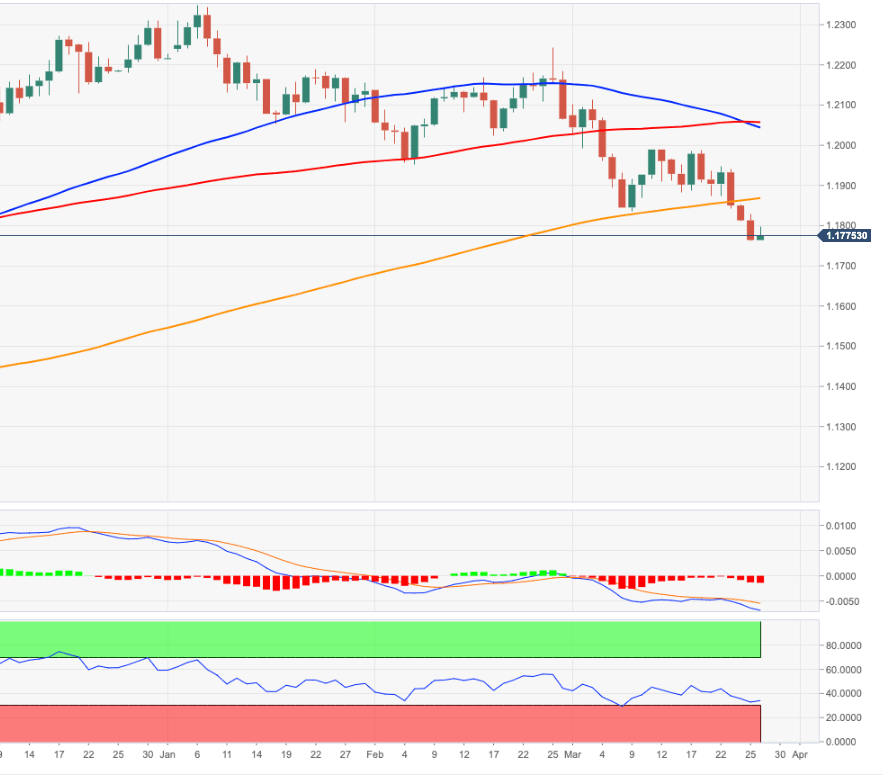

EUR/USD Price Analysis: Upside now targets the 200-day SMA

- EUR/USD hits new 2021 lows in the 1.1760 zone.

- The 200-day SMA near 1.1860 now emerges as the next hurdle.

EUR/USD’s weekly decline appears to have met a decent contention in the 1.1760 area, coincident with a Fibo level (of the November-January rally).

The recent breakdown of the 200-day SMA (1.1854) allows sellers to remain well in control of the sentiment surrounding the European currency, increasing the likelihood of further losses in the short-term horizon.

Below recent YTD lows around 1.1760 there are no relevant support levels until the November 2020 lows in the 1.1600 zone.

While below the 200-day SMA the short-term stance for EUR/USD is expected to remain negative.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.