EUR/USD struggles near 1.1200 as traders brace for Fed Powell's speech

- EUR/USD aims to reclaim 1.1200 despite a further slowdown in German inflation in September.

- ECB’s Lagarde emphasized keeping interest rates restrictive as long as necessary.

- Fed’s Powell would guide about the likely interest rate cut size in November.

EUR/USD gains but struggles to extend the upside above the key resistance of 1.1200 in Monday’s North American trading session. The major currency pair faces mild pressure after the European Central Bank (ECB) President Christine Lagarde’s speech in which she emphasized the need to keep the monetary policy restrictive. The comments from ECB Lagarde indicated that the central bank sees Eurozone inflation temporarily rising in the last quarter of this year but is confident about price pressures returning to the bank's target of 2% in a timely. Lagarde remained confident that the labor market is resilient but expects further deceleration in job growth.

In the late European trading hours, the Euro (EUR) rose despite the flash German Harmonized Index of Consumer Prices (HICP) showing a further deceleration in price pressures in September. Annual HICP grew by 1.8%, slower than estimates of 1.9% and the former release of 2%. The month-on-month inflation deflated again but at a slower pace of 0.1%.

On Friday, the flash French Consumer Price Index (EU Norm) and the Spanish HICP data also showed that price pressures grew at a slower-than-expected pace in September.

A further slowdown in inflationary pressures has prompted market expectations of the European Central Bank (ECB) to cut interest rates again in the October meeting. Investors raised their bets on Friday on another rate cut on October 17 and have now priced in about a 75% chance of a move compared with only about a 25% chance seen last week, Reuters reported. The ECB also reduced its Rate on Deposit Facility by 25 basis points (bps) to 3.5% in its policy meeting on September 12.

Going forward, the Euro is expected to remain highly volatile as investors await the preliminary Eurozone HICP data for September, which will be published on Monday and Tuesday, respectively.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| EUR | USD | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| EUR | 0.14% | -0.00% | 0.54% | 0.05% | -0.28% | -0.27% | 0.44% | |

| USD | -0.14% | -0.12% | 0.43% | -0.09% | -0.45% | -0.41% | 0.25% | |

| GBP | 0.00% | 0.12% | 0.67% | 0.05% | -0.28% | -0.27% | 0.44% | |

| JPY | -0.54% | -0.43% | -0.67% | -0.46% | -0.94% | -0.81% | -0.13% | |

| CAD | -0.05% | 0.09% | -0.05% | 0.46% | -0.31% | -0.32% | 0.39% | |

| AUD | 0.28% | 0.45% | 0.28% | 0.94% | 0.31% | 0.00% | 0.72% | |

| NZD | 0.27% | 0.41% | 0.27% | 0.81% | 0.32% | -0.00% | 0.69% | |

| CHF | -0.44% | -0.25% | -0.44% | 0.13% | -0.39% | -0.72% | -0.69% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: EUR/USD holds gains but struggles to extend its upside

- EUR/USD edges higher on Monday as the US Dollar (USD) remains under pressure ahead of the Federal Reserve (Fed) Chair Jerome Powell’s speech, which is scheduled at 17:00 GMT. Investors expect Powell to provide fresh cues about the likely interest rate cut size by the Fed in the November monetary policy meeting.

- According to the CME FedWatch tool, the probability of the Fed reducing interest rates by 50 basis points (bps) in the November meeting to the range of 4.25%-4.50% is 41.6% at the time of writing. The likelihood has decreased from nearly 53.0% on Friday after the release of the United States (US) Personal Consumption Expenditures Price Index (PCE) report for August.

- The PCE price index report showed on Friday that the annual inflation decelerated at a faster pace to 2.2% from the estimates of 2.3% and July’s reading of 2.5%. This was the lowest reading since February 2021. However, its impact appeared to be offset by the annual core PCE inflation – which excludes volatile food and energy prices – that accelerated to 2.7% from the former release of 2.6%, as expected, diminishing the odds of a double-dose rate cut in the next meeting.

- Lately, Fed policymakers have become more focused on preventing job losses and an economic slowdown, with growing confidence that inflation will return to the bank’s target of 2%. To get fresh insights about the current status of the labor market health, investors will focus on a string of economic data such as JOLTS Job Openings for August, and the ADP Employment Change and Nonfarm Payrolls (NFP) data for September, which will be published this week.

