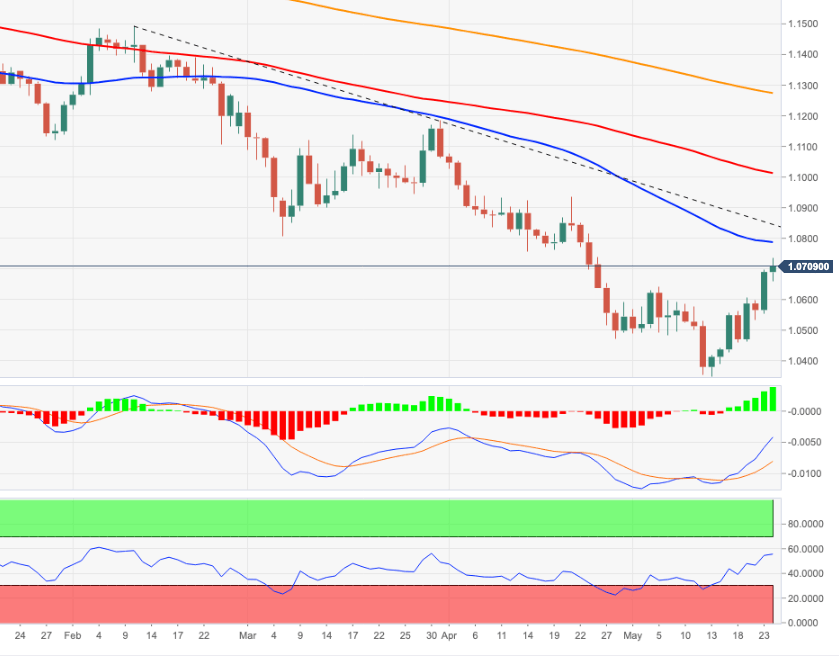

EUR/USD Price Analysis: Gaining momentum above 1.0700

- EUR/USD surpasses the 1.0700 hurdle and reaches 4-week highs.

- Immediately to the upside now comes the 55-day SMA.

EUR/USD sees its upside accelerate above the 1.0700 yardstick on turnaround Tuesday.

Considering the pair’s ongoing price action, the continuation of the recovery appears likely in the very near term at least. That said, the next up barrier now appears at the 55-day SMA, today at 1.0785 before the 3-month resistance line around 1.0840.

The breakout of this area should mitigate the selling pressure and allow for a probable move to the weekly high at 1.0936 (April 21).

The daily RSI around 55 also indicates that extra upside could still be in store for the pair until it reaches the overbought territory (>70).

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.