EUR/USD Price Forecast: Bulls maintain the pressure ahead of critical US employment data

EUR/USD Current price: 1.1181

- German inflation eased further in September, according to preliminary estimates.

- The United States will publish the September Nonfarm Payrolls report.

- EUR/USD retreats once again from around 1.1200, but bears have nothing to do.

The EUR/USD pair hit 1.1208 during European hours on Monday amid persistent US Dollar’s weakness. Financial markets are optimistic following news from China last week, as the Asian giant announced measures to boost the economy, combining monetary and fiscal support. Furthermore, central banks’ monetary loosening and hopes interest rates will keep declining underpinned the mood.

The macroeconomic calendar will be quite busy this week, with a focus on European inflation and United States (US) employment. So far, Germany released the preliminary estimate of the September Harmonized Index of Consumer Prices (HICP), which rose by 1.8% in the previous twelve months, easing from the 2% posted in the previous month. On a monthly basis, the HICP declined by 0.1%.

The American session will include a speech by Federal Reserve (Fed) Chair Jerome Powell. Data-wise, the US will release the September Chicago Purchasing Managers’ Index (PMI) and the Dallas Fed Manufacturing Business Index for the same month.

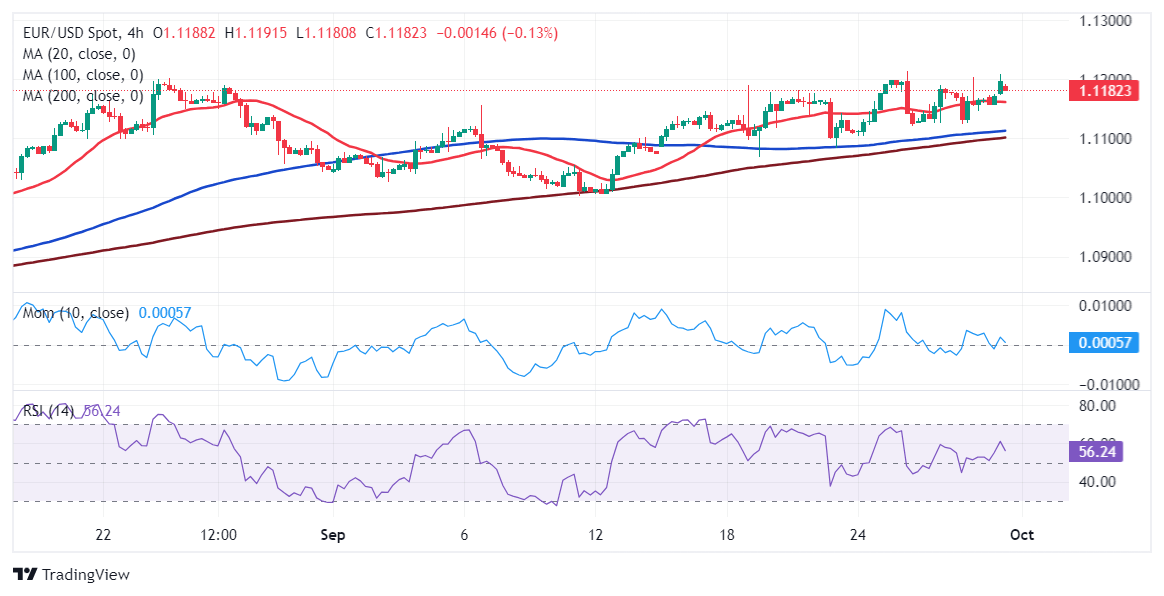

EUR/USD short-term technical outlook

The EUR/USD pair eased from the aforementioned high ahead of the US opening but holds on to intraday gains. In the daily chart, the risk skews to the upside. The pair is developing above all its moving averages, with the 20 Simple Moving Average (SMA) aiming north at around 1.1110, providing dynamic support. The 100 SMA, in the meantime, extends its advance above a flat 200 SMA, both far below the shorter one. Technical indicators, in the meantime, maintain their upward slopes within positive levels, in line with another leg north, should the pair finally clear the 1.1200 resistance area.

In the near term, and according to the 4-hour chart, EUR/USD offers a neutral-to-bullish stance. Technical indicators stand directionless, albeit well above their midlines and without signs of upward exhaustion. At the same time, the pair develops above all its moving averages, with the 20 SMA flat at around 1.1160. The longer moving averages, in the meantime, maintain their upward slopes below the shorter one, limiting the odds of a steeper decline.

Support levels: 1.1160 1.1110 1.1075

Resistance levels: 1.1200 1.1250 1.1290

(This story was corrected on September 30 at 13:25 GMT to say in the headline "US employment data" instead of "US inflation data" as previously stated)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.