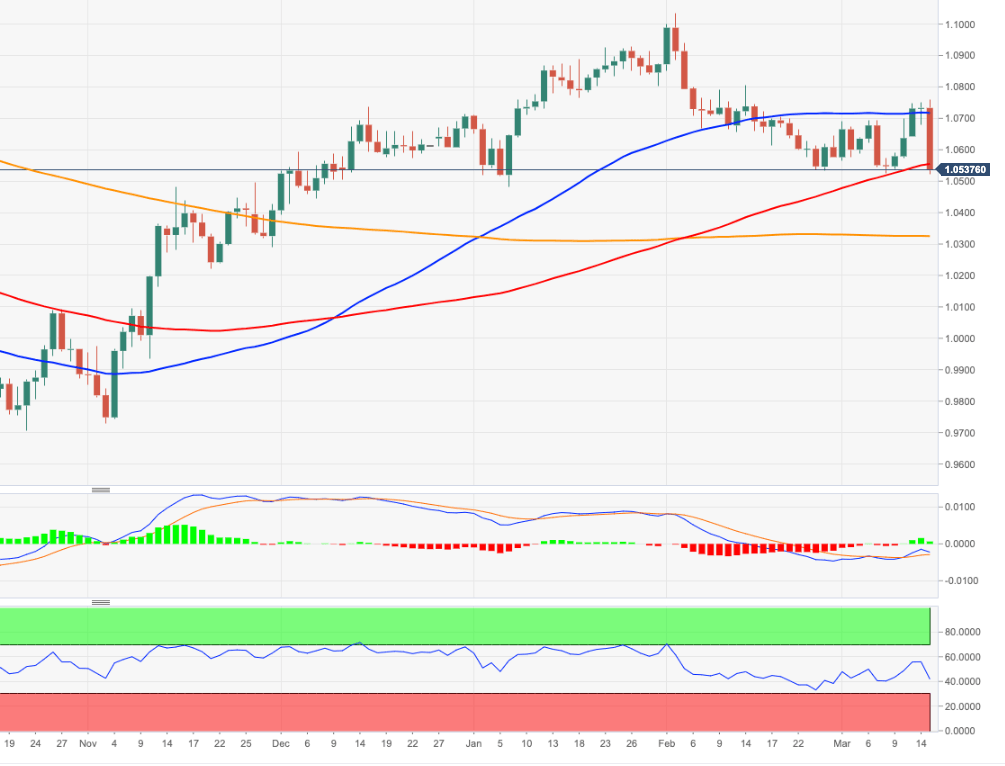

EUR/USD Price Analysis: Sharp decline opens the door to extra losses near term

- EUR/USD melts down and revisits the area of multi-week lows.

- A deeper drop to the 2023 low should not be ruled out now.

EUR/USD comes under heavy selling pressure and fully reverses last week’s strong rebound, revisiting at the same time the 1.0520 area on Wednesday.

The pronounced sell-off carries the potential to retest the 2023 low near 1.0480 (January 6) ahead of the key 200-day SMA, today at 1.0323.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.