EUR/USD Price Analysis: Sees downside to 1.0800 amid dismal market sentiment

- EUR/USD struggles to sustain above 1.0840 as investors turn risk-averse.

- SNB’s surprise rate cut move has prompted the ECB’s rate cut expectations.

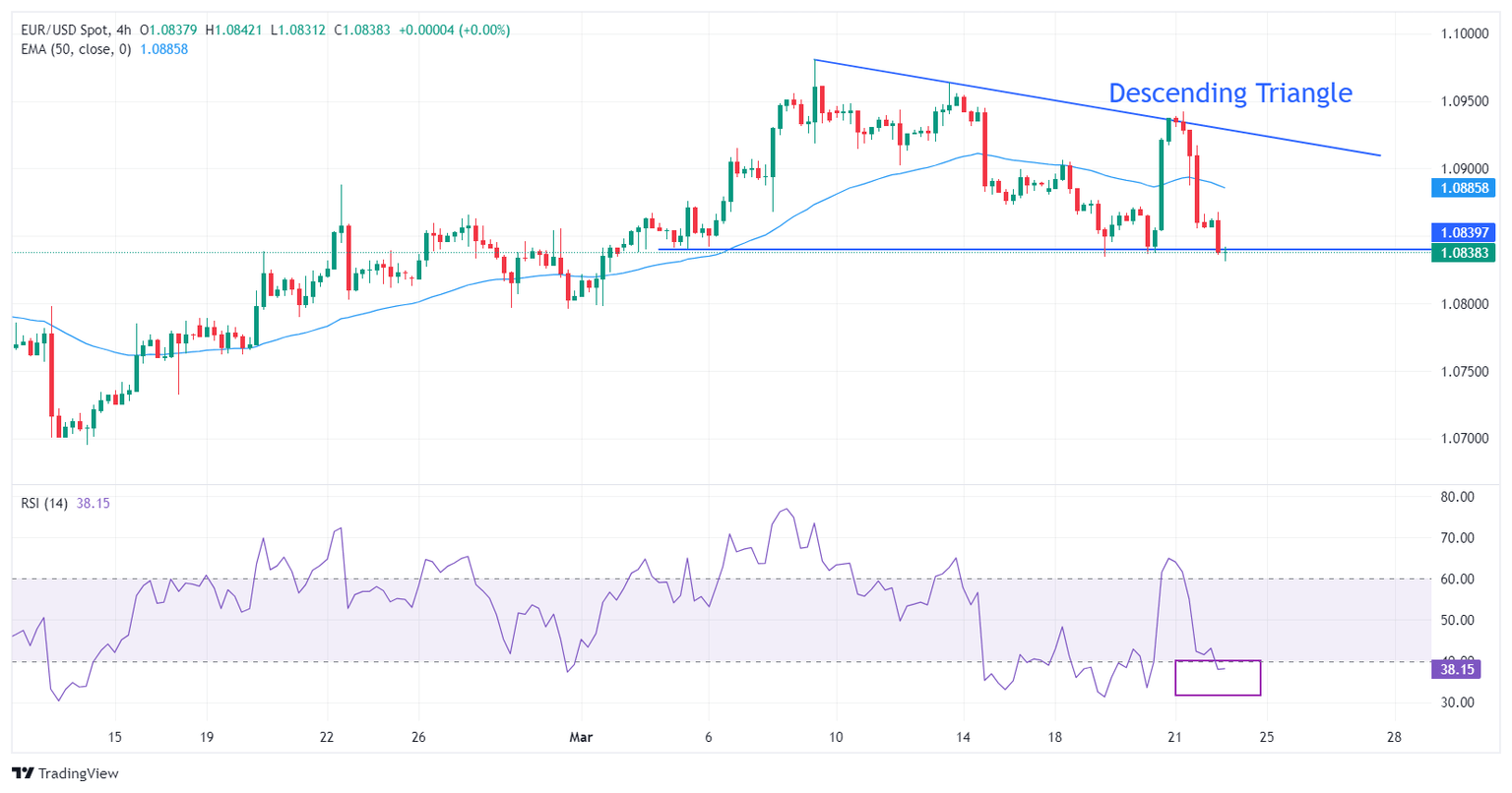

- The major currency pair is on the verge of delivering a Descending Triangle breakdown.

The EUR/USD pair extends its downside to three-day low around 1.0840 in the late Asian session on Friday. The major currency pair is expected to witness as appeal for safe-haven assets improve after the Swiss National Bank (SNB) surprisingly cut interest rates by 25 basis points (bps) to 1.50% on Thursday.

A surprise rate cut by the SNB has prompted hopes that inflation is getting under control and other central banks will follow its footprints. This has underscored the demand of the US Dollar as the Federal Reserve (Fed) has revised higher forecast for the annual core Personal Consumption Expenditure Price Index (PCE) to 2.6% from prior estimates of 2.4% for 2024 in its latest economic projections. The US Dollar Index (DXY) rises to a fresh two-week high around 104.20 and recovers its post-Fed policy losses.

Meanwhile, the Euro come under pressure as market expectations for the European Central Bank (ECB) lowering interest rates in the June meeting have boosted by SNB’s surprise rate cut. The pace at which the Eurozone’s inflation is decelerating is higher than the US economy, strengthening hopes for ECB reducing rates aggressively than the Federal Reserve (Fed).

EUR/USD is on the verge of delivering a breakdown of the Descending Triangle pattern formed on a four-hour timeframe. The asset hovers near the horizontal support of the aforementioned chart pattern plotted from March 5 low at 1.0840 while the downward-sloping border is placed from March 8 high at 1.0981.

The near-term demand is downbeat as it is trading below the 50-period Exponential Moving Average (EMA), which trades around 1.0886.

The 14-period Relative Strength Index (RSI) shifts into the bearish range of 20.00-40.00, which indicates a bearish momentum.

EUR/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.