EUR/USD pulls back from three-week highs with all eyes on the ECB

- The Euro retreats from three-week highs with the bullish trend intact on hopes of an EU-US trade deal.

- News reports anticipate an agreement that would include 15% baseline tariffs for EU products.

- The ECB is expected to leave rates on hold, but it might hint at further easing down the road.

The EUR/USD pair is trimming gains on Thursday, after having rallied on news reports that the European Union (EU) and the United States (US) might be close to a trade deal. The positive preliminary Eurozone PMIs have failed to support the common currency, as investors close Euro long positions ahead of the ECB decision.

The Euro (EUR) is trading at 1.1750 ahead ogf the US market opening, down from a three-week high at 1.1780 reached after the news of the trade deal with the US was released. The pair, however, maintains its immediate bullish trend intact, as the safe-haven US Dollar (USD) struggles to find demand in risk-on markets.

EU and US representatives appear to have brought their positions closer to reaching a deal that would include 15% tariffs for products from the Eurozone, with exemptions for aircraft, medical devices, and alcohol, according to European Commission officials. This agreement would avert the 30% tariff announced by US President Donald Trump earlier in July and, above all, a set of retaliations from the EU that might spiral into a trade war.

Eurozone macroeconomic data have been mixed. The German GfK Consumer Confidence Survey for August confirmed the weak momentum of the Eurozone's major economy, while the preliminary HCOB Purchasing Managers Index (PMI) showed that business activity grew beyond expectations.

Later in the day, the focus will be on the European Central Bank's (ECB) monetary policy meeting. In the US, the preliminary S&P Global PMIs and the weekly Initial Jobless Claims will provide the fundamental background.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.16% | 0.25% | 0.06% | 0.10% | -0.27% | -0.08% | 0.26% | |

| EUR | -0.16% | 0.12% | -0.10% | -0.04% | -0.41% | -0.23% | 0.11% | |

| GBP | -0.25% | -0.12% | -0.22% | -0.15% | -0.52% | -0.34% | -0.01% | |

| JPY | -0.06% | 0.10% | 0.22% | 0.02% | -0.34% | -0.20% | 0.06% | |

| CAD | -0.10% | 0.04% | 0.15% | -0.02% | -0.34% | -0.18% | 0.15% | |

| AUD | 0.27% | 0.41% | 0.52% | 0.34% | 0.34% | 0.18% | 0.52% | |

| NZD | 0.08% | 0.23% | 0.34% | 0.20% | 0.18% | -0.18% | 0.34% | |

| CHF | -0.26% | -0.11% | 0.00% | -0.06% | -0.15% | -0.52% | -0.34% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Hopes of a trade deal will keep the Euro supported

- The fundamental background is Euro-supportive, as higher expectations for a trade agreement between the EU and the US are likely to feed risk appetite and keep the US Dollar's upside attempts limited. The pair, however, might see some correction on profit-taking ahead of the ECB's decision.

- The European Central Bank's monetary policy decision is due at 12:15 GMT on Thursday. The bank is widely expected to leave its Rate on Deposit Facility unchanged at the current 2% but the market will be looking at the Monetary Policy Statement for clues about the timing of the next rate cuts.

- Earlier on Thursday, Eurozone preliminary PMI showed that manufacturing activity improved to 49.8 in July from 49.5 in the previous month, in line with market expectations, while the services activity expanded to 51.2 from 50.5, beating market forecasts of a more moderate improvement to 50.8.

- The German GfK Consumer Confidence Index for August deteriorated to -21.5 from -20.3 in the previous month, against market expectations of a moderate improvement to -19.2. These levels highlight a weak confidence in the economy and are consistent with soft economic growth.

- In the US, the preliminary S&P Global Services PMI is seen accelerating to 53 from 52.9 in June, while the Manufacturing gauge is expected to show a 52.5 reading, up from last month's 52 print.

