%.

- Strong GDP and employment numbers are favorable for the Euro (EUR) as they reduce the chances of further policy easing by the European Central Bank (ECB). The ECB has already pivoted to policy normalization and investors look for cues that could suggest how far the central bank will take its key borrowing rates down.

- Currently, financial markets expect that the ECB will cut interest-rate cuts two more times this year Last week, Finnish ECB policymaker Olli Rehn said, “Rate cuts would help the eurozone economy recover, in particular the "fragile" industrial growth and subdued investments,” Reuters reported.

Technical Forecast: EUR/USD continues to juggle above 1.0900

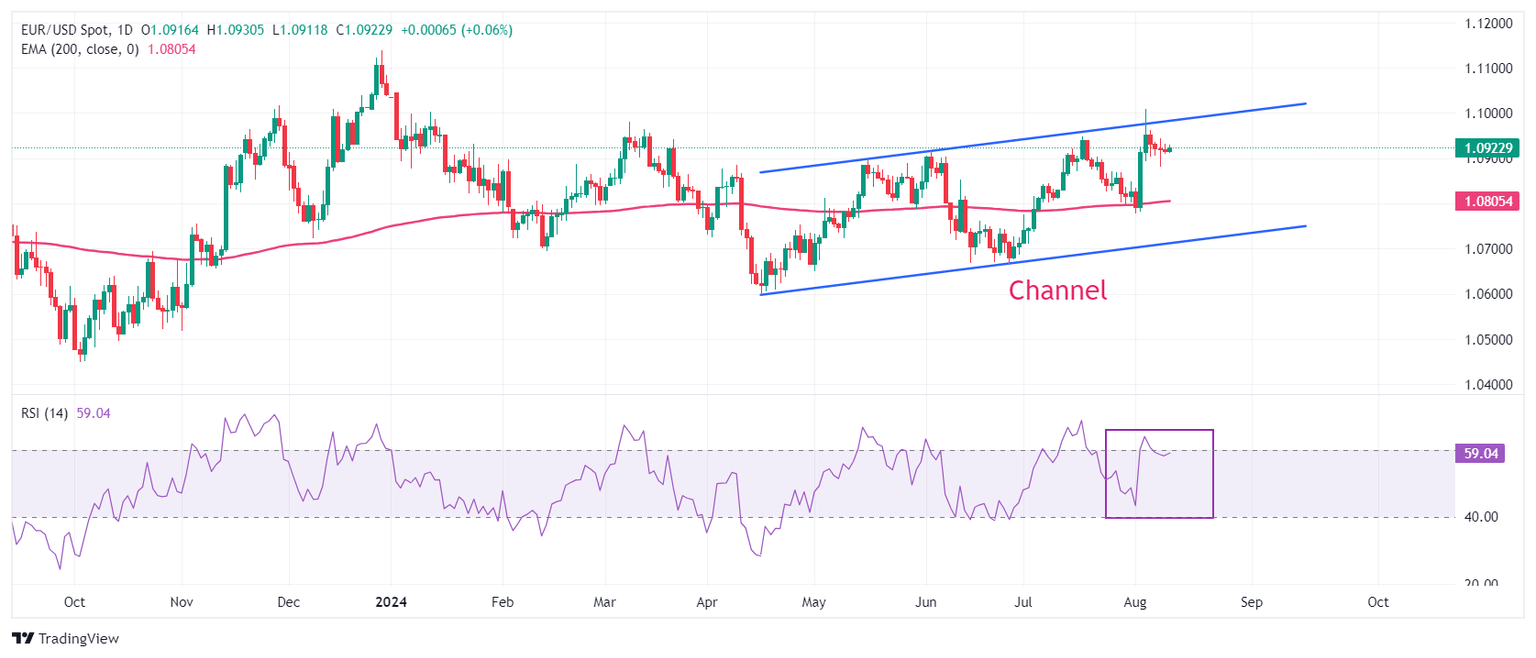

EUR/USD trades close to near the upper boundary of the Channel formation on a daily time frame. A breakout of an aforementioned chart pattern results in wider ticks on the upside and heavy volume. The 200-day Exponential Moving Average (EMA) near 1.0800 has acted as major support for the Euro bulls.

The 14-day Relative Strength Index (RSI) returns inside the 40.00-60.00 range, remaining close to its upper boundary. If the RSI sustains above 60.00, a bullish momentum will trigger.

More upside would appear if the major currency pair breaks above August 5 high of 1.1009. This would drive the asset towardsAugust 10, 2023, high at 1.1065, followed by the round-level resistance of 1.1100.

In an alternate scenario, a downside move below August 1 low at 1.0777 would drag the asset toward February low near 1.0700. A breakdown below the latter would expose the asset to June 14 low at 1.0667.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.