EUR/USD Price Analysis: Treads water below the major resistance of 1.0950

- EUR/USD could test the immediate resistance of the 1.0950 level.

- A break above the eight-week high of 1.0981 could lead the pair to test the psychological barrier of 1.1000.

- The key support area appears around the 23.6% Fibonacci retracement of 1.0913 and the psychological level of 1.0900.

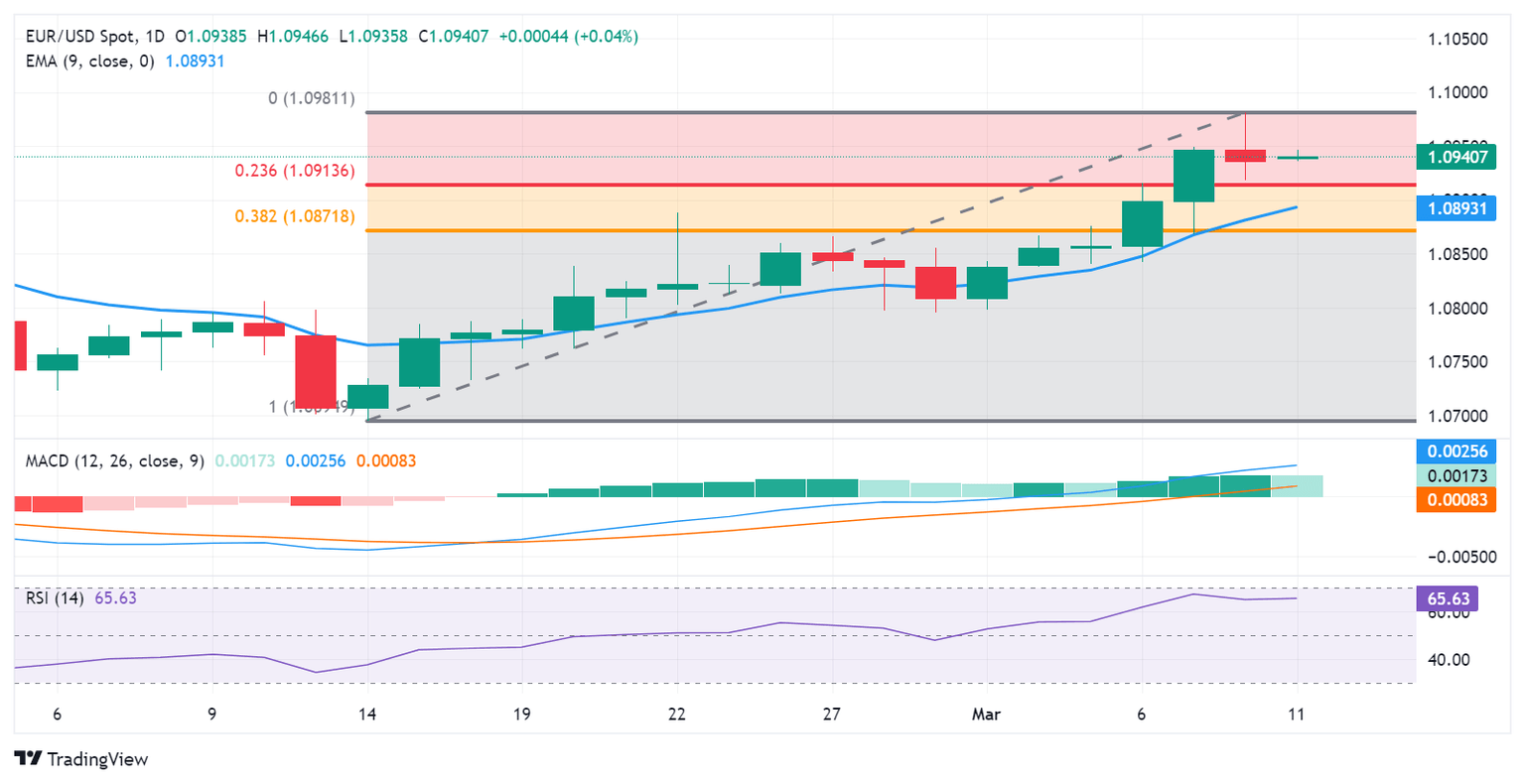

EUR/USD exhibits sideways movement amid a stable US Dollar (USD) following the upbeat US Nonfarm Payrolls released on Friday. The pair hovers around 1.0940 during the Asian trading hours on Monday, with an immediate resistance barrier at 1.0950 level followed by the eight-week high of 1.0981, marked in the previous session.

Technical analysis indicates a bullish sentiment for the EUR/USD pair. The 14-day Relative Strength Index (RSI) is positioned above the 50 mark. Moreover, the Moving Average Convergence Divergence (MACD) exhibits a divergence above the signal line and lies above the centerline. While a lagging indicator, this suggests a confirmation of the bullish momentum for the EUR/USD pair.

If there is a breakthrough above the recent highs, the EUR/USD pair may receive upward support, potentially testing the psychological barrier of 1.1000. Further exploration could lead to the area around January’s high of 1.1038 if surpassed.

On the downside, the EUR/USD pair could find the key support at 23.6% Fibonacci retracement of 1.0913 followed by the psychological level of 1.0900. A break below the latter could push the pair to test the nine-day Exponential Moving Average (EMA) at 1.0892 before the 38.2% Fibonacci retracement level of 1.0871 and the major support of 1.0850 level.

EUR/USD: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.