EUR/USD strengthens on US slowdown fears, optimism on German defense deal

- EUR/USD advances above 1.0900 as the US Dollar extends its downside amid growing concerns over the US economic outlook.

- The Euro gains as German Greens agreed to support defense spending plans.

- Investors await the US JOLTS Job Openings data for January and the CPI data for February.

EUR/USD posts a fresh four-month high to near 1.0920 in North American trading hours on Tuesday. The major currency pair strengthens as the US Dollar (USD) underperforms its peers amid escalating fears of an economic slowdown in the United States (US). The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, refreshes the four-month low near 103.30.

Investors have dumped the US Dollar lately amid caution that the US economy could face economic shocks in the near term due to President Donald Trump’s “America First” policies. Market participants had been expecting Trump's policies to be inflationary and pro-growth in the long term but now see severe economic turbulence in the near term, assuming that US employers will bear the pressure of higher tariffs.

Business owners are unlikely to bear the wholesome tariff burden and will pass on the impact to end consumers. Such a scenario would result in a sharp decline in the overall demand as higher prices would diminish the purchasing power of consumers. Deepening fears of Trump tariff-led slowdown have also led to an increase in market expectations that the Federal Reserve (Fed) will reduce interest rates in the May policy meeting. The likelihood for the Fed to cut interest rates in May has increased to 51% from 37% a day ago, according to the CME FedWatch tool.

For more cues on the Fed’s monetary policy outlook, investors will focus on the US Consumer Price Index (CPI) data for February, which will be released on Wednesday. The inflation data is expected to decelerate but remain above the Fed’s target of 2%. On Friday, Fed Chair Jerome Powell said in an economic forum at the University of Chicago Booth School that the Fed policy is not on a “preset course,” and we can maintain “policy restraint for longer if inflation progress stalls”.

Meanwhile, the US JOLTS Job Openings data for January has met estimates. US employers posted 7.74 million new jobs, almost in line with expectations, higher than the 7.51 million seen in December.

Daily digest market movers: EUR/USD gains as German Greens Party agrees to support defense spending deal

- The strength in the EUR/USD pair is also driven by Euro’s (EUR) outperformance against its peers. The Euro advances in hopes that Franziska Brantner-led-German Green Party would support clearing the defense spending deal, which will be discussed on Thursday. Hopes for Greens to agree to stretch Germany’s borrowing limit accelerated after positive commentary from Franziska Brantner in an interview with Bloomberg on Tuesday during European hours.

- “Of course we are ready to negotiate,” the Green party’s co-head Franziska Brantner said and added, “The situation is dire in Ukraine and we really need Europe to speed up its own defense spending.” Earlier, Greens vowed to oppose restricting ‘debt reforms’. On Monday, Branter said that their party will not likely allow the next Chancellor Friedrich Merz and Social Democratic Party’s (SDP) co-leader Lars Klingbeil to “abuse a difficult European security situation”.

- The shared currency had been performing strongly for almost two weeks as an increase in Germany’s spending capability by widening “the debt brake” would stimulate the economy, which had been fractured and contracted in the last two years.

- Additionally, German spending plans have also forced traders to reassess bets supporting the European Central Bank (ECB) to cut interest rates two times more by the summer. The ECB has already cut its borrowing rates twice this year, and traders had fully priced in two more interest rate cuts amid firm confidence that the Eurozone inflation will sustainably return to the desired rate of 2% this year and fears of a slowdown due to potential US tariffs.

- During European trading hours on Tuesday, ECB policymaker and Governor of Bank of Finland Olli Rehn said that that forecasts and indicators of core inflation suggest that "inflation will align with 2% target”. Rehn warned that US tariffs could cut "global output by more than 0.5%" this year and the next.

