EUR/USD bounces back sharply ahead of Fed policy meeting

- EUR/USD recovers sharply to near 1.0800 ahead of Fed policy while Trump's victory keeps downside bias intact

- German three-party coalition collapsed, paving the way for snap elections in early 2025.

- The Fed is expected to cut interest rates by 25 bps to 4.50%-4.75%.

EUR/USD rebounds sharply to near 1.0800 in North American trading hours on Thursday. The major currency pair bounces back after posting a more than four-month low below 1.0700 on Wednesday. The recovery comes as the US Dollar (USD) corrects ahead of the Federal Reserve’s (Fed) interest rate decision, which will be published at 19:00 GMT.

On Wednesday, the USD Index surged more than 1.6% – the highest single-day gain in almost four years – as United States (US) citizens chose Republican Donald Trump in the presidential elections over Democratic candidate Kamala Harris. The reasoning behind the US Dollar’s rally was Trump’s promise to raise import tariffs and lower corporate taxes. On Thursday, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, drops to near 104.50 after Wednesday’s rally.

Higher tariffs would make imported products more expensive for US citizens and corporations, likely fuelling inflation. Lower taxes could also stimulate spending, contributing to price pressures as well. This scenario would make it more difficult for the Federal Reserve (Fed) to continue with its rate-cutting cycle.

As for the Fed’s monetary policy meeting, traders have priced in a 25 basis points (bps) interest rate cut that will push interest rates lower to 4.50%-4.75%, according to the CME FedWatch tool. As the Fed is widely anticipated to cut interest rates, investors will pay close attention to the monetary policy statement and Fed Chair Jerome Powell’s press conference. Investors would like to know whether the Fed will slow its policy-easing cycle if Trump implements what he promised during the campaign.

On the economic data front, Initial Jobless Claims for the week ending November 1 rose by 221K, as expected. Flash Unit Labor Costs rose by 1.9% in the third quarter of the year, faster than estimates of 0.5% but slower than the 2.4% growth in the previous quarter.

Daily digest market movers: EUR/USD discovers strong buying interest despite multiple headwinds

- EUR/USD recovers to near 1.0770 at the US Dollar’s expense. However, the outlook of the major currency pair remains vulnerable as the Eurozone economy is expected to face a significant burden from Trump’s protectionist policies.

- The blanket 10% tariff on all imported goods advocated by Trump would have a negative impact of 0.1% on the European Union’s (EU) Gross Domestic Product (GDP), according to a recent London School of Economics and Political Science paper.

- At the conference in London on Wednesday, European Central Bank (ECB) Vice President Luis de Guindos warned that tariffs from the US could lead to a vicious cycle of trade war globally. "If you impose a tariff, you have to bear in mind that the other party is going to react, and it’s going to retaliate, and that could give rise to a vicious circle of in terms of inflation, tariffs, which could be the worst possible result and outcome," Guindos said, Reuters reported.

- Meanwhile, the collapse of the German three-party coalition has also added to downside risks of economic growth in the shared continent. On Wednesday, German Chancellor Olaf Scholz fired Federal Minister of Finance Christian Lindner, paving the way for snap elections in early 2025. “It was necessary to prevent harm to our country,” Scholz said, CNN reported.

- On the economic data front, German Industrial Production declined by 2.5%, faster than the 1% contraction expected by market participants in September on month.

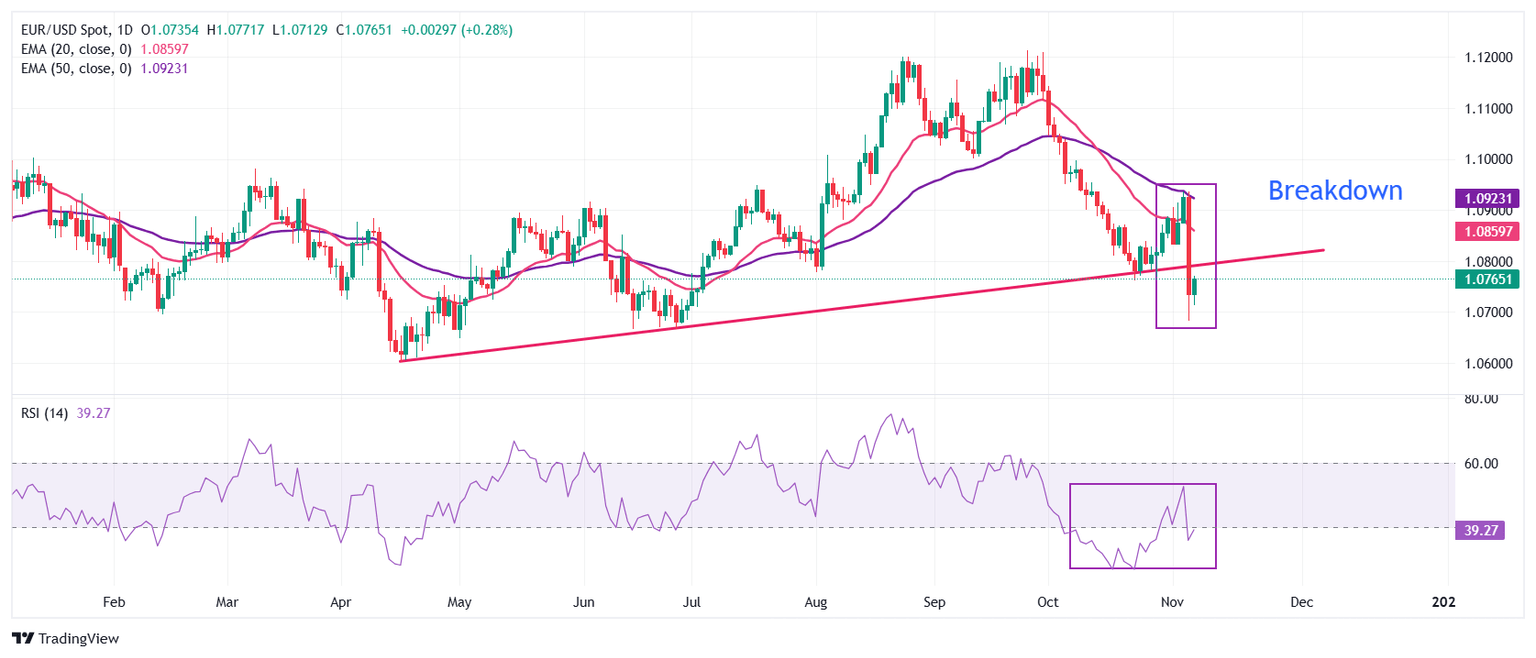

Technical Analysis: EUR/USD aims to revisit 200-day EMA

EUR/USD rebounds to near 1.0800 after discovering buying interest below the key support of 1.0700. However, the major currency pair’s recovery appears to be lacking strength as declining 20-day and 50-day Exponential Moving Averages (EMAs) near 1.0860 and 1.0920, respectively, suggest a strong bearish trend.

Additionally, the 14-day Relative Strength Index (RSI) retreats below 40.00, suggesting a resumption of the bearish momentum.

The upward-sloping trendline around 1.0800, which is plotted from the April 16 low at around 1.0600, will act as a key resistance zone for Euro (EUR) bulls. Looking down, the shared currency pair could decline to the year-to-date (YTD) low of 1.0600.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Thu Nov 07, 2024 19:00

Frequency: Irregular

Consensus: 4.75%

Previous: 5%

Source: Federal Reserve

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.