Technical Analysis: EUR/USD remains above key 20-EMA

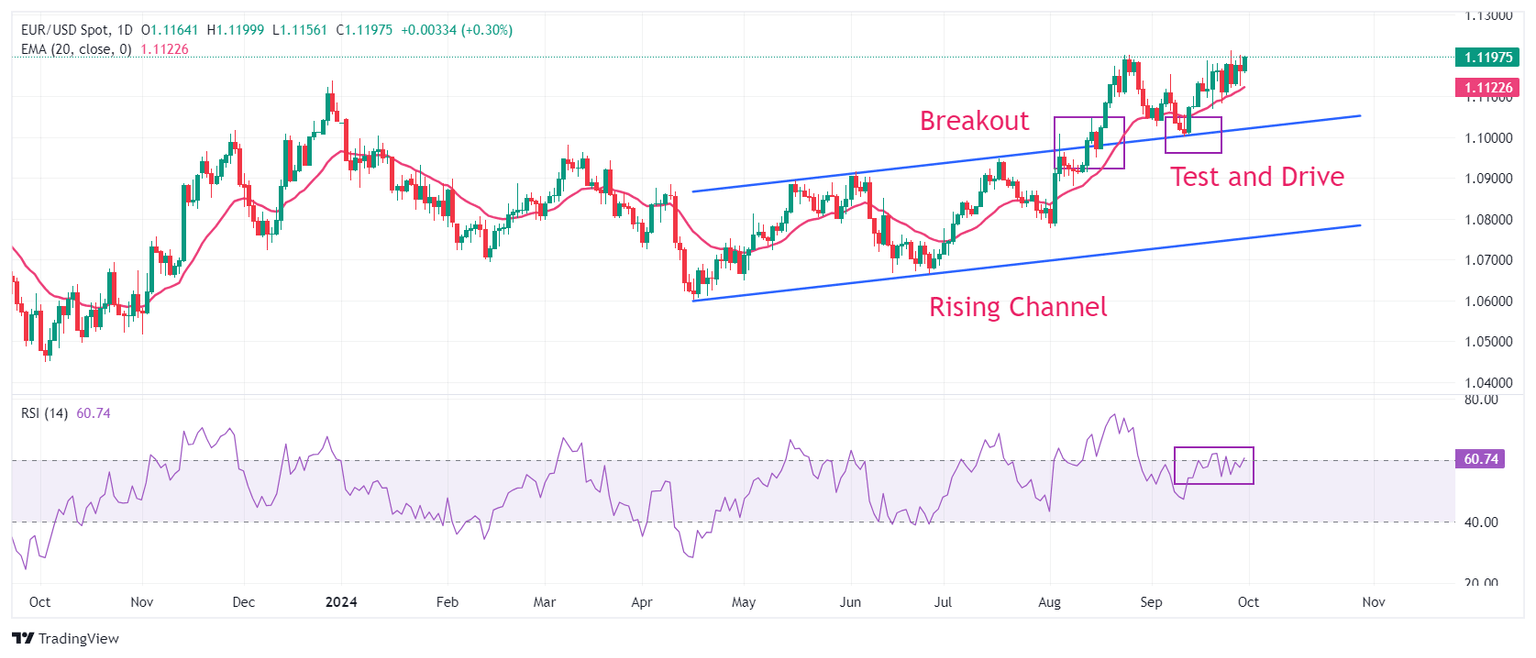

EUR/USD gathers strength to recapture 1.1200 in North American trading hours on Monday. The major currency pair remains firm as it holds the breakout of the Rising Channel chart pattern formed on a daily time frame near the psychological level of 1.1000.

The upward-sloping 20-day Exponential Moving Average (EMA) near 1.1110 suggests that the near-term trend is bullish.

The 14-day Relative Strength Index (RSI) hovers near 60.00. A bullish momentum would trigger if the oscillator remains above this level.

Looking up, a decisive break above the round-level resistance of 1.1200 will result in further appreciation toward the July 2023 high of 1.1276. On the downside, the psychological level of 1.1000 and the July 17 high near 1.0950 will be major support zones.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.