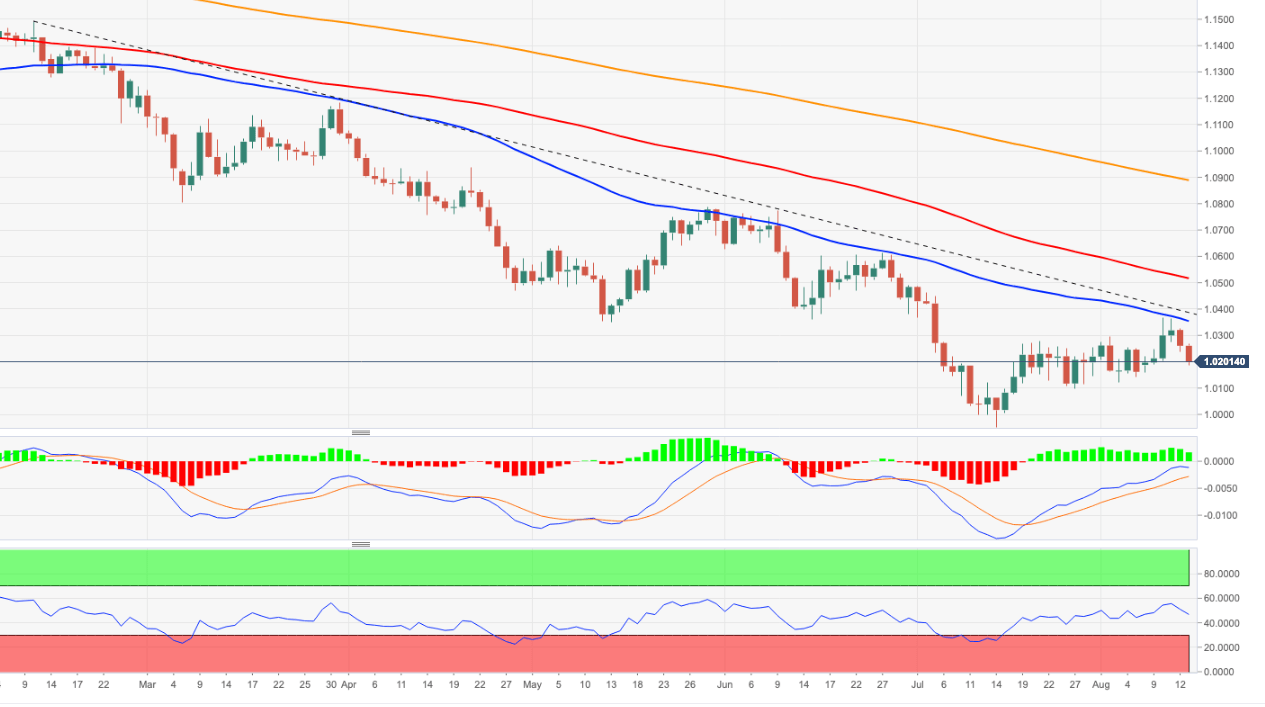

EUR/USD Price Analysis: There is a solid support around 1.0100

- EUR/USD corrects sharply lower and retests 1.0190/85.

- The lower bound of the range emerges around 1.0100.

EUR/USD accelerates the losses and drops below the key 1.0200 support on Monday.

Further correction carries the potential to revisit the lower end of the recent range in the 1.0100 neighbourhood, although a sustained break below this level looks not favoured for the time being.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0887.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.