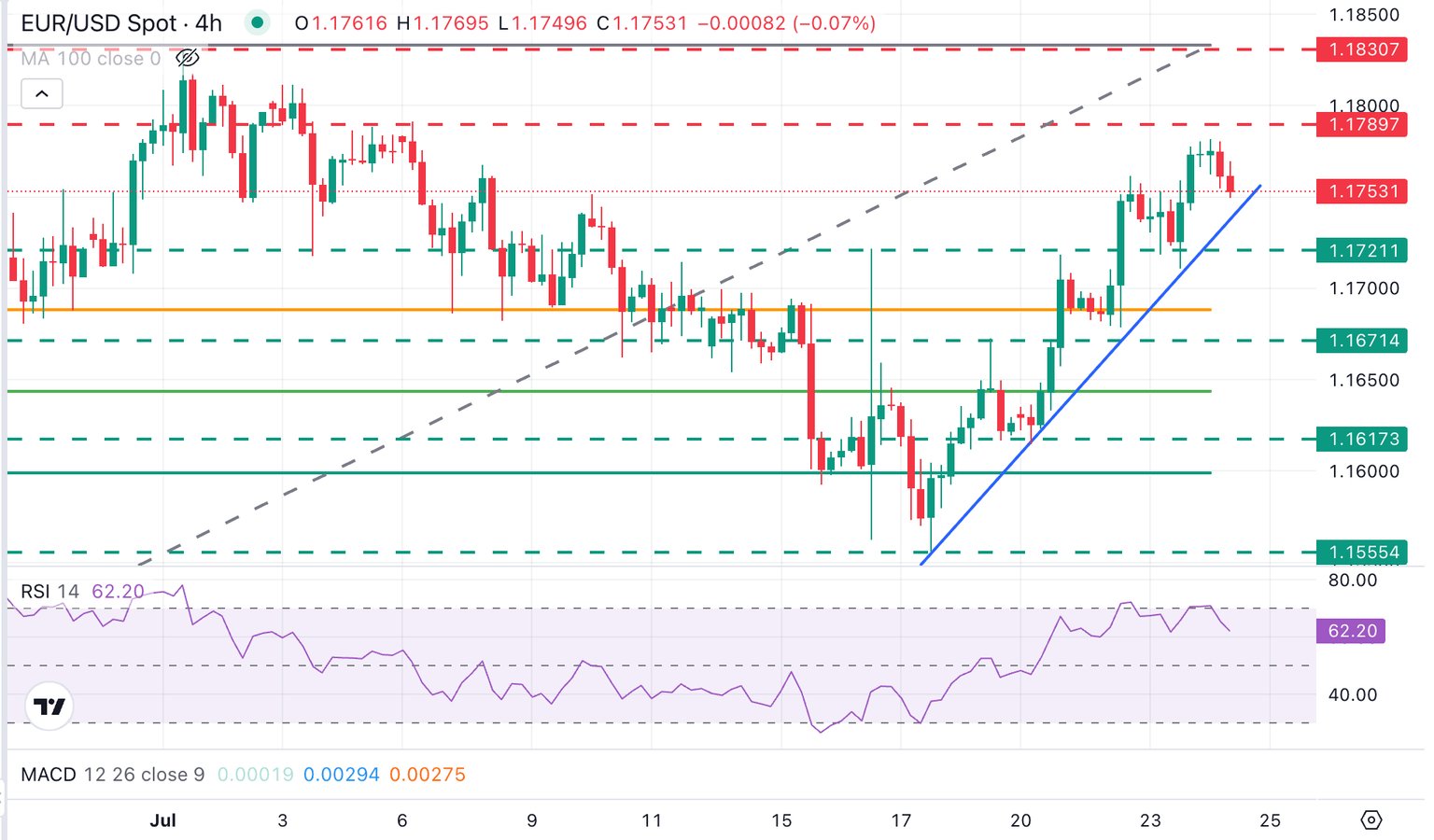

EUR/USD remains bullish with the 1.1830 level in sight

EUR/USD is pulling lower from three-week highs. The 4-hour Relative Strength Index (RSI) indicator has reached overbought levels, and the pair might seem to be set for some correction, as investors square their EUR long positions ahead of the outcome of the ECB meeting, awaiting further insight into the bank's monetary policy plans.

On the downside, the pair may find support at the ascending trendline from July 17 lows, now at 1.1740, ahead of Tuesday's low near 1.1715 and the July 22 low, at 1.1680. Immediate resistance is at the 1.1790 area (July 7 highs), ahead of the long-term high of 1.1830, hit on July 1.

Economic Indicator

ECB Rate On Deposit Facility

One of the European Central Bank's three key interest rates, the rate on the deposit facility, is the rate at which banks earn interest when they deposit funds with the ECB. It is announced by the European Central Bank at each of its eight scheduled annual meetings.

Read more.Next release: Thu Jul 24, 2025 12:15

Frequency: Irregular

Consensus: 2%

Previous: 2%

Source: European Central Bank

Economic Indicator

ECB Press Conference

Following the European Central Bank’s (ECB) economic policy decision, the ECB President gives a press conference regarding monetary policy. The president’s comments may influence the volatility of the Euro (EUR) and determine a short-term positive or negative trend. If the president adopts a hawkish tone it is considered bullish for the EUR, whereas if the tone is dovish the result is usually bearish for the Euro.

Read more.Next release: Thu Jul 24, 2025 12:45

Frequency: Irregular

Consensus: -

Previous: -

Source: European Central Bank

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.