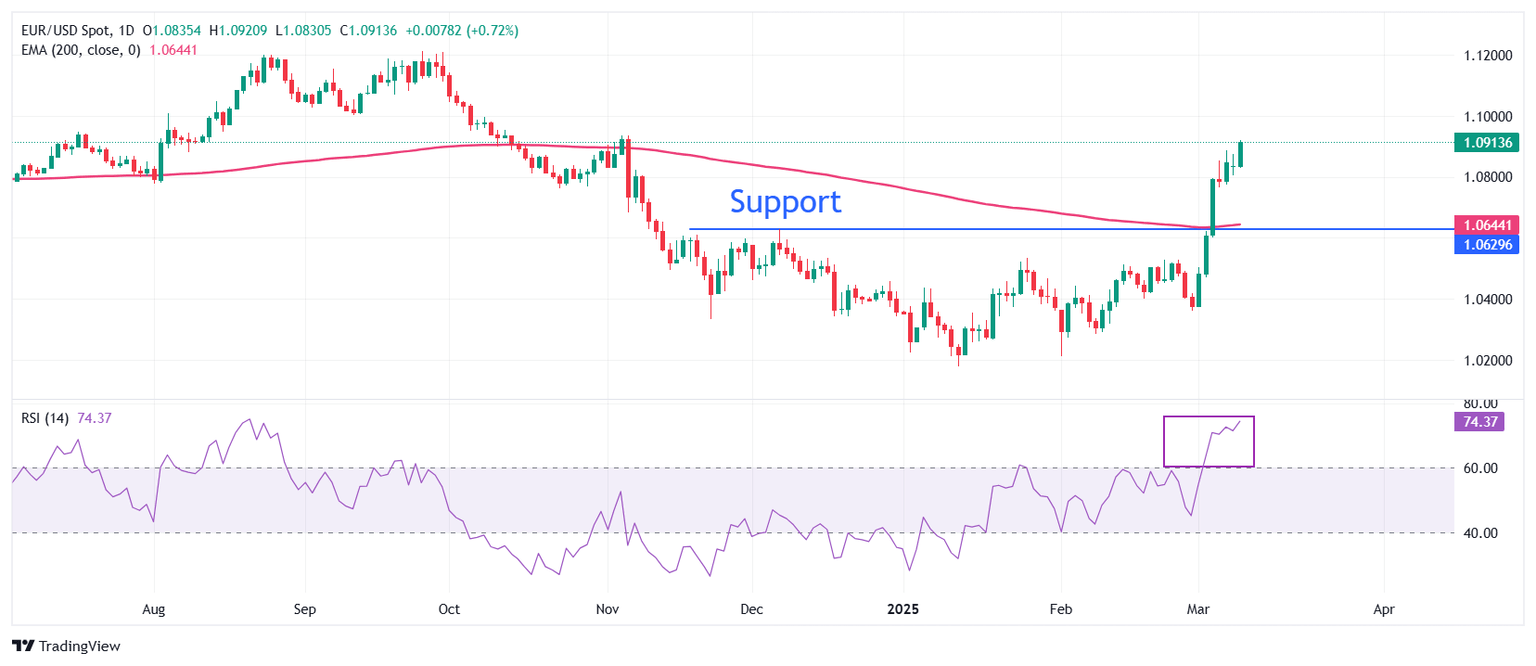

Technical Analysis: EUR/USD aims to revisit 1.1000

EUR/USD jumps above 1.0900 on Tuesday. The major currency pair strengthened after a decisive breakout above the December 6 high of 1.0630 last week. The long-term outlook of the major currency pair is bullish as it holds above the 200-day Exponential Moving Average (EMA), which trades around 1.0640.

The 14-day Relative Strength Index (RSI) jumps to near 75.00, indicating a strong bullish momentum.

Looking down, the December 6 high of 1.0630 will act as the major support zone for the pair. Conversely, the psychological level of 1.1000 will be a key barrier for the Euro bulls.

Economic Indicator

JOLTS Job Openings

JOLTS Job Openings is a survey done by the US Bureau of Labor Statistics to help measure job vacancies. It collects data from employers including retailers, manufacturers and different offices each month.

Read more.Last release: Tue Mar 11, 2025 14:00

Frequency: Monthly

Actual: 7.74M

Consensus: 7.63M

Previous: 7.6M

Source: US Bureau of Labor Statistics

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.