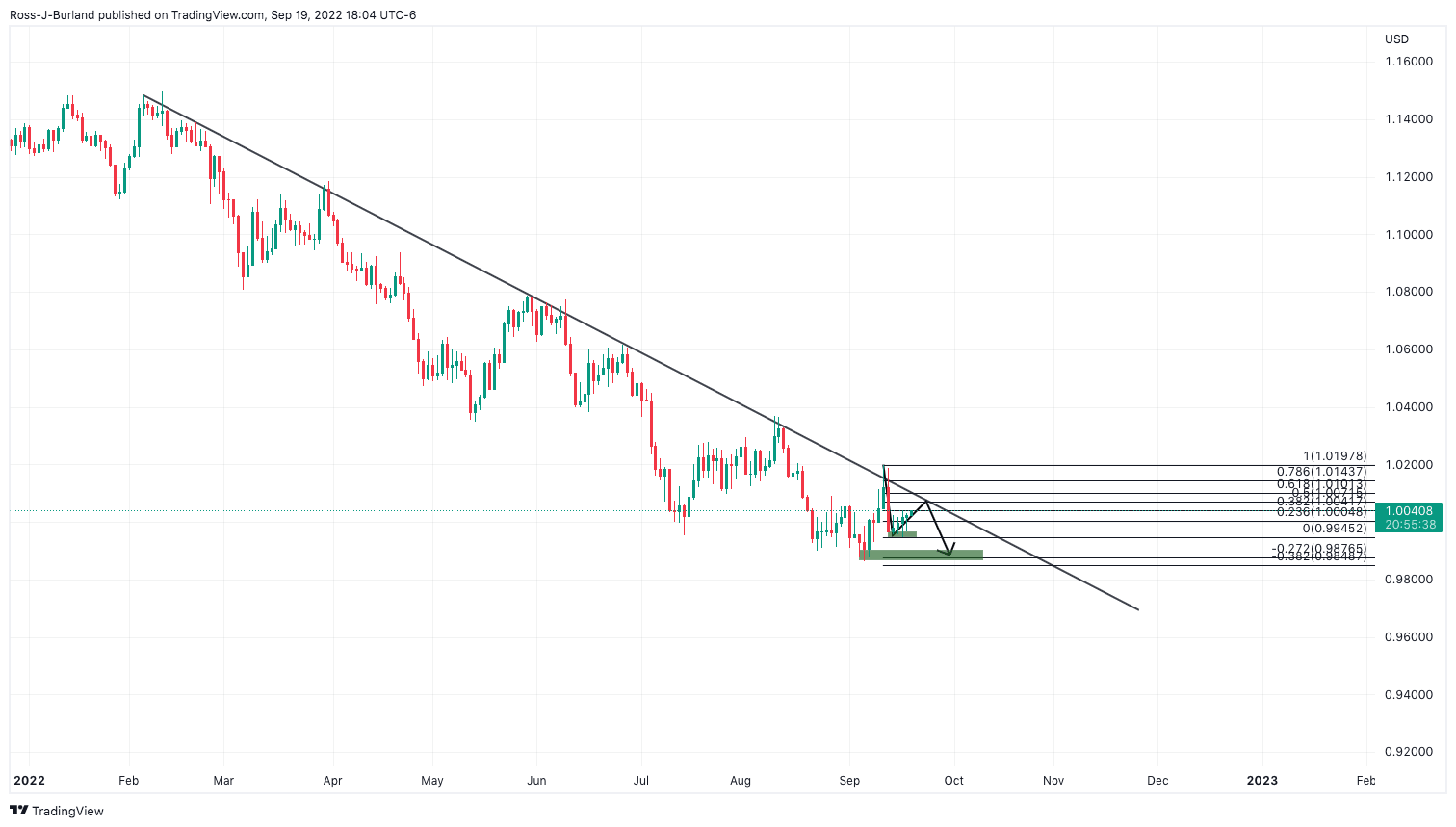

EUR/USD Price Analysis: The bulls are testing the bear's commitments at key resistance

- EUR/USD continues to creep higher in a correction on the daily charts

- Bulls eye a 50% mean reversion but failures will bring the lows back into focus with prospects of a downside extension of the broader bear trend.

As per the North American analysis, the euro is on the verge of testing critical resistances across the time frames and the following illustrates this n the hourly and daily charts. There will be prospects of a significant breakout of the bulls can take on the bearish commitments but failures will likely lead to a downside extension for the days ahead.

EUR/USD H1 chart, prior analysis

EUR/USD update

EUR/USD is on the verge of a break of horizontal resistance.

The price is attempting to break higher, but as explained in the prior analysis, there is plenty of resistance ahead:

EUR/USD daily charts

EUR/USD continues to creep higher in a correction on the daily charts within the bearish cycle and below trendline resistance and is about to cross the 38.2% ratio.

A 50% mean reversion will bring the price into close proximity to the resistance and failures will bring the lows back into focus with prospects of a downside extension of the broader bear trend.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.